- United States

- /

- Metals and Mining

- /

- NYSE:MTRN

Materion (MTRN): Is the Surge in Share Price Justified by Current Valuation?

Reviewed by Kshitija Bhandaru

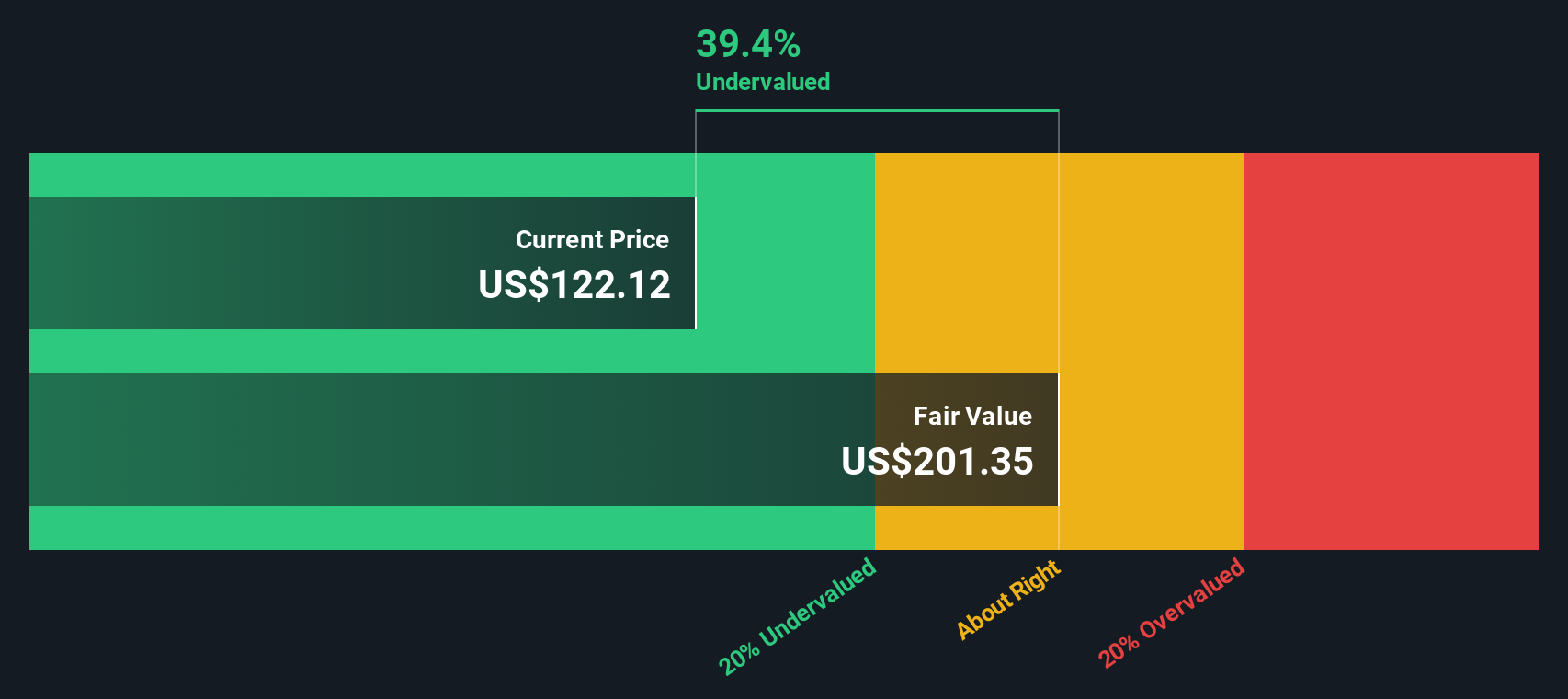

If you have been tracking Materion (MTRN) lately, you have probably noticed something curious. The company’s stock has jumped an impressive 49% over the past three months, a move that stands out, especially as Materion’s return on equity sits at just 1.8%, much lower than the industry’s 11% average. That kind of gap between market excitement and underlying returns always deserves a closer look, especially for investors weighing whether to dial up their exposure or take some chips off the table.

This disconnect is not just about a single earnings report. Materion’s net income growth has been steady but modest, up just 4.8% over the past five years, despite retaining 87% of earnings for reinvestment. Meanwhile, the company’s recent momentum is in sharp contrast to its long-term track record, which is more muted. Momentum is clearly building, with a 12% return over the past year and nearly 60% over three years, but questions remain about whether fundamentals are keeping pace.

So, does Materion’s recent share surge represent a genuine buying opportunity, or is the market already pricing in all the future growth?

Most Popular Narrative: 2.8% Undervalued

The leading narrative sees Materion as moderately undervalued, driven by bullish analyst expectations for revenue growth, margin expansion, and strategic industry positioning. Analysts highlight the company's ability to capture a larger share of fast-growing end markets as a key value driver looking ahead.

Accelerating demand in the semiconductor sector, driven by increasing wafer starts, growth in data storage and communication devices, and the recent acquisition of Konasol (expanding footprint in Asia), positions Materion to capture a higher share of a rapidly expanding global market and supports sustained top line revenue growth over the next several years as new capacity ramps by 2026.

Curious about why this valuation stands out? The real story lies in bold expectations for growth, supported by aggressive forecasts in future margins, sales, and earnings. Want to know the details behind these eye-catching projections analysts are betting on? The secret sauce behind Materion’s target price just might surprise you.

Result: Fair Value of $124.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain if customer concentration or ongoing competition in China's semiconductor sector leads to unexpected revenue volatility or margin pressure. This could challenge upbeat forecasts.

Find out about the key risks to this Materion narrative.Another View: Sizing Up with the SWS DCF Model

While the analyst consensus highlights attractive growth and a rising target price, our DCF model comes to its own conclusion. This offers a different perspective on Materion's value that investors may want to weigh carefully. Is the market missing something, or is one method misreading the signals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Materion for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Materion Narrative

If you have a different perspective or want to dig into the numbers yourself, it only takes a few minutes to craft your own analysis and see how your conclusions compare. Do it your way

A great starting point for your Materion research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Eager to level up your strategy? The Simply Wall Street Screener gives you access to smart stock picks designed for today’s fast-moving markets. Don’t risk missing your next standout investment. Uncover fresh opportunities now.

- Spot promising small-cap stocks showing impressive financial strength by checking out our curated list of penny stocks with strong financials leading the way in resilience and growth.

- Tap into the future of healthcare by finding top innovators harnessing advanced algorithms and machine learning through our selection of healthcare AI stocks shaping tomorrow’s medical breakthroughs.

- Lock in consistent income with leading companies offering generous yields. Explore our picks for dividend stocks with yields > 3% if you want your capital working harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTRN

Materion

Produces advanced engineered materials in the United States, Asia, Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives