- United States

- /

- Metals and Mining

- /

- NYSE:NEM

Can Newmont's (NEM) Recent Restructuring Address Investor Concerns Over Gold Miner Valuations?

Reviewed by Sasha Jovanovic

- Gold miners, including Newmont Corporation, experienced a significant sector-wide pullback in the past week following a period of historic gains fueled by record gold prices and strong analyst optimism.

- This shift reflects growing investor caution about valuations in the gold mining sector, as market participants assess whether recent rallies have outpaced underlying fundamentals despite Newmont's operational improvements and expanding asset base.

- We'll explore how increased investor skepticism over gold miner valuations, highlighted by Newmont's recent asset sales and restructuring, shapes the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Newmont Investment Narrative Recap

To be a shareholder in Newmont right now, you need to believe that elevated gold prices can be sustained and that the company’s operational improvements will translate into resilient earnings, even as markets express caution on valuation. The recent sector-wide selloff and volatility following historic gains have not substantially altered near-term catalysts, with the market’s immediate focus still on Newmont’s upcoming Q3 2025 earnings and the ability to meet profit expectations. The largest risk remains the market’s reassessment of gold miner valuations after an extraordinary rally, which may increase downside if results disappoint.

One of the most relevant recent announcements is the asset sale of Goldcorp Kaminak Ltd. and the Coffee Gold Project, which saw Newmont retain a 26% indirect stake in Fuerte Metals Corporation. This transaction highlights Newmont’s ongoing efforts to streamline operations and reallocate capital, all while preserving some future upside through retained interests. Such moves are particularly relevant as Newmont seeks to support shareholder returns and operational flexibility amid earnings scrutiny and elevated sector valuations.

However, amid renewed optimism, investors should be aware that if margins are squeezed by rising costs or production shortfalls at key mines…

Read the full narrative on Newmont (it's free!)

Newmont’s outlook anticipates $21.6 billion in revenue and $6.4 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 1.6% and a $0.2 billion increase in earnings from the current $6.2 billion.

Uncover how Newmont's forecasts yield a $88.91 fair value, in line with its current price.

Exploring Other Perspectives

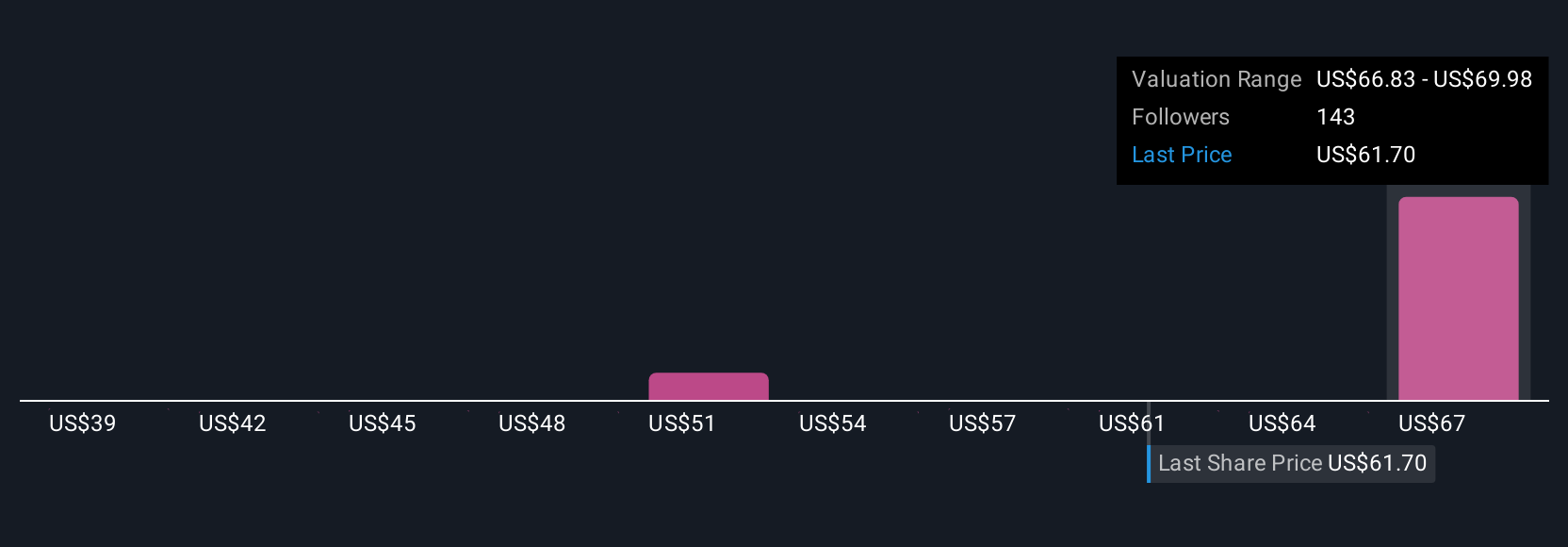

Simply Wall St Community members have set fair value estimates for Newmont ranging widely from US$40.60 to US$96.99, based on 11 different forecasts. While many in the Community see strong gold demand supporting future earnings, you should consider how quickly shifting market sentiment could impact both near-term profits and longer-term price targets.

Explore 11 other fair value estimates on Newmont - why the stock might be worth as much as 7% more than the current price!

Build Your Own Newmont Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmont research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Newmont research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmont's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives