- United States

- /

- Chemicals

- /

- NYSE:LYB

What LyondellBasell Industries (LYB)'s Possible Dividend Suspension Means For Shareholders

Reviewed by Sasha Jovanovic

- Recently, LyondellBasell Industries revealed it may have to suspend its longstanding dividend if its Net Debt/EBITDA ratio exceeds 4.25 times, as required by a debt covenant.

- This development introduces new uncertainty for income-focused shareholders and highlights how chemicals market softness and financial leverage can combine to challenge even historically stable dividend payers.

- Now, we'll examine how the risk of a potential dividend suspension could alter LyondellBasell's previously outlined investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

LyondellBasell Industries Investment Narrative Recap

To own shares of LyondellBasell, you need confidence in its ability to weather cyclical downturns in chemicals, execute on investments in recycling and cost-efficient regions, and protect capital returns through industry softness. The recent news around potential dividend suspension adds new tension to the short-term outlook, particularly for those focused on yield, but does not materially change the biggest immediate risk: persistent margin and revenue pressure from oversupply and weak demand in core petrochemicals.

Of recent announcements, the September 2025 credit agreement amendment stands out. This amendment allows higher leverage under certain conditions, but adds restrictions to dividend and buyback flexibility, directly linking financial discipline to future capital returns, an especially relevant detail as the dividend faces pressure from both market conditions and covenant limits.

However, should chemicals markets remain subdued and margins stay under pressure, even the most robust balance sheet can quickly reach its limits...

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries is projected to reach $29.2 billion in revenue and $2.2 billion in earnings by 2028. This forecast assumes a 9.0% annual decline in revenue, but a significant increase in earnings of $2.05 billion from the current $150.0 million.

Uncover how LyondellBasell Industries' forecasts yield a $57.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

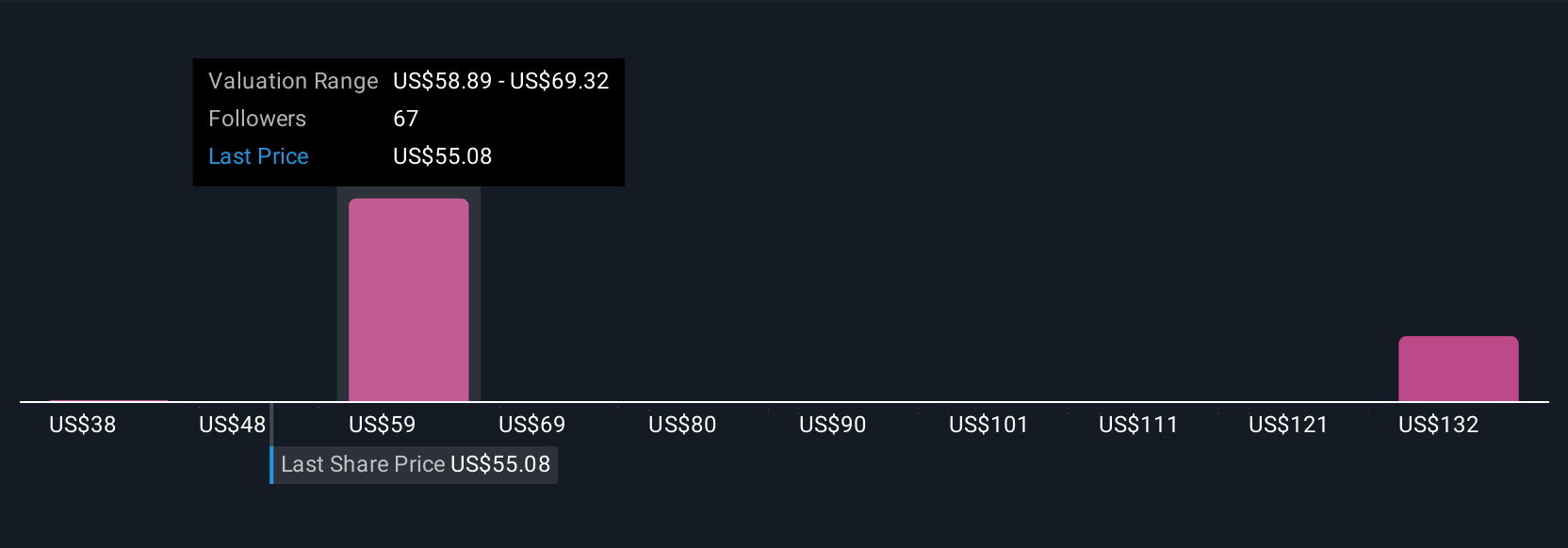

Fair value estimates for LyondellBasell from 14 Simply Wall St Community members range broadly from US$35.57 to US$144.07. As you weigh these perspectives, remember that ongoing revenue and margin compression risks continue to shape how shareholders assess LYB's performance and future potential.

Explore 14 other fair value estimates on LyondellBasell Industries - why the stock might be worth over 3x more than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives