Last Update 10 Dec 25

Fair value Increased 4.60%NGVT: Future Battery Materials Role Will Drive Stronger Long Term Upside Potential

Analysts have nudged their price target on Ingevity higher from $65.25 to $68.25, citing a modestly richer future earnings multiple that more than offsets slightly softer revenue growth and margin assumptions.

What's in the News

- Ingevity announced that Executive Vice President and Chief Financial Officer Mary Dean Hall will transition from her role effective May 1, 2026, and remain in an advisory capacity for one year, as part of a planned leadership change. (Company announcement)

- Phillip J. Platt, currently Senior Vice President, Finance and Chief Accounting Officer, has been appointed to succeed Hall as CFO effective May 1, 2026, bringing extensive experience in global finance operations and technology enabled process improvements. (Company announcement)

- Ingevity signed a license agreement with CHASM Advanced Materials to manufacture CHASM's NTeC E carbon nanotube conductive additives for battery applications in North America and select European markets, reinforcing its position in the EV battery materials supply chain. (Company and CHASM announcement)

- The company completed a share repurchase tranche, buying back 445,724 shares for 25 million dollars in the third quarter of 2025, bringing total repurchases under the August 2022 authorization to 2,497,877 shares, or 6.71 percent of shares outstanding. (Company filing)

- Ingevity revised its 2025 full year net sales guidance to a range of 1.25 billion to 1.35 billion dollars, citing competitive pressure and indirect tariff impacts in the Advanced Polymer Technologies segment that are delaying an industrial demand recovery. (Company guidance update)

Valuation Changes

- Fair Value Estimate increased modestly from 65.25 dollars to 68.25 dollars, reflecting a slightly richer view of intrinsic equity value.

- Discount Rate edged up marginally from 8.57 percent to 8.57 percent, implying essentially unchanged perceived risk in the cash flow profile.

- Revenue Growth shifted meaningfully lower from 1.77 percent to a decline of roughly 1.49 percent, indicating a more cautious outlook on top line trends.

- Net Profit Margin was trimmed slightly from about 29.56 percent to 29.17 percent, suggesting modest pressure on long term profitability assumptions.

- Future P/E increased from approximately 7.28 times to 7.71 times, signaling a somewhat higher valuation multiple applied to projected earnings.

Key Takeaways

- Strategic divestitures and operational optimization drive focus on high-value specialty chemicals, boosting margins, efficiency, and free cash flow resilience.

- Innovation investment and global expansion into sustainable applications support long-term growth, business diversification, and margin stability.

- Ongoing segment weakness, trade uncertainties, portfolio shifts, and rising competition threaten margin stability, revenue growth, and future earnings reliability.

Catalysts

About Ingevity- Manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America.

- Accelerated portfolio repositioning and the advanced-stage divestiture of non-core, lower-margin businesses (Industrial Specialties and CTO refinery) are expected to drive a step-change in margin profile, enabling greater focus and capital allocation toward higher-growth, value-added specialty chemicals-supporting both revenue quality and sustained EBITDA margin improvement.

- Substantial investments in innovation and engineered additives, especially in applications such as EV battery materials (via the Nexeon partnership) and process purification, position Ingevity to capture new demand arising from the increased global focus on sustainability and decarbonization-providing future top-line growth opportunities as industries transition to green technologies.

- Structural optimization of operational footprint, resulting in lower maintenance CapEx and improved manufacturing efficiency, is freeing up cash flow while lowering cost per unit, directly enhancing free cash flow generation and improving net earnings resiliency.

- Pricing power in high-value Performance Materials, supported by long-standing customer relationships and differentiated proprietary technologies, continues even in soft-volume environments and tariff uncertainty-demonstrating business resilience and enabling above-average net margin retention.

- Organic and geographic expansion plans, paired with ongoing portfolio review targeting high-growth applications and regions (such as Asia-Pacific and green infrastructure), are expected to reduce cyclicality and broaden the addressable market, positively impacting future revenue diversification and long-term earnings stability.

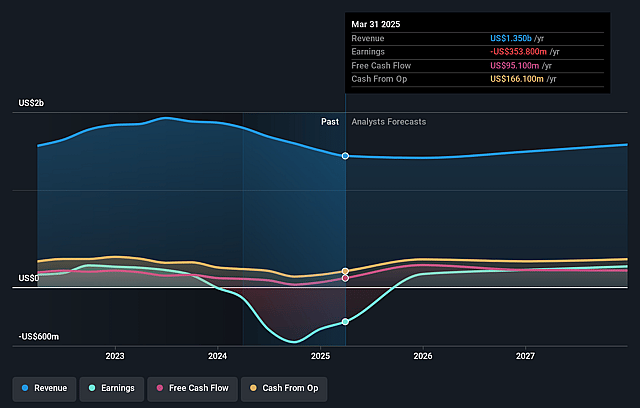

Ingevity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ingevity's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -16.3% today to 28.4% in 3 years time.

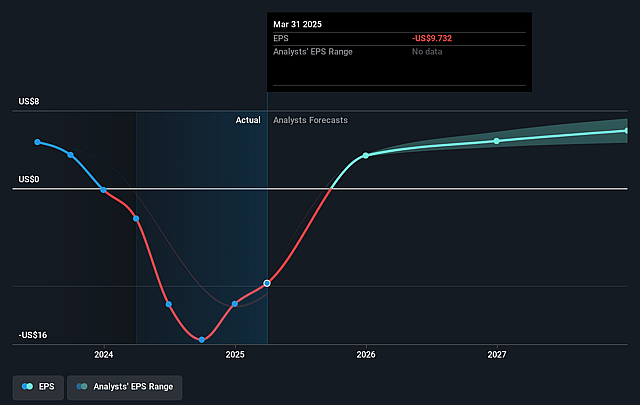

- Analysts expect earnings to reach $412.8 million (and earnings per share of $5.9) by about September 2028, up from $-216.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, up from -9.7x today. This future PE is lower than the current PE for the US Chemicals industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 0.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.55%, as per the Simply Wall St company report.

Ingevity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- APT (Advanced Polymer Technologies) segment suffered a non-cash goodwill impairment charge of $184 million this quarter, with ongoing tariff-related uncertainty and persistent weakness in global industrial markets leading to reduced demand and lower EBITDA margins (now guided only at 15–20%), threatening long-term revenue and margin stability.

- Company remains exposed to cyclical downturns in key industrial and automotive end-markets-recent headwinds in Europe and Asia and cautious auto production forecasts outside China highlight vulnerability to macroeconomic and regulatory shifts, impacting long-term revenues and earnings.

- Indirect and direct tariff impacts have meaningfully reduced customer demand, especially in global APT markets like automotive, footwear, and apparel-prolonged tariff uncertainties and shifts in global trade patterns could further erode future revenues and net margins.

- The company's reliance on legacy segments (e.g., activated carbon, pine-chemical-derived products) and ongoing portfolio rationalization-such as the planned sale of the Industrial Specialties business and CTO refinery-adds business model uncertainty and may introduce future earnings volatility if asset divestitures or repositioning strategies fail to deliver anticipated synergies.

- Rising competitive pressures and the need for price concessions in the APT segment (in part to address global competitive dynamics) suggest risk of margin compression and potential loss of market share to more innovative or sustainable chemical producers, challenging long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $60.5 for Ingevity based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $412.8 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 8.5%.

- Given the current share price of $57.89, the analyst price target of $60.5 is 4.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ingevity?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.