- United States

- /

- Chemicals

- /

- NYSE:LYB

Is LyondellBasell's (LYB) Steadfast Dividend a Sign of Strength or a Response to Growth Pressures?

Reviewed by Sasha Jovanovic

- LyondellBasell Industries announced on November 21, 2025, that it has declared a US$1.37 per share dividend, with an ex-dividend and record date of December 1, 2025, and payment scheduled for December 8, 2025.

- This dividend affirmation comes at a time when analysis highlights concerns about LyondellBasell's financial health, including limited financial flexibility and declining growth metrics.

- Next, we'll explore how maintaining the dividend payout influences LyondellBasell's investment case amid ongoing financial and growth headwinds.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

LyondellBasell Industries Investment Narrative Recap

To own LyondellBasell Industries shares today, investors need confidence in the company's ability to sustain shareholder returns amid headwinds including weak growth, declining profitability, and a cyclical petrochemical industry. The recently affirmed US$1.37 per share dividend provides stability for income-focused investors, but does not materially impact the most pressing catalyst, the company's strategic shift toward circular and sustainable materials, or the main risk of prolonged industry downturn and margin pressure.

Among LyondellBasell’s recent developments, the September 2025 amendment to its Credit Agreement stands out as highly relevant. This adjustment, which increases the maximum leverage ratio and imposes further restrictions on dividend increases, clearly ties near-term shareholder returns to the company’s debt position and cash flow generation, both of which play pivotal roles as the company faces industry-wide demand challenges.

Yet, in contrast to the company’s efforts to maintain its dividend, investors should be aware of...

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries' outlook anticipates $29.2 billion in revenue and $2.2 billion in earnings by 2028. This projection is based on a 9.0% annual revenue decline and an increase in earnings of $2.05 billion from current earnings of $150.0 million.

Uncover how LyondellBasell Industries' forecasts yield a $53.78 fair value, a 11% upside to its current price.

Exploring Other Perspectives

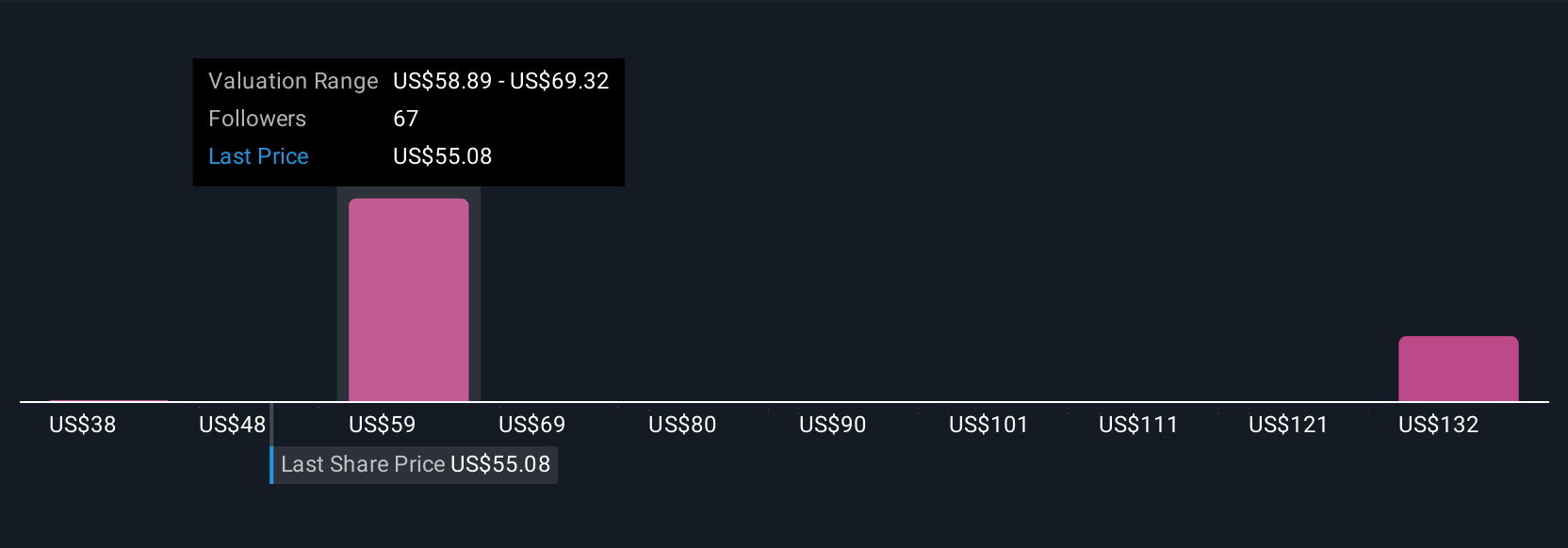

Twelve members of the Simply Wall St Community see LyondellBasell's fair value from as low as US$38.02 to as high as US$116.35 per share. As you review these different perspectives, keep in mind that extended market headwinds and compressed margins could influence the company’s fundamentals in the years ahead.

Explore 12 other fair value estimates on LyondellBasell Industries - why the stock might be worth 21% less than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

No Opportunity In LyondellBasell Industries?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success