- United States

- /

- Office REITs

- /

- NYSE:PGRE

June 2025's Undervalued Small Caps With Insider Buying Opportunities

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but it has shown an impressive 11% increase over the past year with earnings expected to grow by 14% annually in the coming years. In this context, identifying small-cap stocks that are perceived as undervalued and exhibit insider buying can be a strategic approach for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 34.70% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 40.80% | ★★★★★☆ |

| S&T Bancorp | 10.4x | 3.6x | 44.89% | ★★★★☆☆ |

| Barrett Business Services | 20.7x | 0.9x | 47.05% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 25.82% | ★★★★☆☆ |

| Farmland Partners | 9.2x | 9.3x | -20.52% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -55.18% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.9x | 0.2x | -72.33% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2733.50% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 1.0x | 4.72% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Magnera (MAGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magnera operates as a global technology company with a focus on innovative solutions across various sectors, boasting a market capitalization of $2.85 billion.

Operations: Magnera's revenue is primarily derived from the Americas and Rest of World regions, totaling $2.64 billion. The company experienced a declining trend in its gross profit margin, reaching 10.77% by June 2025. Operating expenses have fluctuated between $176 million and $209 million over recent periods, with significant non-operating expenses impacting net income margins negatively in the latter half of the timeline provided.

PE: -1.8x

Magnera, a small company in the U.S., is drawing attention with its anticipated 108.67% annual earnings growth, despite facing challenges such as a net loss of US$41 million for Q2 2025 and reliance on riskier external borrowing. Sales increased to US$824 million from US$558 million year-on-year, yet profitability remains elusive. Recent insider confidence was evident with share purchases in April 2025. The company's presence at industry conferences hints at strategic efforts to bolster investor relations and future prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Magnera.

Examine Magnera's past performance report to understand how it has performed in the past.

Myers Industries (MYE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Myers Industries operates in the manufacturing and distribution sectors, focusing on material handling and distribution products, with a market cap of approximately $0.83 billion.

Operations: The company's revenue streams are primarily driven by its Material Handling segment, contributing $627.10 million, and Distribution segment with $209.12 million. The gross profit margin has shown fluctuations over the years, reaching 33.11% in the latest reported period ending June 5, 2025. Operating expenses have consistently been a significant cost factor, with General & Administrative expenses being a notable component within this category.

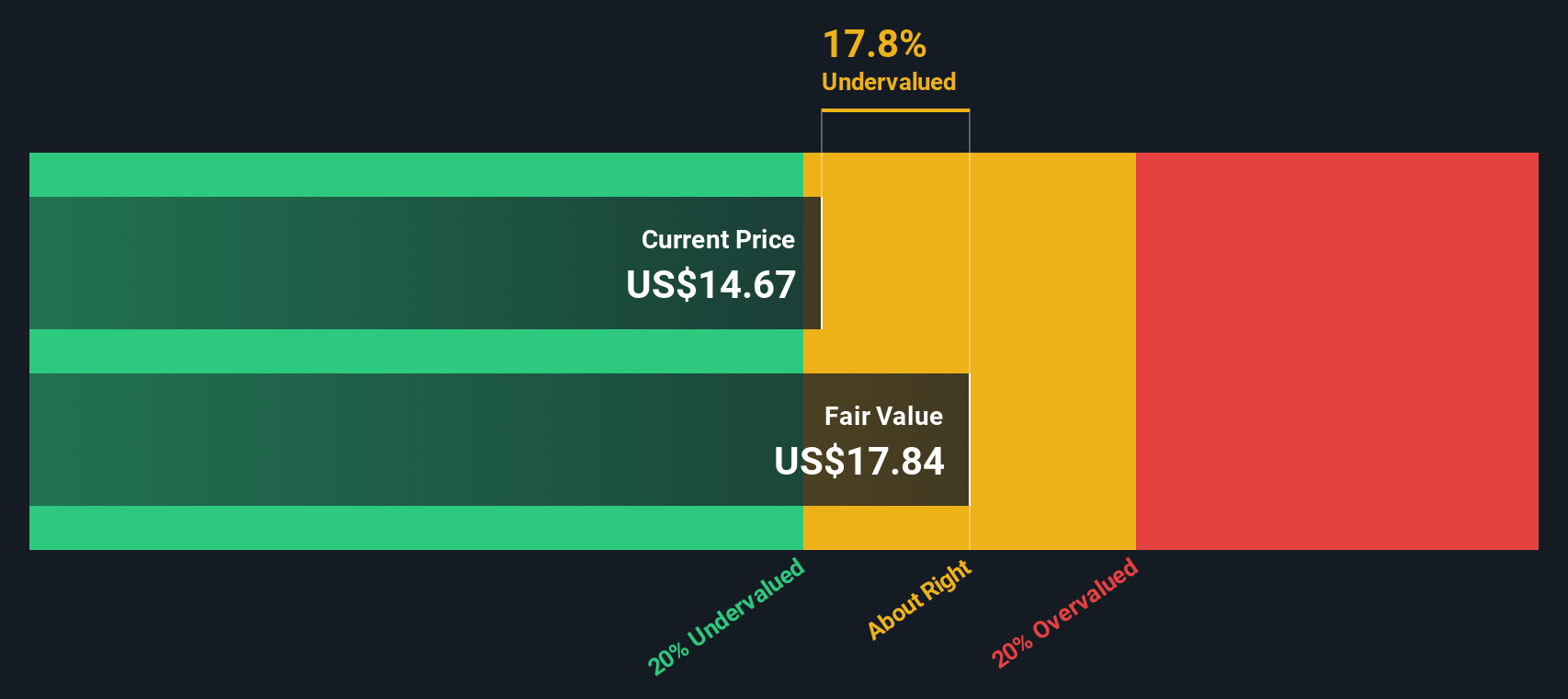

PE: 48.1x

Myers Industries, a smaller company in the U.S., shows potential despite challenges. Recent insider confidence is evident with share repurchases totaling 76,800 shares for US$1 million between February and March 2025. Although profit margins decreased from 4.9% to 1.3%, earnings per share doubled from US$0.09 to US$0.18 year-over-year in Q1 2025, indicating operational resilience amidst financial hurdles like high-risk funding reliance and large one-off items impacting results.

Paramount Group (PGRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Paramount Group is a real estate investment trust focusing on owning, operating, and managing high-quality office properties in New York and San Francisco with a market cap of approximately $1.34 billion.

Operations: The company generates revenue primarily from its New York and San Francisco segments, with recent figures showing $459.63 million and $274.28 million respectively. Over time, the gross profit margin has shown a decreasing trend, reaching 56.50% by mid-2025 from a peak of 95.83% in late 2014. Operating expenses have consistently impacted profitability, with general and administrative expenses being a notable component within these costs.

PE: -21.0x

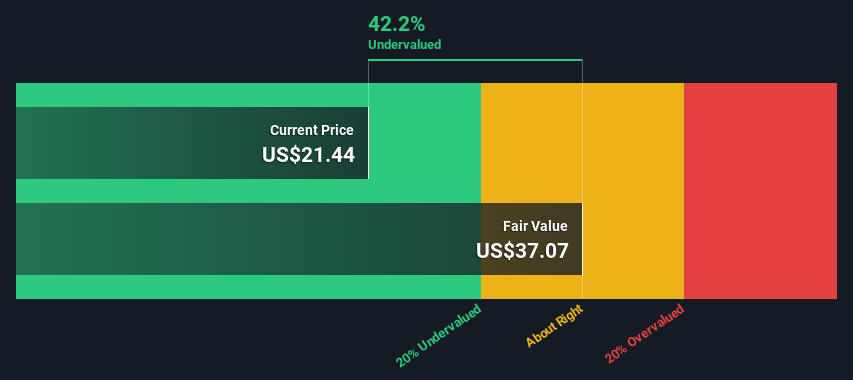

Paramount Group, a smaller U.S. real estate player, is navigating challenges with its unprofitable status and declining earnings forecasted at 17.4% annually over the next three years. Despite these hurdles, insider confidence is evident as they explore strategic alternatives to bridge the gap between market and intrinsic value. Recent strong leasing activity, including a significant 16.5-year lease in Midtown Manhattan, highlights their operational strengths amid financial struggles. The company's proactive approach could potentially unlock shareholder value in the future.

- Navigate through the intricacies of Paramount Group with our comprehensive valuation report here.

Review our historical performance report to gain insights into Paramount Group's's past performance.

Seize The Opportunity

- Discover the full array of 104 Undervalued US Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGRE

Paramount Group

Paramount Group, Inc. ("Paramount" or the "Company") is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York and San Francisco.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives