- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (MP) Is Down 5.4% After Apple, DoD Supply Deals and $500M Mine Investment - Has The Bull Case Changed?

Reviewed by Simply Wall St

- In the past week, MP Materials presented at two major industry conferences and announced a multi-billion-dollar agreement with the U.S. Department of Defense, alongside a US$500 million investment from Apple supporting its rare-earth operations at Mountain Pass Mine.

- These announcements highlight how global trade restrictions have elevated the company's role in establishing a secure U.S. supply of neodymium, essential for electronics and defense manufacturing.

- We'll explore how the high-profile partnership with Apple signals a deeper shift in MP Materials' investment narrative toward supply chain resilience and downstream growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MP Materials Investment Narrative Recap

Shareholders in MP Materials are betting on the rise of secure domestic rare earth production and downstream integration, premised on deep public and private sector buy-in for U.S. supply chains. The flurry of recent announcements, including the Department of Defense (DoD) agreement and Apple partnership, directly reinforce this investment case and could strengthen short-term revenue visibility, but the biggest immediate risk, execution challenges as new facilities come online, remains unchanged by these latest developments.

The new multi-billion-dollar DoD partnership stands out as the most relevant recent announcement, underscoring the U.S. government's commitment to secure rare earth magnet supply for defense needs. This agreement not only locks in minimum pricing and EBITDA for MP Materials but also puts a spotlight on execution risk tied to scaling up facilities and meeting contractual milestones, making operational follow-through a continuing key catalyst for the stock.

Yet, in contrast, investors should keep a close eye on how cost overruns or delays at new plants could...

Read the full narrative on MP Materials (it's free!)

MP Materials' outlook projects $1.0 billion in revenue and $236.3 million in earnings by 2028. This assumes 61.3% annual revenue growth and a $337.7 million increase in earnings from the current -$101.4 million.

Uncover how MP Materials' forecasts yield a $77.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

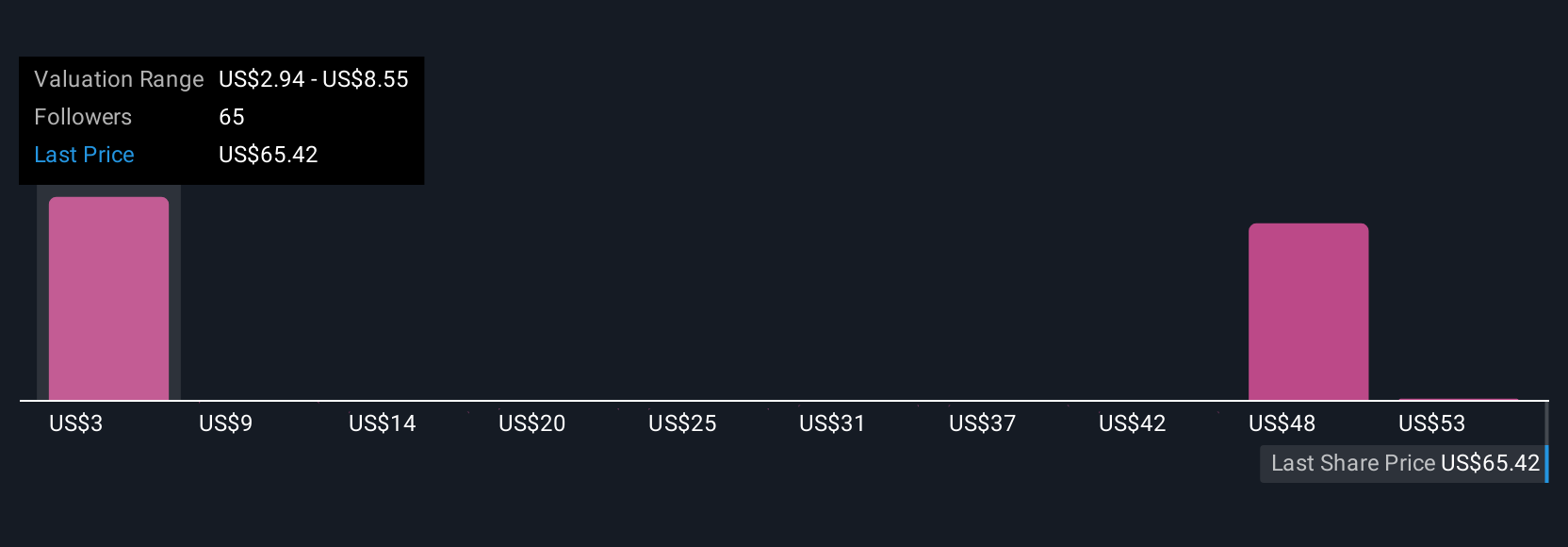

Fair value estimates from 21 Simply Wall St Community members span from just over US$2.64 to US$85 per share, with opinions clearly stretching across the spectrum. While many are focused on future government-backed revenues, some analyses caution that execution risks during expansion could have broader impacts on earnings and valuation, inviting you to explore the full spread of viewpoints.

Explore 21 other fair value estimates on MP Materials - why the stock might be worth as much as 36% more than the current price!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026