- United States

- /

- Chemicals

- /

- NYSE:MTX

Did a Turkey Plant Expansion Just Shift Minerals Technologies’ (MTX) Sustainable Growth Narrative?

Reviewed by Sasha Jovanovic

- Minerals Technologies Inc. recently announced an investment at its Usak City, Turkey plant to expand its Rafinol™ product line for the natural oil purification market, supporting both renewable fuel and edible oil applications.

- This expansion aims to leverage the company's unique mineral reserves and technical expertise amid growing demand for purification solutions driven by increased regulatory focus on renewable fuels.

- We'll examine how this move to expand production capacity could reshape Minerals Technologies' investment narrative, especially regarding its sustainable growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Minerals Technologies Investment Narrative Recap

To own Minerals Technologies stock, you need to believe that expansion into high-growth, sustainable products, like natural oil purification, will eventually offset headwinds from weaker traditional segments such as Specialty Additives. The new investment in Usak, Turkey, supports this pivot and bolsters the company’s presence in renewable fuels, but it does not immediately resolve the most pressing short-term volume and margin challenges tied to North American and European paper markets.

Among recent company announcements, the 9% dividend increase stands out, showing continued shareholder returns even as growth investments ramp up. This move may signal a focus on balancing near-term capital allocation with the pursuit of longer-term catalysts like Rafinol’s expansion, all while the company confronts margin compression and sluggish volumes from its legacy portfolio.

Yet, despite these growth moves, investors should be aware that persistent weakness in key paper markets means...

Read the full narrative on Minerals Technologies (it's free!)

Minerals Technologies' narrative projects $2.3 billion revenue and $818.2 million earnings by 2028. This requires 3.3% yearly revenue growth and a $816.1 million increase in earnings from $2.1 million currently.

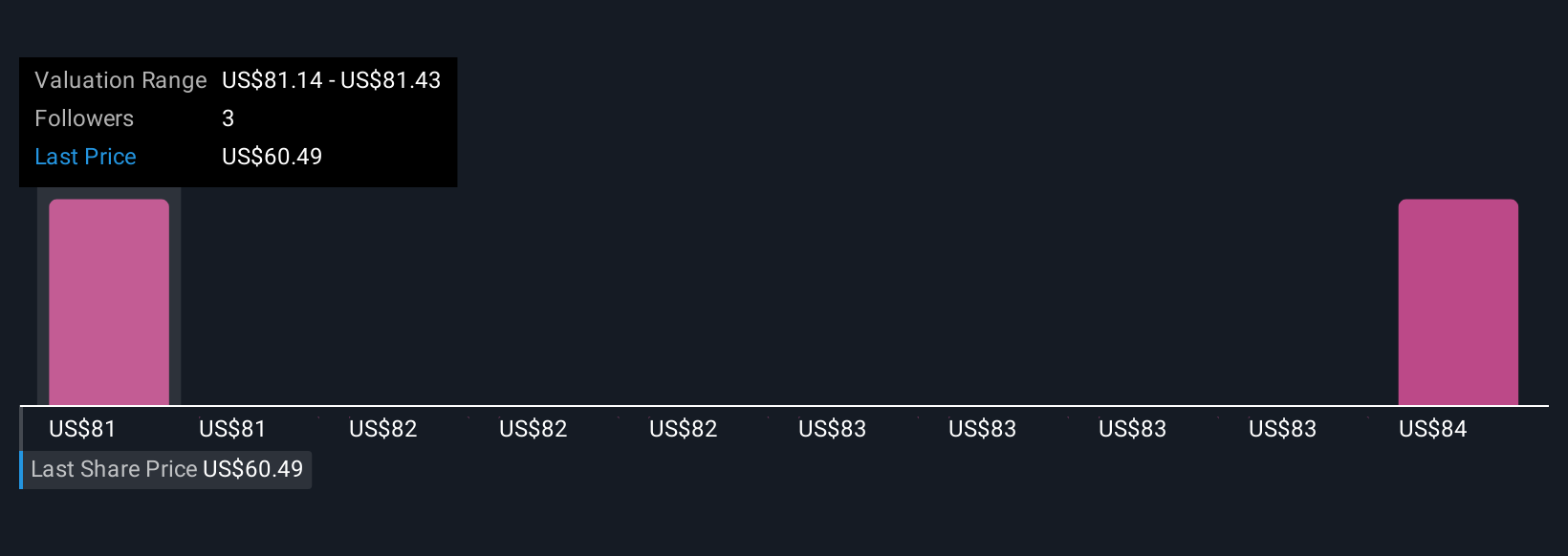

Uncover how Minerals Technologies' forecasts yield a $84.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for MTX span from US$78.38 to US$84 across two estimates, underscoring a tight range but differing confidence in recovery. While some anticipate sustainable product investments can drive growth, concerns remain about the drag from legacy segments, so you might find several competing viewpoints worth exploring.

Explore 2 other fair value estimates on Minerals Technologies - why the stock might be worth just $78.38!

Build Your Own Minerals Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Minerals Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Minerals Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Minerals Technologies' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives