- United States

- /

- Chemicals

- /

- NYSE:MTX

Will Global Plant Upgrades and SIVO Expansion Reshape Minerals Technologies' (MTX) Market Leadership Narrative?

Reviewed by Sasha Jovanovic

- In September 2025, Minerals Technologies Inc. announced significant upgrades at three of its global plants, aiming to expand capacity and enhance the SIVO pet care business to better serve rising demand for high-quality cat litter across key regional markets.

- This move underscores the company's intent to bolster its position as a global leader in private label cat litter through broad manufacturing capability and an optimized supply chain.

- We'll consider how MTI's major plant investments to expand SIVO production could influence the company's long-term growth outlook and market leadership.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Minerals Technologies Investment Narrative Recap

Investors in Minerals Technologies Inc. are typically focused on the company's strategy to build a global footprint in high-margin, specialty minerals, especially its SIVO pet care division, while managing input costs and competing in mature markets. The recent upgrades across three plants to expand SIVO cat litter production could support the most important short-term catalyst: capturing growth in the pet care segment. At the same time, heightened pricing pressure from private labels remains a substantial risk to margins. Of MTI's recent announcements, the upcoming Q3 2025 earnings release is most relevant, as it will provide an early indication of whether expanded SIVO manufacturing capacity is translating into tangible revenue growth or margin improvement, and how this aligns with recovery efforts after a challenging first quarter. Shareholders will be watching closely to see if renewed momentum in high-growth divisions starts to offset margin concerns in other parts of the business. In contrast, investors should be aware that pricing pressure from aggressive competitors may further delay...

Read the full narrative on Minerals Technologies (it's free!)

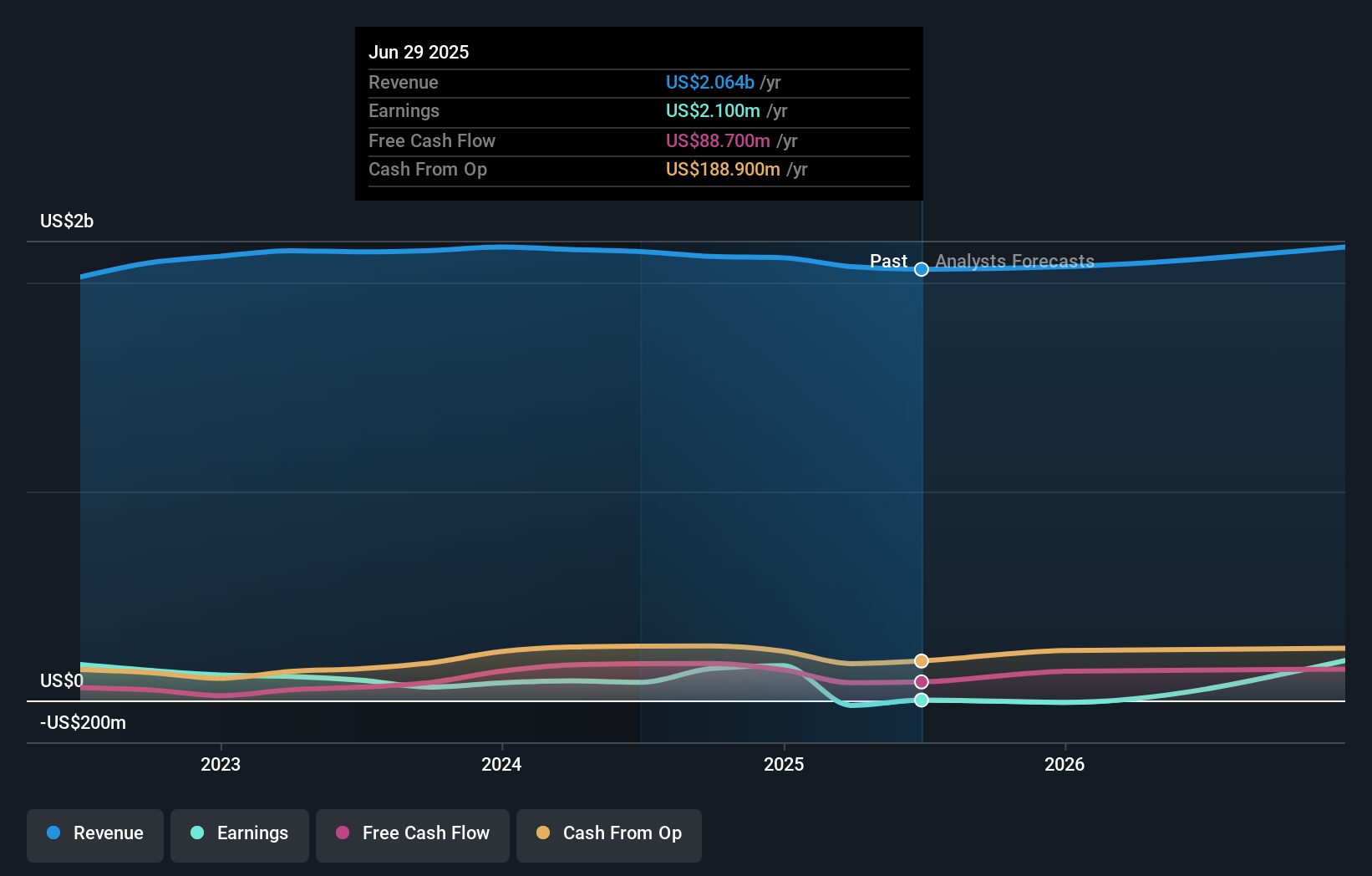

Minerals Technologies' outlook anticipates $2.3 billion in revenue and $818.2 million in earnings by 2028. This scenario reflects a 3.3% annual revenue growth rate and an increase in earnings of $816.1 million from the current $2.1 million.

Uncover how Minerals Technologies' forecasts yield a $84.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate MTI’s fair value in a narrow US$82.06 to US$84 range across two views. Yet, with margin pressure from competitors a continuing risk, you can expect much broader interpretations of future performance, consider checking several alternative viewpoints.

Explore 2 other fair value estimates on Minerals Technologies - why the stock might be worth just $82.06!

Build Your Own Minerals Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Minerals Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Minerals Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Minerals Technologies' overall financial health at a glance.

No Opportunity In Minerals Technologies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives