- United States

- /

- Chemicals

- /

- NYSE:KRO

Investors Continue Waiting On Sidelines For Kronos Worldwide, Inc. (NYSE:KRO)

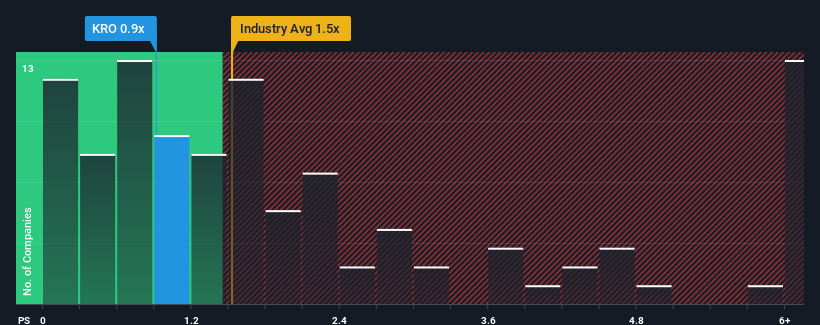

When you see that almost half of the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") above 1.5x, Kronos Worldwide, Inc. (NYSE:KRO) looks to be giving off some buy signals with its 0.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Kronos Worldwide

What Does Kronos Worldwide's P/S Mean For Shareholders?

There hasn't been much to differentiate Kronos Worldwide's and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Keen to find out how analysts think Kronos Worldwide's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kronos Worldwide's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Kronos Worldwide's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.2%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 29% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.9%, which is noticeably less attractive.

With this information, we find it odd that Kronos Worldwide is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Kronos Worldwide's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Kronos Worldwide's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Kronos Worldwide.

If these risks are making you reconsider your opinion on Kronos Worldwide, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kronos Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRO

Kronos Worldwide

Produces and markets titanium dioxide pigments (TiO2) in Europe, North America, the Asia Pacific, and internationally.

Good value with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026