- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Is the Recent Share Price Momentum Reflected in Its Valuation?

Reviewed by Kshitija Bhandaru

Martin Marietta Materials (MLM) stock has shown steady performance through the month, rising just over 1% in the past 30 days. Investors seem to be weighing the company’s strong track record alongside current industry trends and recent results.

See our latest analysis for Martin Marietta Materials.

Martin Marietta Materials has gained notable traction this year, reflected in a robust year-to-date share price return of nearly 25%, while its 1-year total shareholder return sits just above 20%. This momentum suggests investors remain confident after a string of strong quarterly results and ongoing sector demand.

Curious about what else is gaining attention among investors? Now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares near record highs and strong fundamentals in play, investors may be wondering if Martin Marietta Materials is undervalued right now or if a surge in expectations has already been reflected in its price. Could this still be a buying opportunity, or is the market simply pricing in future growth?

Most Popular Narrative: 1.8% Undervalued

Martin Marietta Materials' most widely followed narrative points to a fair value just above the last closing price, highlighting how investor expectations have caught up with fundamentals. This sets the scene for a closer look at the assumptions behind the consensus view.

Sustained, multi-year demand for aggregates is expected due to ongoing U.S. federal and state infrastructure investment, with state and local highway, bridge, and tunnel contract awards recently hitting record highs. Anticipated extensions to federal spending packages would further increase revenue visibility and support continued top-line and EBITDA growth.

Will construction tailwinds keep fueling the runway for future growth, or is there a twist in the numbers? The real intrigue lies in the bold expectations for margins and analyst assumptions on future performance. See what future growth levers might tip the scale further.

Result: Fair Value of $648.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in residential construction or unexpected delays in government infrastructure spending could challenge the bullish outlook for Martin Marietta Materials.

Find out about the key risks to this Martin Marietta Materials narrative.

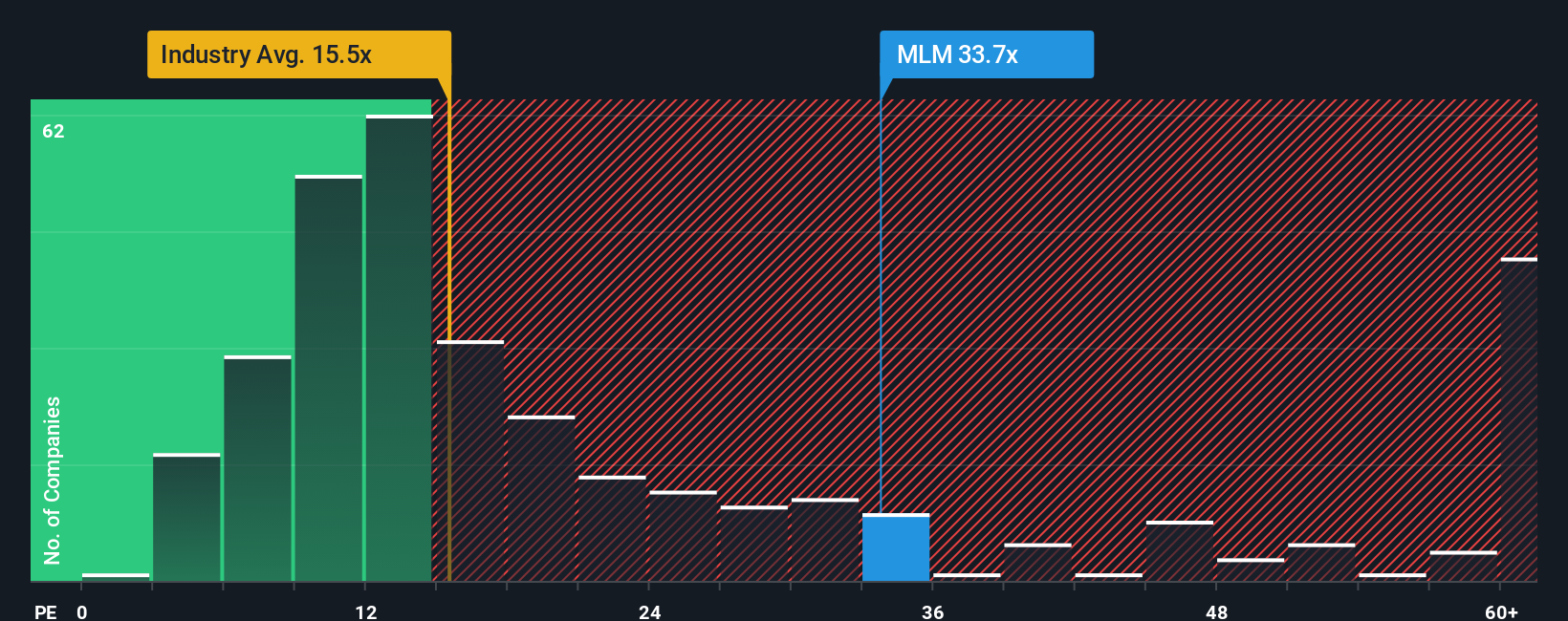

Another View: Market Multiples Raise a Caution Flag

Looking at valuation from a market multiple perspective, Martin Marietta Materials trades at a price-to-earnings ratio of 34.9x. This is much higher than both its global industry average of 15.6x and peer average of 27.1x. The current ratio also far exceeds the fair ratio of 22.9x, hinting at a premium that investors are paying today.

Does this higher multiple indicate confidence in future growth, or could it limit upside if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If these perspectives do not quite match your outlook, you can explore the numbers, question the consensus, and build your own narrative in just a few minutes with Do it your way

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Move ahead of the crowd and uncover untapped opportunities by searching stocks that fit your unique goals. Gain an advantage with fresh insights now.

- Tap into high-potential tech trends by checking out these 25 AI penny stocks as they revolutionize automation and intelligence across multiple industries.

- Boost your income strategy with these 19 dividend stocks with yields > 3% providing yields above 3% for those seeking reliable cash flow in their portfolio.

- Seize early opportunities for rapid growth and volatility with these 3572 penny stocks with strong financials leading the way in emerging markets and bold innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives