- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

Will Sharp EPS and Revenue Drops Shift Louisiana-Pacific's (LPX) Outlook and Analyst Sentiment?

Reviewed by Simply Wall St

- In recent news, Louisiana-Pacific is predicted to post earnings per share of US$0.41, representing a 66.39% decline and an 8.12% decrease in revenue compared to the same quarter last year, with the company now ranked #5 (Strong Sell) by Zacks due to heightened analyst caution.

- This marks a significant shift in analyst sentiment, as concerns mount over Louisiana-Pacific's near-term business outlook and profit potential.

- We'll now examine how this pronounced earnings and revenue decline raises new questions for Louisiana-Pacific's future growth expectations and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Louisiana-Pacific Investment Narrative Recap

For investors to be confident in Louisiana-Pacific, they generally need to believe in a rebound in US housing demand and continued growth in the company’s high-margin siding products. The recent sharp downgrade in earnings expectations and analyst sentiment could weaken one of the key near-term catalysts, expanding siding sales, while amplifying the principal risk tied to cyclical weakness in core construction markets. The company’s August 2025 Q2 earnings announcement is highly relevant in this context, as it revealed significant year-over-year drops in both revenue and net income. Despite reaffirmed growth in siding net sales in its latest guidance, the overall decline in profitability throws the sustainability of this growth into sharper focus. Yet, with housing starts faltering and price pressures lingering, investors should also be aware of...

Read the full narrative on Louisiana-Pacific (it's free!)

Louisiana-Pacific's outlook anticipates $3.3 billion in revenue and $435.7 million in earnings by 2028. This scenario assumes a 4.6% annual revenue growth rate and a $137.7 million increase in earnings from current earnings of $298.0 million.

Uncover how Louisiana-Pacific's forecasts yield a $102.40 fair value, a 7% upside to its current price.

Exploring Other Perspectives

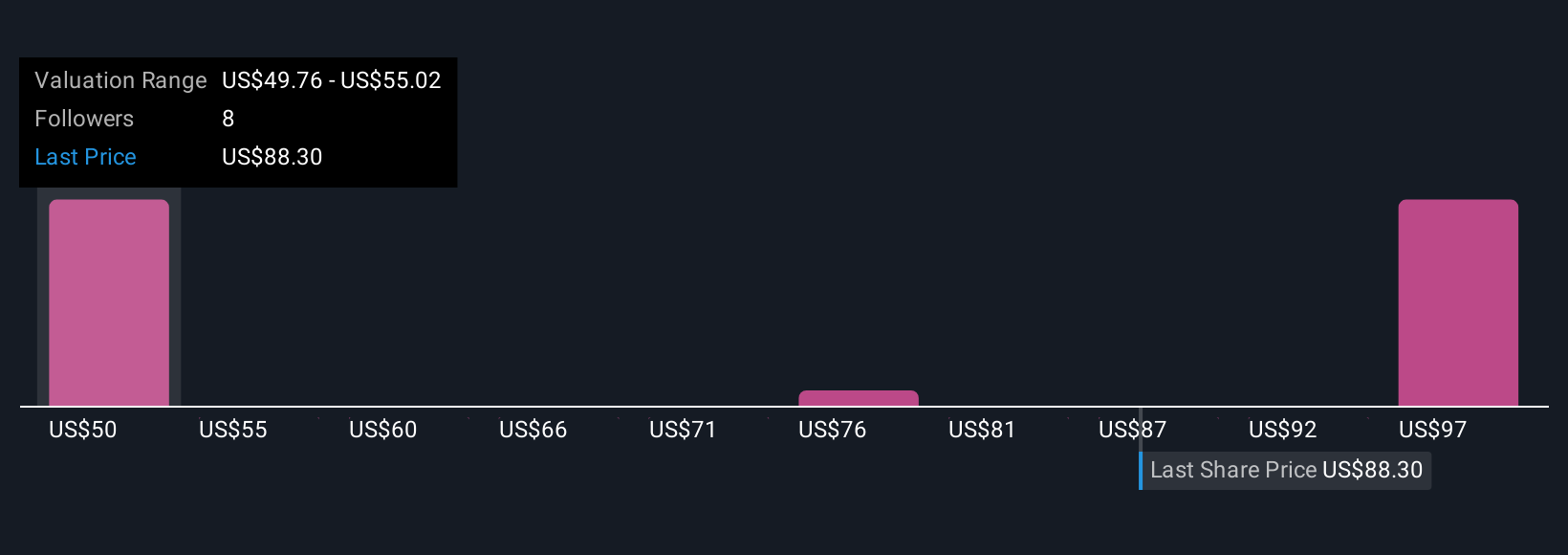

Simply Wall St Community members provided four fair value estimates for Louisiana-Pacific between US$49.26 and US$102.40 per share. These varied views surface as the risk of sustained low OSB prices and construction demand weighs heavily on performance, encouraging you to consider multiple perspectives on the stock's outlook.

Explore 4 other fair value estimates on Louisiana-Pacific - why the stock might be worth as much as 7% more than the current price!

Build Your Own Louisiana-Pacific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Louisiana-Pacific research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Louisiana-Pacific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Louisiana-Pacific's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives