- United States

- /

- Chemicals

- /

- NYSE:IFF

The Bull Case for IFF (IFF) Could Change Following Industry-First Green Hydrogen Facility Launch

Reviewed by Sasha Jovanovic

- International Flavors & Fragrances Inc. recently announced the installation of a nature-based hydrogen production facility at its Benicarlo, Spain site, making it the first in the fragrance industry to use renewable electricity for hydrogenation reactions in manufacturing key fragrance ingredients.

- This shift is projected to eliminate 2,000 tons of carbon dioxide emissions per year and aligns with IFF’s longer-term goal of achieving net zero emissions from its operations by 2040, providing a blueprint for broader innovation across its global manufacturing network.

- We'll now explore how IFF's new green hydrogen facility could influence its investment narrative, especially its focus on sustainable operations and emissions reduction.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

International Flavors & Fragrances Investment Narrative Recap

To be a shareholder in International Flavors & Fragrances, you need confidence in the company’s ability to innovate and reposition toward higher-margin, sustainable operations amid ongoing pressures in core markets and segments. The launch of IFF’s nature-based hydrogen plant supports its long-term sustainability goals but is not expected to alter the most immediate catalyst, successful recovery of volumes and margins in core businesses, nor does it materially mitigate current risks from competitive pressures and weak segments.

Among recent developments, IFF’s reaffirmed full-year 2025 guidance, anticipating up to 4% currency-neutral sales growth, stands out. This signals management’s ongoing focus on navigating near-term headwinds, with operational and cost initiatives underpinning the company’s broader efforts to return to profitable growth while integrating sustainability milestones such as the Benicarlo hydrogen project.

By contrast, the persistent threat to margins from low-cost competition in the Fragrance Ingredients segment is something investors should not overlook as they...

Read the full narrative on International Flavors & Fragrances (it's free!)

International Flavors & Fragrances is expected to reach $11.4 billion in revenue and $784.4 million in earnings by 2028. This outlook assumes a -0.3% annual revenue decline and a $1,177.4 million increase in earnings from the current level of -$393.0 million.

Uncover how International Flavors & Fragrances' forecasts yield a $81.96 fair value, a 30% upside to its current price.

Exploring Other Perspectives

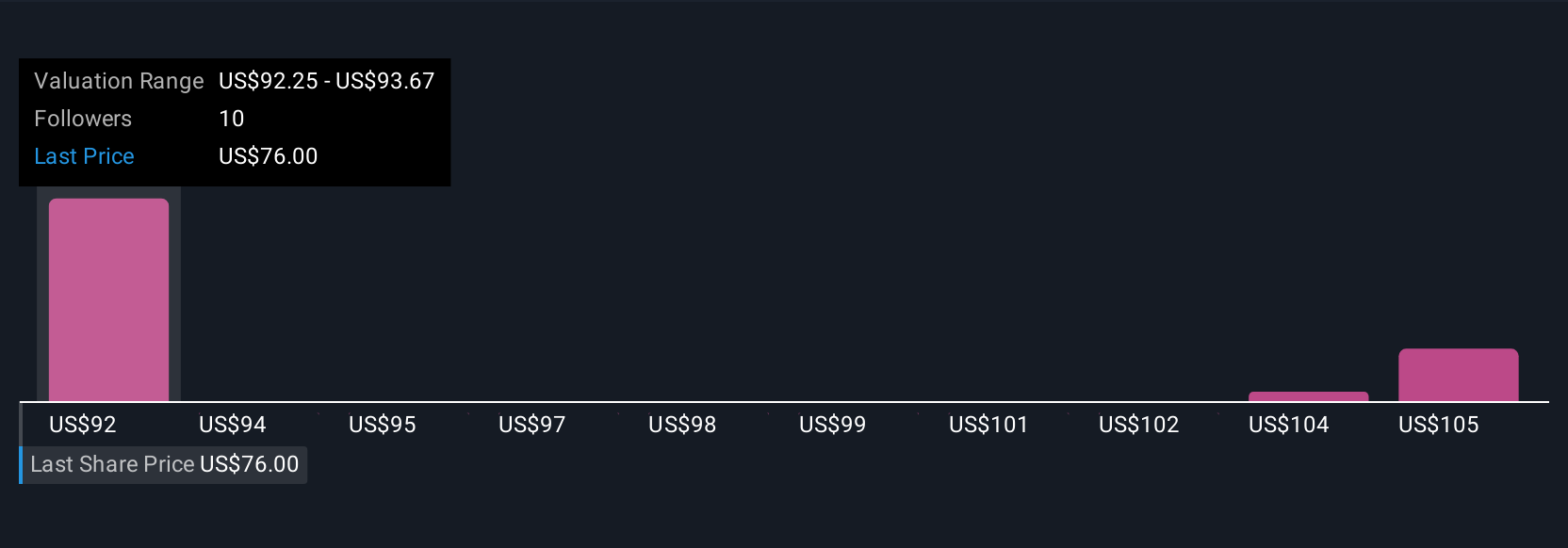

Four members of the Simply Wall St Community estimate IFF’s fair value between US$81.96 and US$108.03. While catalysts like accelerating R&D and innovation pipelines could support future results, investors may want to explore how much opinions differ on the company’s medium-term earnings path.

Explore 4 other fair value estimates on International Flavors & Fragrances - why the stock might be worth as much as 72% more than the current price!

Build Your Own International Flavors & Fragrances Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Flavors & Fragrances research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Flavors & Fragrances' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives