- United States

- /

- Chemicals

- /

- NYSE:KWR

Investor Optimism Abounds Quaker Chemical Corporation (NYSE:KWR) But Growth Is Lacking

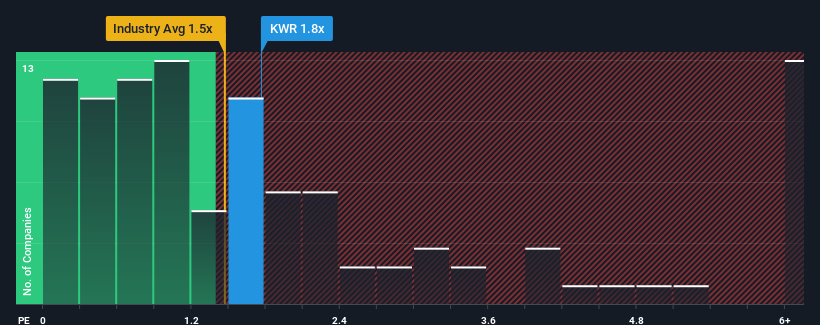

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Chemicals industry in the United States, you could be forgiven for feeling indifferent about Quaker Chemical Corporation's (NYSE:KWR) P/S ratio of 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Quaker Chemical

What Does Quaker Chemical's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Quaker Chemical has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Quaker Chemical will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Quaker Chemical's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 4.0% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 7.9% growth per annum, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Quaker Chemical's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Quaker Chemical's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Quaker Chemical's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Having said that, be aware Quaker Chemical is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Quaker Chemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids for steel, aluminum, automotive, aerospace, offshore, can, mining, and metalworking companies worldwide.

Flawless balance sheet, undervalued and pays a dividend.