- United States

- /

- Metals and Mining

- /

- NYSE:NEM

How $3 Billion in Buybacks at Newmont (NEM) Could Reshape Its Capital Allocation Story

Reviewed by Simply Wall St

- Newmont recently completed the renewal and divestiture of its Akyem East Mining Lease in Ghana, receiving US$100 million from Zijin Mining and bringing total after-tax proceeds from the sale of Akyem to US$770 million.

- This influx forms part of US$3.1 billion in after-tax cash proceeds expected from its 2025 divestiture program, supporting debt reduction and a recently authorized US$3 billion share buyback initiative.

- Next, we’ll explore how Newmont’s US$3 billion buyback plan could shape its investment narrative and future capital allocation.

Find companies with promising cash flow potential yet trading below their fair value.

Newmont Investment Narrative Recap

To be a Newmont shareholder today, you have to believe in the company’s ability to convert a more focused portfolio and strong gold prices into sustainable returns, even as divestitures increase exposure to single-asset risk. The recent US$770 million Akyem sale and the renewal of the Ghana mining lease add to the $3.1 billion in divestiture proceeds, but do not fundamentally change the company’s biggest near-term catalyst (capital returns through buybacks) or its largest risk (concentration in fewer key assets).

Among recent announcements, the July 2025 launch of a new US$3 billion share buyback program stands out. This move is especially relevant given the influx of divestiture cash, as it could support earnings per share and headline shareholder returns, a central catalyst for near-term investor sentiment.

Yet, while the buyback plan is a strong signal, investors also need to be mindful of how heavier reliance on fewer mines could affect...

Read the full narrative on Newmont (it's free!)

Newmont's outlook anticipates $21.3 billion in revenue and $5.8 billion in earnings by 2028. This reflects an annual revenue growth rate of 2.7% and an earnings increase of $0.8 billion from current earnings of $5.0 billion.

Uncover how Newmont's forecasts yield a $67.90 fair value, a 8% upside to its current price.

Exploring Other Perspectives

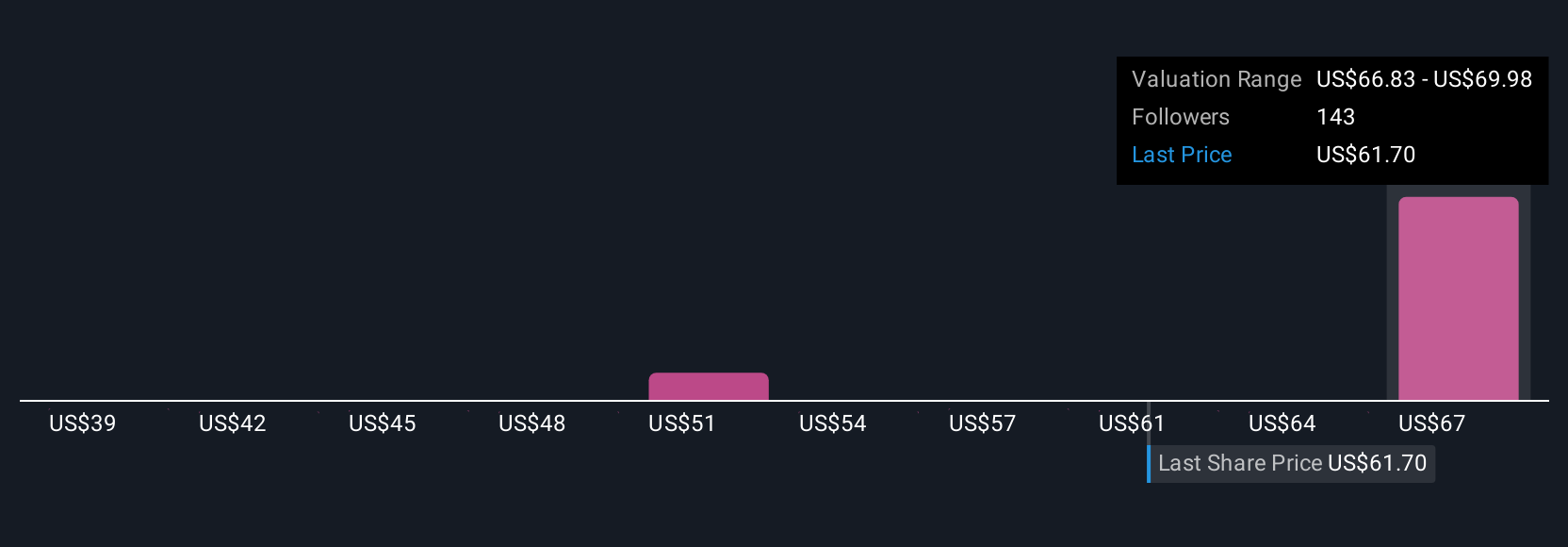

Eleven fair value estimates from the Simply Wall St Community for Newmont range from US$38.50 to US$74.52 per share, reflecting wide disagreement on future growth and risks. While some see major upside, others point out that concentrating operations might mean heightened exposure to regulatory and operational setbacks.

Explore 11 other fair value estimates on Newmont - why the stock might be worth 38% less than the current price!

Build Your Own Newmont Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmont research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Newmont research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmont's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives