- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

The Bull Case For Louisiana-Pacific (LPX) Could Change Following Strategic Shift Toward High-Margin Siding Solutions

Reviewed by Sasha Jovanovic

- In recent news, Louisiana-Pacific Corporation announced a continued shift toward its high-margin Siding Solutions segment, aiming to offset challenges faced in its commodity-driven OSB business amid new US tariffs on imported softwood lumber.

- This focus comes as the company strengthens strategic partnerships and seeks operational efficiencies against a backdrop of housing market uncertainties and changing construction sector costs.

- We'll explore how Louisiana-Pacific's emphasis on Siding Solutions amid industry headwinds could influence its long-term investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Louisiana-Pacific Investment Narrative Recap

To be a shareholder in Louisiana-Pacific right now, you must believe in the company's ability to grow its higher-margin Siding Solutions business as OSB profitability remains pressured by lingering low prices and new tariffs. The recent news of a continued strategic pivot toward Siding Solutions reinforces the most important short-term catalyst, sustained demand for engineered siding despite broader housing market softness, while persistent weak OSB pricing still stands out as the biggest risk. The shift isn't expected to materially change that risk in the near term.

Among the recent announcements, Q2 2025 earnings provide the most relevant context: sales and net income declined year over year, illustrating the headwinds facing the commodity-driven OSB segment despite growth efforts in Siding Solutions. This underlines why LPX’s near-term performance hinges on expanding sales and market share in the Siding segment, as management forecasts continued Siding net sales growth for the full year 2025 despite softer totals elsewhere.

However, investors should also consider that if demand for single-family construction remains muted, even Siding Solutions growth may not be enough to offset persistent weakness in ...

Read the full narrative on Louisiana-Pacific (it's free!)

Louisiana-Pacific's outlook anticipates $3.3 billion in revenue and $435.7 million in earnings by 2028. This scenario is built on a projected 4.6% annual revenue growth and a $137.7 million increase in earnings from the current $298.0 million.

Uncover how Louisiana-Pacific's forecasts yield a $105.30 fair value, a 14% upside to its current price.

Exploring Other Perspectives

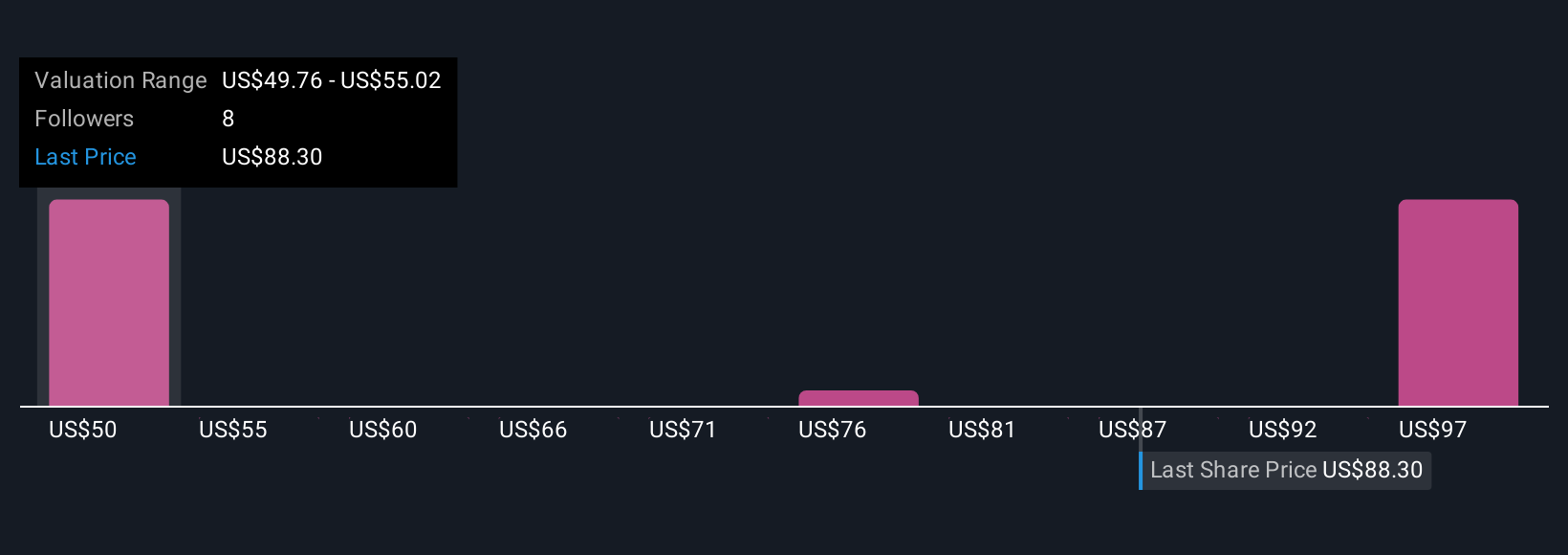

Fair value estimates from the Simply Wall St Community range from US$45.12 to US$105.30 across four individual perspectives, underscoring varied optimism about LPX’s outlook. As you weigh these differing views, remember that housing market demand remains a critical swing factor for future results.

Explore 4 other fair value estimates on Louisiana-Pacific - why the stock might be worth less than half the current price!

Build Your Own Louisiana-Pacific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Louisiana-Pacific research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Louisiana-Pacific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Louisiana-Pacific's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives