Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Livent Corporation (NYSE:LTHM) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Livent

What Is Livent's Debt?

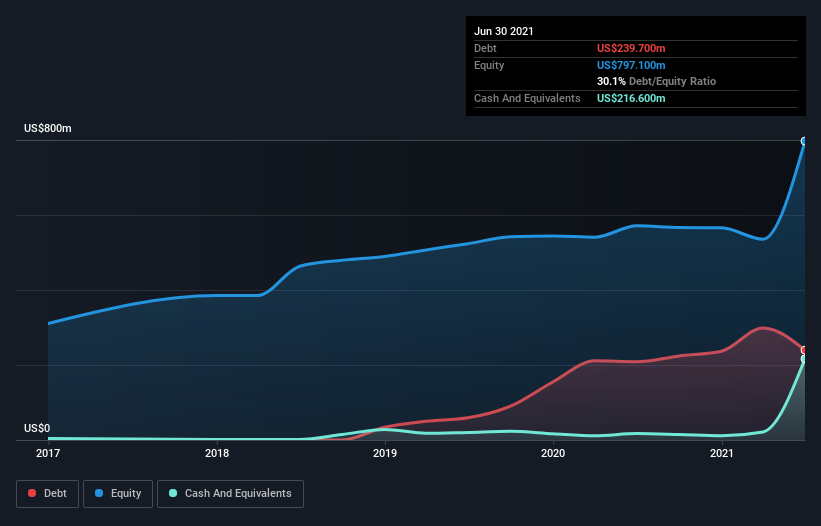

The image below, which you can click on for greater detail, shows that at June 2021 Livent had debt of US$239.7m, up from US$208.7m in one year. On the flip side, it has US$216.6m in cash leading to net debt of about US$23.1m.

A Look At Livent's Liabilities

We can see from the most recent balance sheet that Livent had liabilities of US$79.8m falling due within a year, and liabilities of US$275.6m due beyond that. On the other hand, it had cash of US$216.6m and US$113.1m worth of receivables due within a year. So it has liabilities totalling US$25.7m more than its cash and near-term receivables, combined.

This state of affairs indicates that Livent's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$3.57b company is struggling for cash, we still think it's worth monitoring its balance sheet. Carrying virtually no net debt, Livent has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Livent can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Livent reported revenue of US$349m, which is a gain of 13%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months Livent produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at US$2.4m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through US$38m of cash over the last year. So suffice it to say we do consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Livent is showing 2 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Livent, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:LTHM

Livent

Engages in the production of lithium chemicals products in the Asia Pacific, North America, Europe, the Middle East, Africa, and Latin America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives