- United States

- /

- Metals and Mining

- /

- NYSE:NEM

A Fresh Look at Newmont (NEM) Valuation Following CEO Succession Announcement

Reviewed by Kshitija Bhandaru

Newmont, the world’s largest gold miner, is navigating a major leadership transition. CEO Tom Palmer will retire at the end of 2025, and President and COO Natascha Viljoen is set to take the helm.

See our latest analysis for Newmont.

Newmont’s leadership shakeup comes on the heels of positive company milestones, with the first gold pour at Ghana’s Ahafo North project underscoring operational progress. While these recent developments reflect ambition, the stock’s momentum has been measured, with a 1-year total shareholder return of just 0.7%. Investors appear to be waiting for evidence that management’s long-term vision will translate into sustained value, especially as the gold market remains in flux.

If you’re curious where else leadership changes or growth stories might drive value, now is a great time to discover fast growing stocks with high insider ownership.

Given Newmont's steady performance and major leadership change ahead, the real question for investors is whether today's price offers long-term upside or if the market has already priced in most future growth potential.

Most Popular Narrative: 8.5% Overvalued

Newmont’s narrative consensus fair value stands at $79.64, noticeably below its last close of $86.43. This signals that analysts see limited upside at current prices, given expectations around near-term growth, cash flow, and industry factors.

The realization of synergies and increased production scale following the Newcrest Mining acquisition, together with ongoing asset optimization and the ramp-up of expansion projects (such as Ahafo North and Tanami), should support long-term revenue growth and cash flow stability.

What’s fueling this valuation? Fresh expansion projects and the golden promise of asset synergies provide the backbone. There is more beneath the surface. Want to see which bold analyst projections drive the premium, or what assumptions are quietly baked into these numbers? Hit the full narrative to uncover the strategies powering the fair value.

Result: Fair Value of $79.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks, such as operational disruptions or leadership transitions, could quickly shift sentiment and challenge the bullish case analysts are building for Newmont.

Find out about the key risks to this Newmont narrative.

Another View: What Do the Ratios Say?

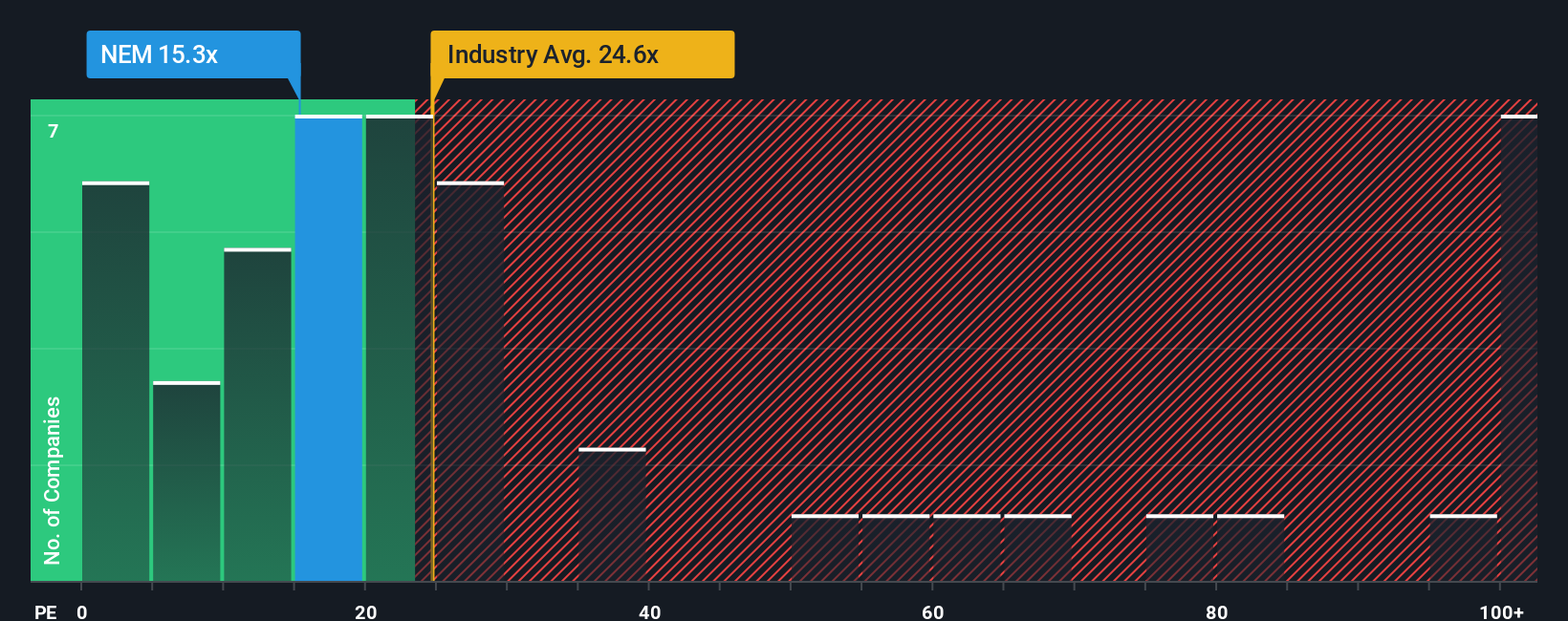

Looking through the lens of price-to-earnings, Newmont trades at 15.2 times earnings, noticeably lower than both its industry peers (24.7x) and the peer group average (35.3x). Compared to the fair ratio of 23.8x, Newmont appears to offer attractive value. However, with such a gap, are investors underestimating potential upside, or is there a hidden risk keeping the stock discounted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Newmont Narrative

If you have a different perspective on Newmont's outlook or like to dive deeper into the numbers, you can shape your own story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Newmont.

Looking for more investment ideas?

Take charge of your portfolio and scout untapped markets for your next winning opportunity. Missing these could mean leaving real potential off the table.

- Capitalize on groundbreaking breakthroughs by starting with these 23 AI penny stocks to catch emerging winners at the intersection of tech and innovation.

- Fuel your growth strategy by targeting value picks with strong fundamentals using these 914 undervalued stocks based on cash flows for hidden gems overlooked by the market.

- Secure steady returns by considering these 19 dividend stocks with yields > 3% that consistently reward shareholders with competitive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives