- United States

- /

- Chemicals

- /

- NYSE:LTHM

New Forecasts: Here's What Analysts Think The Future Holds For Livent Corporation (NYSE:LTHM)

Celebrations may be in order for Livent Corporation (NYSE:LTHM) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The market may be pricing in some blue sky too, with the share price gaining 29% to US$28.12 in the last 7 days. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

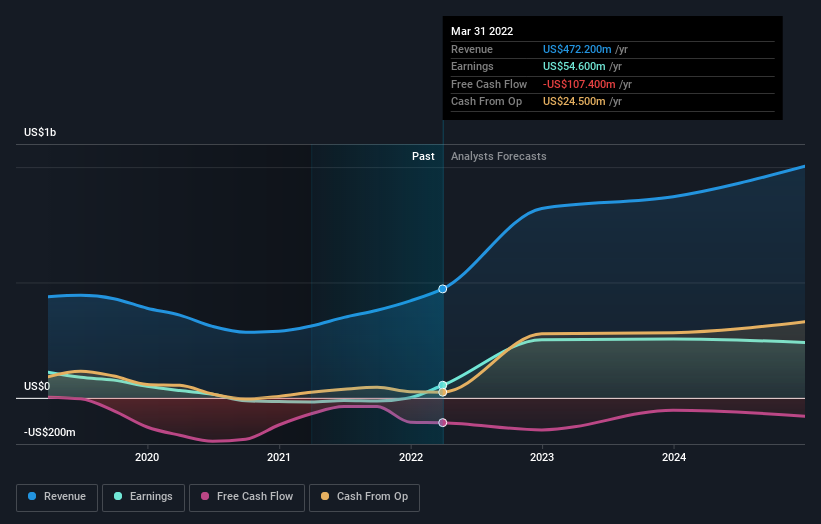

Following the upgrade, the latest consensus from Livent's 13 analysts is for revenues of US$817m in 2022, which would reflect a huge 73% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to surge 267% to US$1.24. Before this latest update, the analysts had been forecasting revenues of US$585m and earnings per share (EPS) of US$0.63 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Livent

It will come as no surprise to learn that the analysts have increased their price target for Livent 9.3% to US$33.14 on the back of these upgrades. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Livent at US$41.00 per share, while the most bearish prices it at US$26.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. For example, we noticed that Livent's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 108% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 2.1% a year over the past three years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 4.0% annually. Not only are Livent's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Livent.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Livent analysts - going out to 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LTHM

Livent

Engages in the production of lithium chemicals products in the Asia Pacific, North America, Europe, the Middle East, Africa, and Latin America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives