- United States

- /

- Chemicals

- /

- NYSE:IFF

International Flavors & Fragrances (IFF): Valuation Check After Q3 Results and Reaffirmed 2025 Outlook

Reviewed by Simply Wall St

International Flavors & Fragrances (IFF) released its third quarter results, revealing lower revenue and profits compared to last year. Despite these hurdles, IFF reiterated its full-year guidance and remains focused on sustainable business expansion.

See our latest analysis for International Flavors & Fragrances.

Even with a tough earnings report and revenue down from last year, International Flavors & Fragrances has seen its share price bounce back, showing a 9.3% one-month return after unveiling ambitious sustainability projects and reaffirming yearly guidance. While the year-to-date share price return remains firmly negative, it appears recent momentum is building as the market factors in both improved outlook and long-term innovation. However, total shareholder returns still show notable declines over one, three, and five years.

If sustainability progress and shifting momentum at IFF have you wondering what else could be on the move, it’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether International Flavors & Fragrances offers investors a discounted entry point after recent declines, or if recent optimism already reflects all the company’s growth potential in the share price.

Most Popular Narrative: 17.7% Undervalued

With the most followed narrative putting International Flavors & Fragrances' fair value at $81.96, the last close at $67.43 paints a picture of discounted potential. This sets the stage for a deeper dive into what could justify a higher valuation in the eyes of the market’s most closely watched voices.

Ongoing investments in R&D and capacity (especially in Health & Biosciences, Taste, and Specialty Fragrance Ingredients) are strengthening the company's innovation pipeline. Management expects these initiatives to accelerate revenue and profit growth beginning in 2026 and reaching full impact by 2027.

Curious about the leap in future earnings that anchors this narrative’s valuation? The anticipated transformation in margin, profitability, and market position might surprise you. Uncover the bold financial roadmap and projections insiders are betting on to find out what could power that gap between price and fair value.

Result: Fair Value of $81.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in key markets like North America and persistent challenges in the Health segment could threaten IFF’s rebound and put pressure on profitability in the near term.

Find out about the key risks to this International Flavors & Fragrances narrative.

Another View: Looking at Sales Ratios

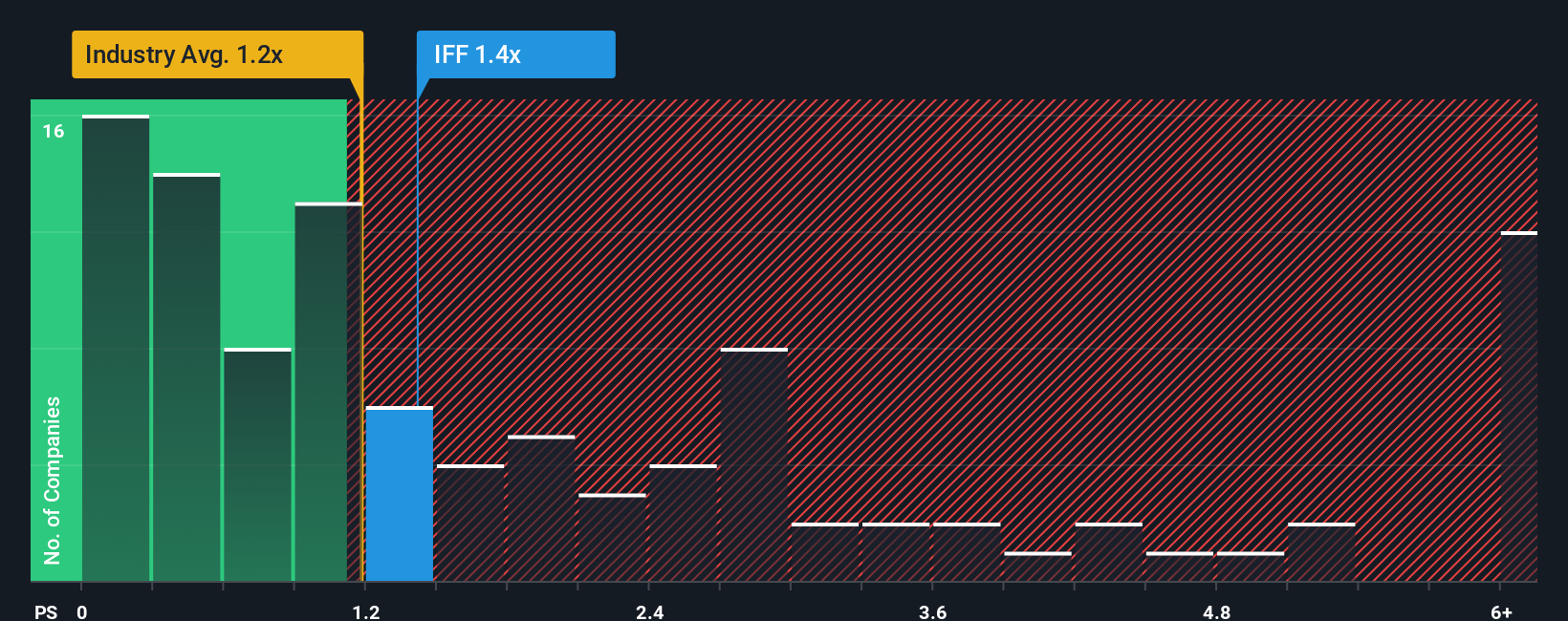

While discounted cash flow highlights IFF’s upside, the price-to-sales ratio gives a different angle. Right now, IFF trades at 1.6 times sales, higher than the US Chemicals industry average of 1.2, but below its peer average of 1.8 and the fair ratio of 1.8. This gap suggests the market sees IFF as less attractive than its best-matched peers. Is this a warning sign or an opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Flavors & Fragrances Narrative

If you see another angle or want to dig into the numbers yourself, you can build a unique narrative in just minutes. Do it your way

A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Opportunity?

Expand your investing horizons today and get ahead of the market by scouting for stocks with outstanding potential and unique market advantages.

- Capitalize on the sharpest bargains and assess which companies are truly undervalued with the help of these 884 undervalued stocks based on cash flows.

- Tap into AI innovation by checking out these 27 AI penny stocks offering leadership in artificial intelligence and next-generation automation.

- Boost your passive income by examining these 15 dividend stocks with yields > 3% featuring reliable yields for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives