- United States

- /

- Metals and Mining

- /

- NYSE:MP

Why MP Materials (MP) Is Down 8.0% After Historic Pentagon Investment and Price Floor Announcement

Reviewed by Sasha Jovanovic

- In late September 2025, the U.S. Department of Defense announced a major partnership with MP Materials, acquiring a 15% equity stake via a US$400 million preferred share issuance, providing a US$150 million low-interest loan, and establishing a price floor for rare earth magnet materials.

- This move marks one of the most robust federal efforts yet to secure a domestic supply chain for critical minerals, aligning national security interests with significant logistical and financial support for MP Materials’ expansion.

- We’ll explore how this government-backed deal with price guarantees impacts MP Materials’ risk profile and future earnings trajectory.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

MP Materials Investment Narrative Recap

To own shares of MP Materials, you need to believe in a long-term shift toward US-based rare earth supply chains, with a particular focus on the success of MP’s downstream magnet production, now heavily underpinned by federal support. The new Department of Defense alliance, involving a US$400 million equity stake and price floors, directly addresses MP’s biggest short-term catalyst: de-risking the ramp-up of its new magnetics plant, while partially muting the company’s greatest risk around project execution and volatile pricing.

Among recent announcements, the US$500 million Apple partnership stands out, closely connected to the government’s efforts by reinforcing high-volume demand for MP’s magnets and offering another layer of revenue stability. As MP moves to scale production, this dual anchor, government and Apple contracts, could be crucial in supporting expansion and absorbing potential setbacks.

Yet, despite these buffers, investors should be aware there are still execution challenges ahead if cost overruns or construction delays emerge in the next year…

Read the full narrative on MP Materials (it's free!)

MP Materials' narrative projects $1.0 billion in revenue and $236.3 million in earnings by 2028. This requires 61.3% annual revenue growth and a $337.7 million increase in earnings from the current level of -$101.4 million.

Uncover how MP Materials' forecasts yield a $77.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

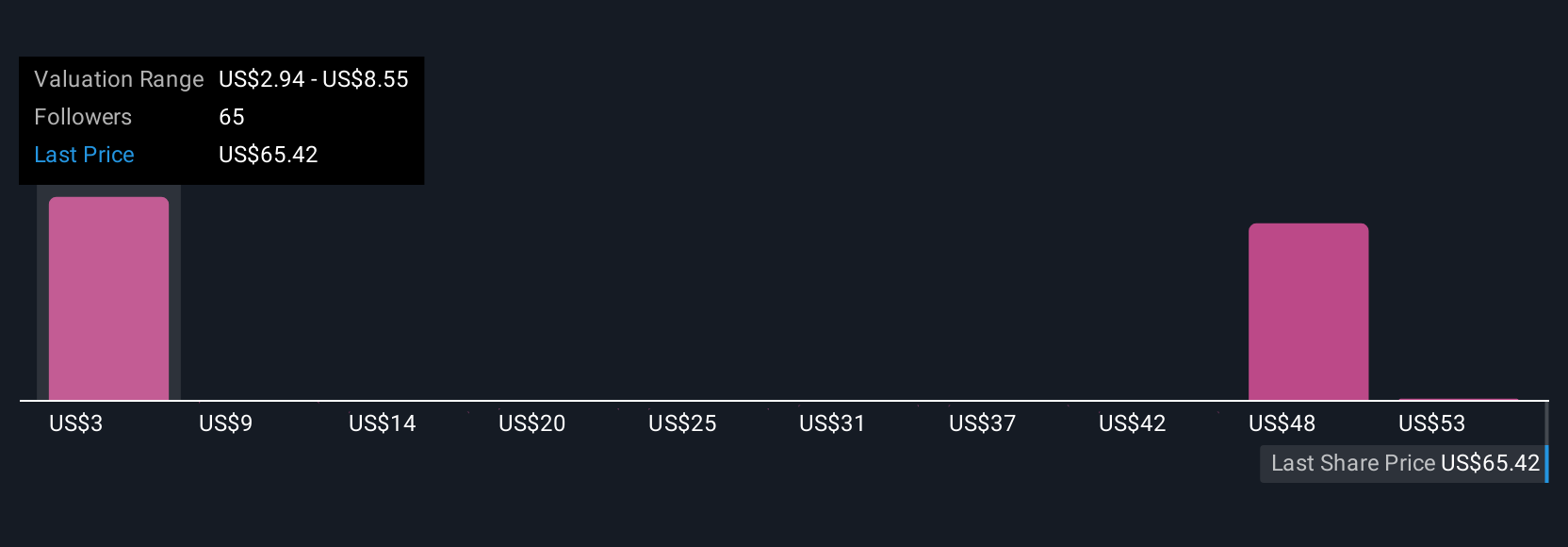

Twenty Simply Wall St Community members provided fair value estimates for MP Materials, spanning from US$5.86 to US$85 per share. These wide-ranging viewpoints reflect uncertainty around the benefits and risks of government-backed contracts and project buildout, so explore different projections to get a fuller picture.

Explore 20 other fair value estimates on MP Materials - why the stock might be worth less than half the current price!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.