- United States

- /

- Chemicals

- /

- NYSE:LYB

Does LYB’s Cash Generation Strategy Reveal a New Phase for Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- In a recent update, LyondellBasell Industries reported a very high third-quarter cash conversion rate and noted substantial progress on its cash improvement plan, aiming for US$600 million by year-end and US$1.1 billion by the end of 2026.

- The company also highlighted that domestic polyethylene demand for 2025 is expected to be the strongest since the downturn began in third-quarter 2022, while global ethylene capacity rationalization could remove about 10% of supply by 2028.

- We’ll explore how LyondellBasell’s reported cash improvement progress influences the broader investment narrative for the company.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

LyondellBasell Industries Investment Narrative Recap

To be a shareholder in LyondellBasell, you need to believe in the company’s ability to navigate the petrochemical cycle, capitalize on growing polyethylene demand, and execute on cost and cash improvement plans. The latest update on high cash conversion and working capital progress directly supports the cash flow story, an important short-term catalyst, while the biggest risk of ongoing global overcapacity in key products appears unchanged by this news.

Among LyondellBasell’s recent announcements, new guidance pointing to improved profitability in the next quarter stands out. This is particularly relevant as investors weigh the impact of cash flow generation and margin recovery amidst expectations for stronger polyethylene demand in the coming year.

However, it’s also important to consider that, even as management builds cash reserves, the persistent risk of industry overcapacity remains something investors should be aware of, especially if…

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries is projected to reach $29.2 billion in revenue and $2.2 billion in earnings by 2028. This outlook reflects a 9.0% annual decline in revenue, but forecasts an earnings increase of $2.05 billion from current earnings of $150 million.

Uncover how LyondellBasell Industries' forecasts yield a $55.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

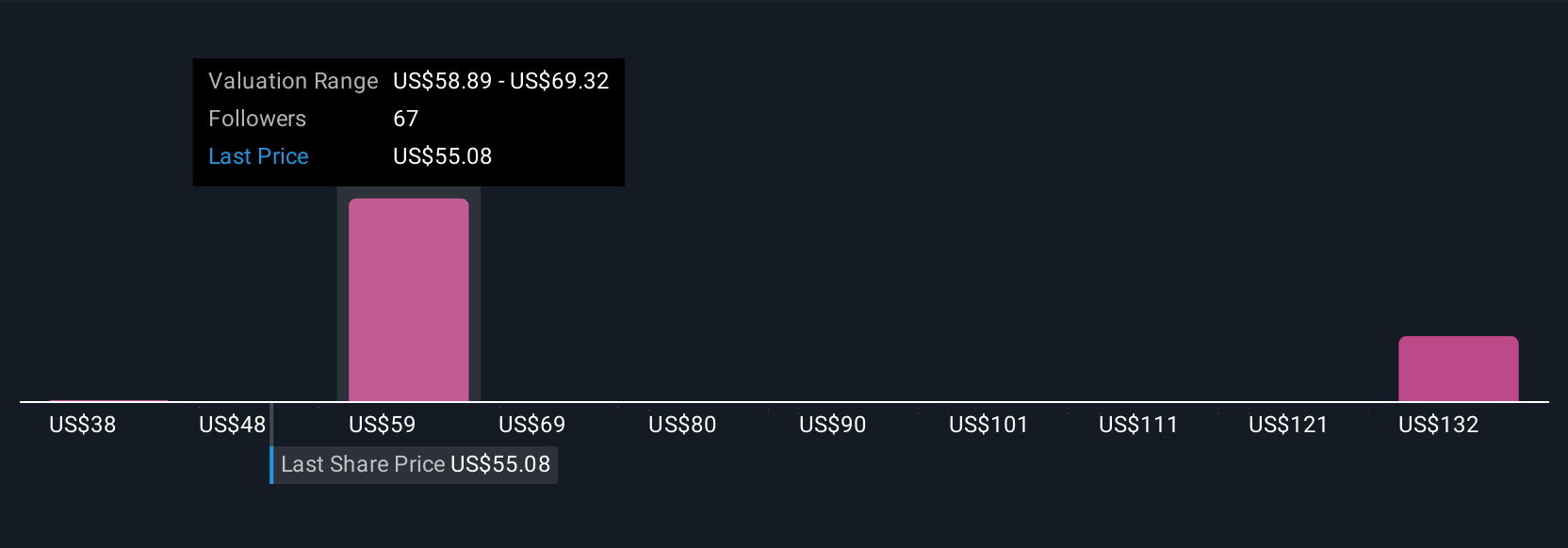

Twelve Simply Wall St Community member fair values for LyondellBasell range widely from US$38 to nearly US$97 per share. While some see opportunity at current prices, others point to risks like prolonged global overcapacity that could weigh on results and sector confidence, so exploring several viewpoints may be useful before making judgments.

Explore 12 other fair value estimates on LyondellBasell Industries - why the stock might be worth over 2x more than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives