- United States

- /

- Luxury

- /

- NYSE:MOV

Top 3 US Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. market experiences a mixed performance with the S&P 500 and Dow Jones Industrial Average pulling back from record highs while the Nasdaq sees gains, investors are keenly observing economic indicators and Federal Reserve actions for signs of stability. In such a dynamic environment, dividend stocks can offer a measure of consistency and income potential, making them an attractive option for those looking to balance their portfolios amidst fluctuating indices.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.72% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.41% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.25% | ★★★★★★ |

| Hope Bancorp (NasdaqGS:HOPE) | 4.43% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.34% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.16% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.77% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 177 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

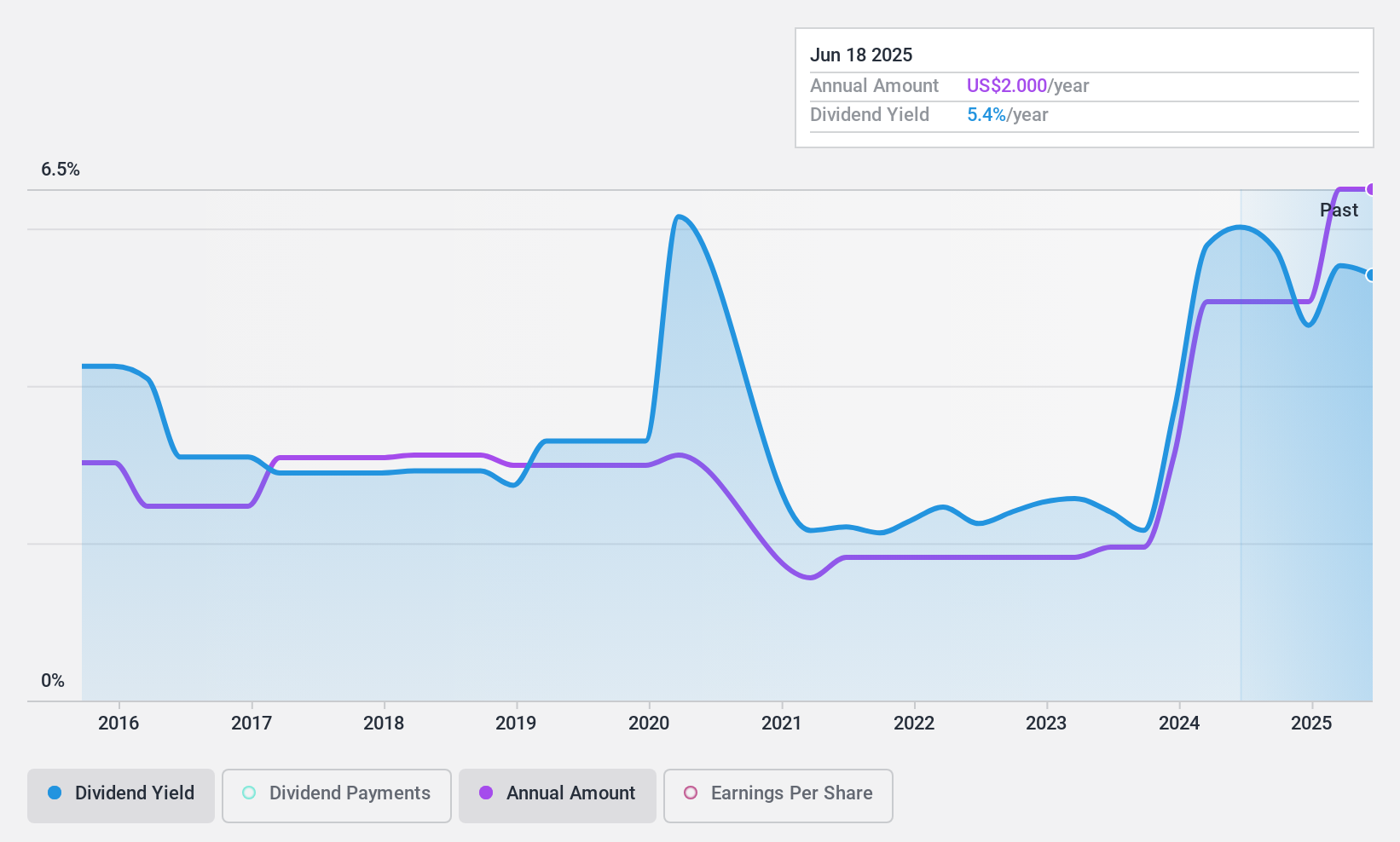

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd., along with its subsidiaries, offers location-based telematics services and machine-to-machine telematics products, with a market cap of $552.05 million.

Operations: Ituran Location and Control Ltd. generates revenue primarily from its Telematics Services segment, which accounts for $240.93 million, and its Telematics Products segment, contributing $87.83 million.

Dividend Yield: 5.6%

Ituran Location and Control offers a dividend yield of 5.57%, placing it in the top quartile of U.S. dividend payers, with dividends well-covered by earnings (55.3% payout ratio) and cash flows (49.7% cash payout ratio). Despite past volatility in its dividend history, recent affirmations include a US$0.39 per share distribution for October 2024, totaling approximately US$8 million. Additionally, Ituran's strategic partnership with Microsoft and Porsche highlights its technological innovation in motorsports telemetry systems.

- Navigate through the intricacies of Ituran Location and Control with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Ituran Location and Control shares in the market.

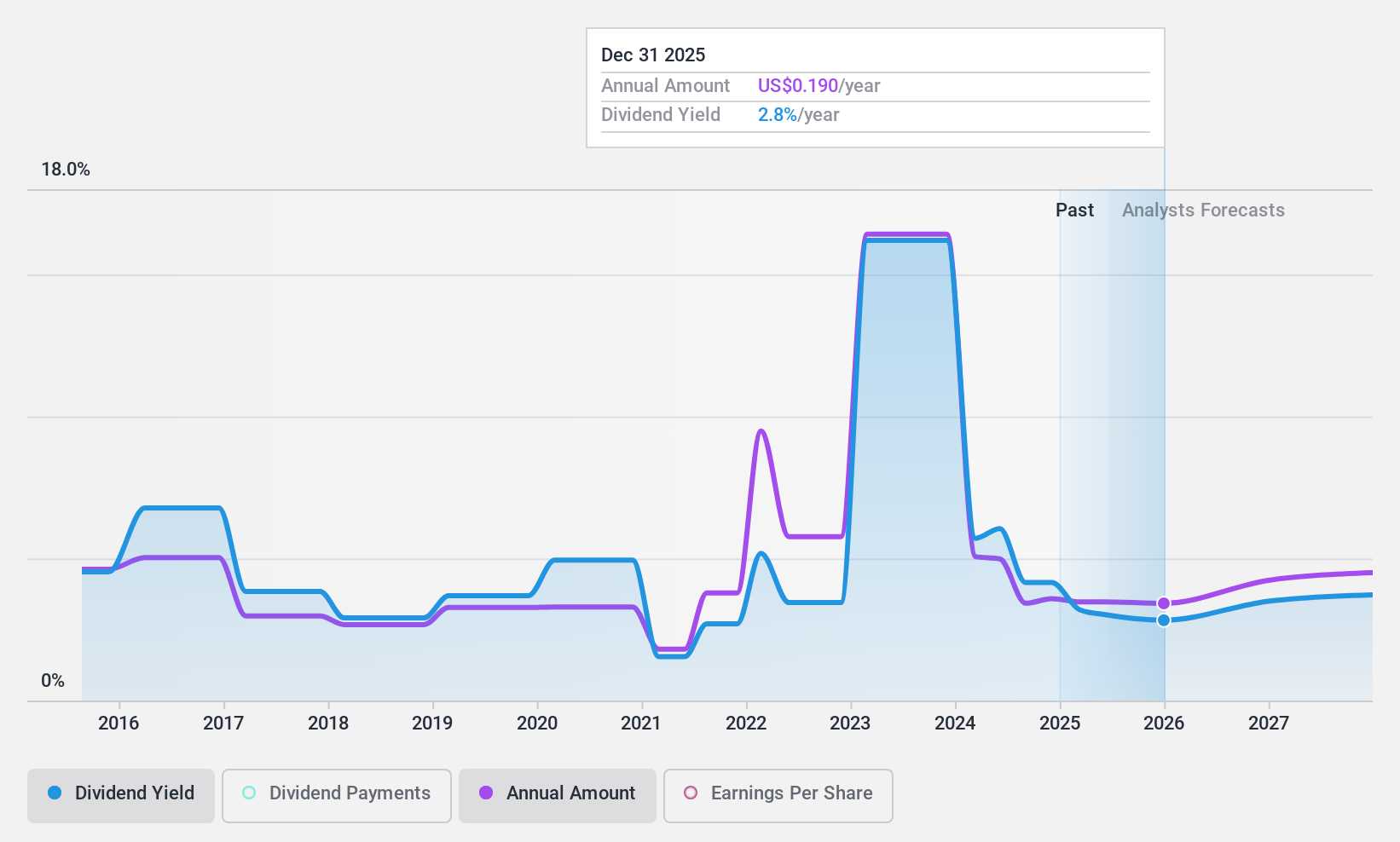

ICL Group (NYSE:ICL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ICL Group Ltd operates as a specialty minerals and chemicals company worldwide, with a market cap of approximately $5.25 billion.

Operations: ICL Group Ltd generates its revenue from several segments, including Potash ($1.85 billion), Growing Solutions ($2.00 billion), Industrial Products ($1.22 billion), and Phosphate Solutions ($2.37 billion).

Dividend Yield: 4.5%

ICL Group's dividend yield of 4.49% ranks in the top 25% of U.S. dividend payers, with a sustainable payout ratio covered by earnings (60.5%) and cash flows (38.2%). However, its dividend history has been volatile over the past decade, lacking consistent growth. Recent financials show a decline in net income to US$115 million for Q2 2024 from US$163 million a year ago, impacting overall stability despite ongoing payouts like the recent US$63 million distribution announced in August 2024.

- Delve into the full analysis dividend report here for a deeper understanding of ICL Group.

- Our comprehensive valuation report raises the possibility that ICL Group is priced lower than what may be justified by its financials.

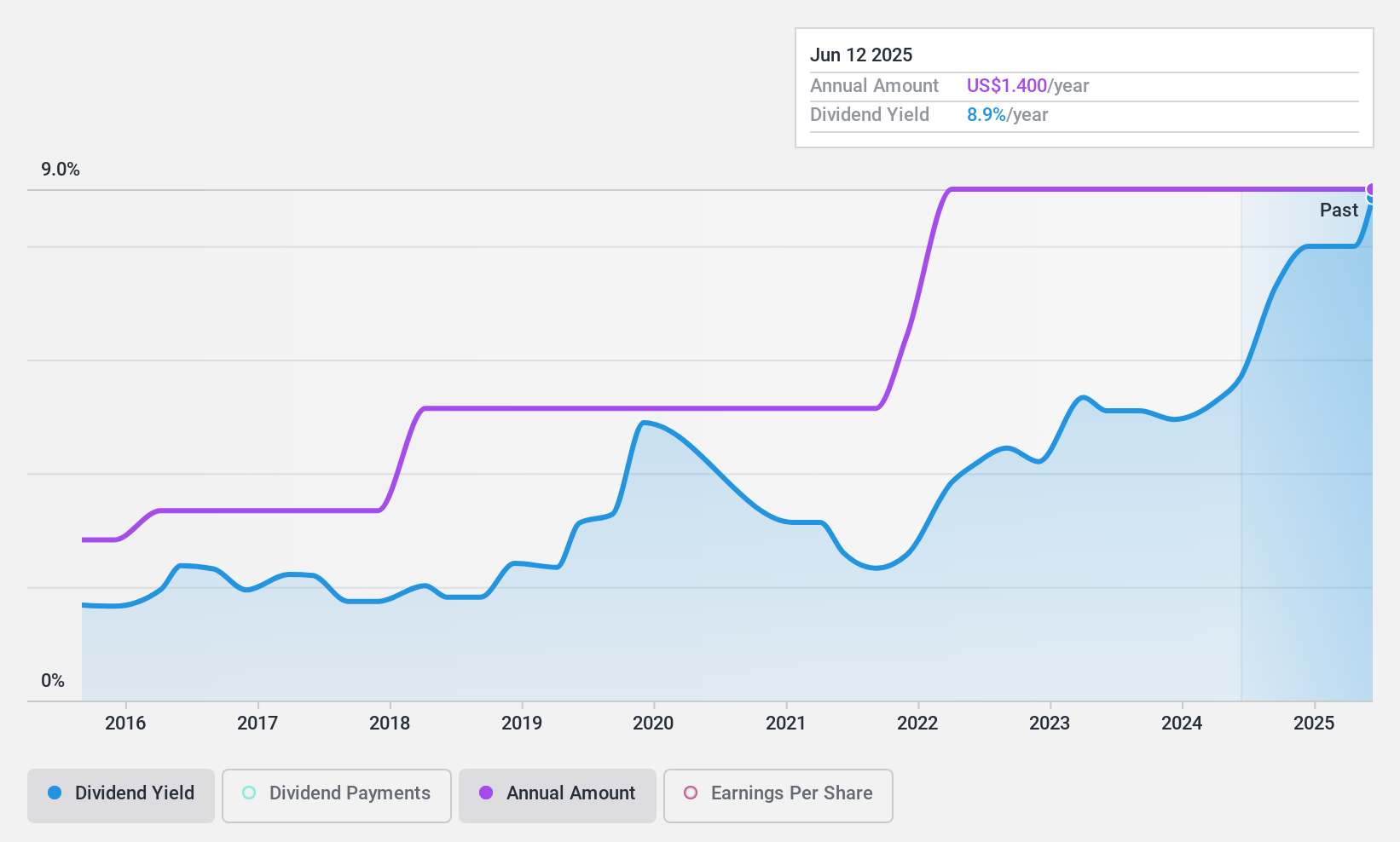

Movado Group (NYSE:MOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Movado Group, Inc. is a company that designs, sources, markets, and distributes watches both in the United States and internationally, with a market cap of approximately $440.48 million.

Operations: Movado Group's revenue is primarily derived from its Watch and Accessory Brands segment, which accounts for $562.31 million, complemented by $100.98 million from Company Stores.

Dividend Yield: 7.2%

Movado Group's dividend yield of 7.25% is among the top 25% in the U.S., yet its history is marked by volatility and unreliability over the past decade. The payout ratio of 86.2% suggests dividends are covered by earnings, but cash flow coverage remains weak at a high cash payout ratio of 130%. Recent financial challenges include lowered earnings guidance and reduced profitability, with net income dropping to US$3.72 million for Q2 2024 from US$8.05 million a year ago.

- Take a closer look at Movado Group's potential here in our dividend report.

- According our valuation report, there's an indication that Movado Group's share price might be on the cheaper side.

Summing It All Up

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 174 more companies for you to explore.Click here to unveil our expertly curated list of 177 Top US Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOV

Movado Group

Designs, sources, markets, and distributes watches worldwide.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives