- United States

- /

- Metals and Mining

- /

- NYSE:MUX

McEwen Mining Inc. (NYSE:MUX) Analysts Just Cut Their EPS Forecasts By 608%

The latest analyst coverage could presage a bad day for McEwen Mining Inc. (NYSE:MUX), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business. What's more, McEwen Mining has been out of favour with the market in recent times, so it will be interesting to see if this downgrade is enough to sink the stock even further. Shares are down 7.4% to US$0.58 over the past 7 days.

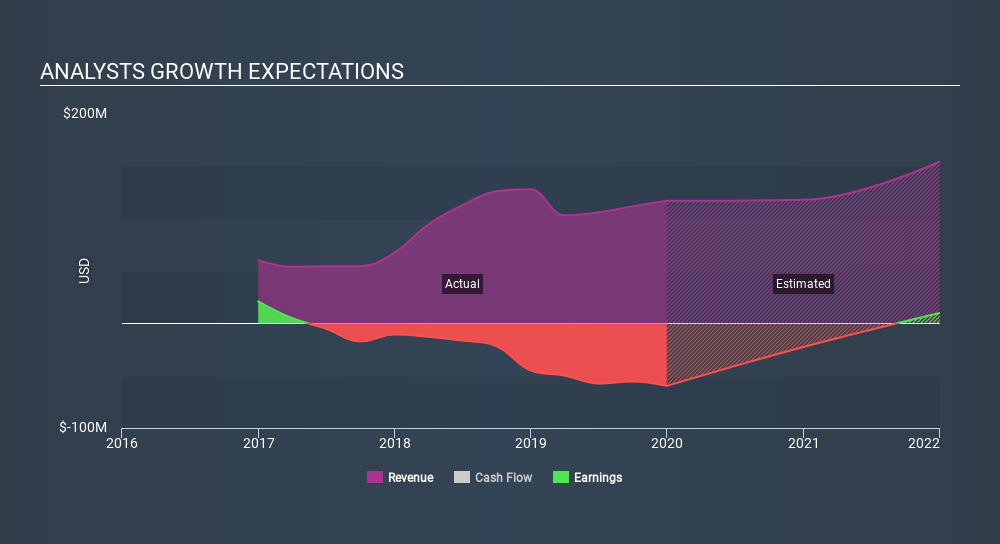

Following this downgrade, McEwen Mining's four analysts are forecasting 2020 revenues to be US$118m, approximately in line with the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 74% to US$0.043. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$164m and losses of US$0.006 per share in 2020. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

View our latest analysis for McEwen Mining

The consensus price target fell 13% to US$2.49, implicitly signalling that lower earnings per share are a leading indicator for McEwen Mining's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on McEwen Mining, with the most bullish analyst valuing it at US$4.40 and the most bearish at US$1.70 per share. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that McEwen Mining's revenue growth is expected to slow, with forecast 0.8% increase next year well below the historical 17% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 3.6% next year. Factoring in the forecast slowdown in growth, it seems obvious that McEwen Mining is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at McEwen Mining. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that McEwen Mining's revenues are expected to grow slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of McEwen Mining.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with McEwen Mining's financials, such as dilutive stock issuance over the past year. Learn more, and discover the 2 other warning signs we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives