- United States

- /

- Chemicals

- /

- NYSE:LYB

LyondellBasell Industries (LYB): Valuation in Focus as Dividend Suspension Risk and Debt Concerns Draw Investor Scrutiny

Reviewed by Simply Wall St

LyondellBasell Industries (LYB) has come into focus after reports indicated the company might be forced to suspend its dividend if its Net Debt/EBITDA ratio climbs above a key limit in its debt agreements. Management's move to reduce capital expenditures highlights the seriousness of the situation, while a weaker chemicals market is adding to investor concerns.

See our latest analysis for LyondellBasell Industries.

While LyondellBasell Industries works to address debt covenant pressures and a flagging chemicals market, investors have taken notice. The stock’s 1-year total shareholder return is down 41%, and price momentum has faded sharply, with shares now at $47.59.

If LYB’s volatility has you scanning the market for fresh opportunities, now is a perfect time to explore fast growing stocks with high insider ownership.

With financial pressures mounting and shares trading well below analyst targets, the question becomes clear: is LyondellBasell Industries a bargain for value seekers, or is the challenging outlook already reflected in the stock price?

Most Popular Narrative: 16.5% Undervalued

Compared to the closing share price of $47.59, the most widely followed narrative values LyondellBasell Industries at $57.00. A gap remains between the current market level and what the consensus believes is fair value, as the narrative looks ahead to financial recovery and profit expansion.

LyondellBasell's strategic investments in circular and advanced recycling (MoReTec-1 and plans for MoReTec-2, as well as expanding renewable feedstock capacity in Europe) position the company to benefit from rising regulatory and consumer demand for recycled and sustainable plastics. This may improve product mix and support higher net margins and long-term revenue growth.

Curious how future earnings might defy today’s weak returns? The narrative is built on aggressive shifts in profit margins and ambitious growth targets few would predict. Find out the surprising assumptions and unanswered questions driving this fair value.

Result: Fair Value of $57.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained global overcapacity and delayed investment in sustainable projects could continue to put pressure on both LyondellBasell’s margins and its long-term competitiveness.

Find out about the key risks to this LyondellBasell Industries narrative.

Another View: Multiples Paint a Cautious Picture

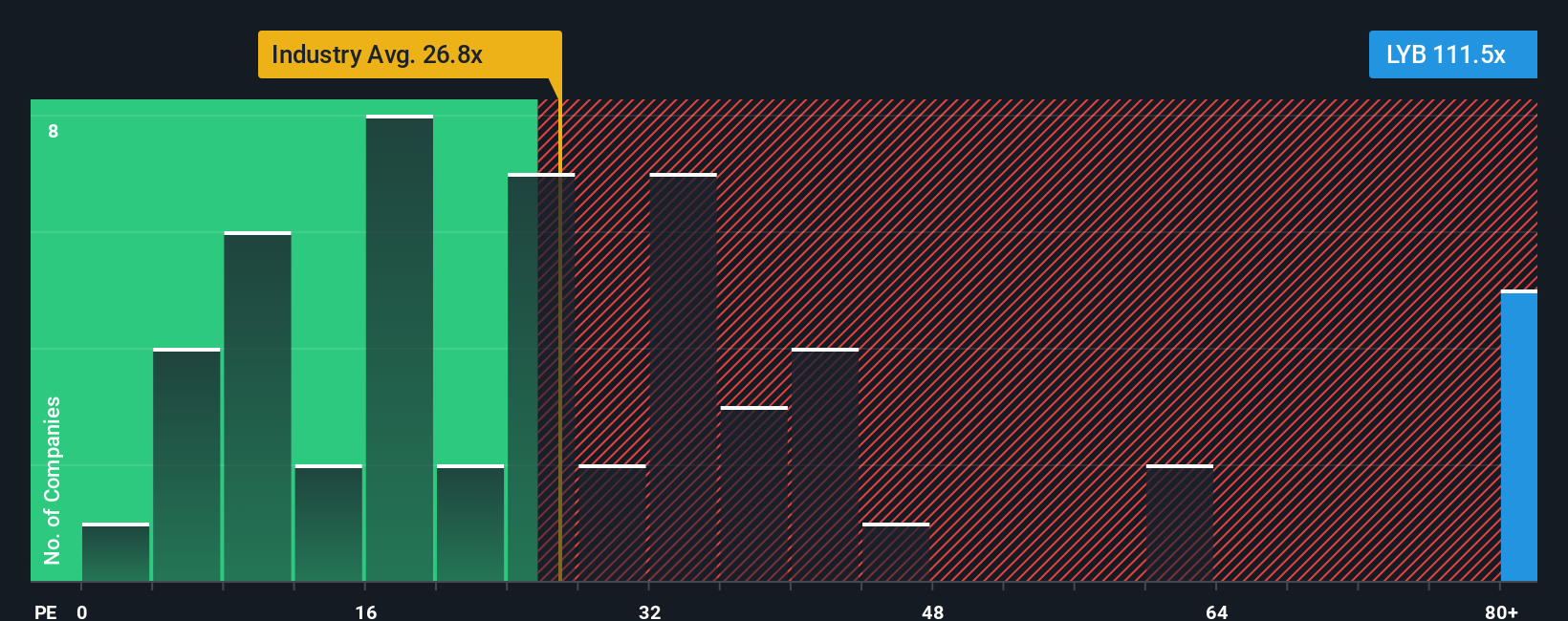

Looking instead at the price-to-earnings ratio, LyondellBasell is trading at 102x, much higher than both industry peers at 25.7x and the fair ratio of 38.9x. This signals the stock is expensive by this metric and raises questions about the margin for error in today’s price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LyondellBasell Industries Narrative

If you want to dive deeper or reach your own conclusions, you can shape your own perspective using the same data in just a few minutes. Do it your way

A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Make smarter investment moves by unleashing the full power of the Simply Wall Street Screener so you never miss out on the next big winner.

- Spot stocks trading well below their intrinsic value by reviewing these 877 undervalued stocks based on cash flows. Get ahead of the crowd seeking hidden bargains.

- Fuel your portfolio’s growth with these 27 AI penny stocks, tapping into emerging leaders reshaping industries with artificial intelligence breakthroughs.

- Secure income potential with these 17 dividend stocks with yields > 3% to access attractive yields and a steady stream of cash flow for your investments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives