- United States

- /

- Chemicals

- /

- NYSE:HUN

Assessing Huntsman (HUN) Valuation After Rotterdam Plant Disruption Lowers Q4 2025 EBITDA Outlook

Reviewed by Simply Wall St

Huntsman (HUN) has reduced its fourth quarter 2025 adjusted EBITDA outlook after an unplanned disruption at its Rotterdam polyurethanes plant, where the larger MDI production line is expected to remain offline until roughly mid December.

See our latest analysis for Huntsman.

The update comes after a sharp run, with a 1 month share price return of about 32 percent helping Huntsman claw back some ground despite a much weaker year to date picture and deeply negative multi year total shareholder returns. This suggests recent momentum is improving sentiment but not yet rewriting the longer term story.

If this kind of event driven move has you rethinking your materials exposure, it could be worth scanning other fast growing stocks with high insider ownership that might offer stronger structural growth alongside committed insiders.

With shares still down sharply over one and five years despite the recent spike, investors now face a tougher question: is Huntsman genuinely undervalued here, or is the market already pricing in any cyclical recovery?

Most Popular Narrative: 10.3% Overvalued

Compared with Huntsman’s last close at $10.61, the most followed narrative points to a lower fair value, implying the latest rebound has already overshot fundamentals.

The company is actively transforming its portfolio away from lower-margin, commodity chemicals toward specialty chemicals (e.g., adhesives, elastomers, aerospace composites), aiming to further improve EBITDA margins and overall profitability in future cycles. Cost optimization, working capital discipline, and strategic asset closures (e.g., the maleic anhydride facility in Europe) are expected to enhance free cash flow generation and support improved net margins and earnings resilience during the next macro upturn.

Want to see what kind of margin lift and earnings rebound this narrative is baking in, and how that justifies a premium valuation multiple? The underlying projections blend modest top line growth, a sharp swing from losses to profits, and a future earnings multiple more commonly reserved for faster growing names. Curious how those moving parts combine into a single fair value number that still sits below today’s price? You will need the full narrative to see which assumptions do the heavy lifting.

Result: Fair Value of $9.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained overcapacity in global MDI markets and weak construction demand could prolong margin pressure and challenge the upbeat recovery assumptions embedded in this narrative.

Find out about the key risks to this Huntsman narrative.

Another Angle on Value

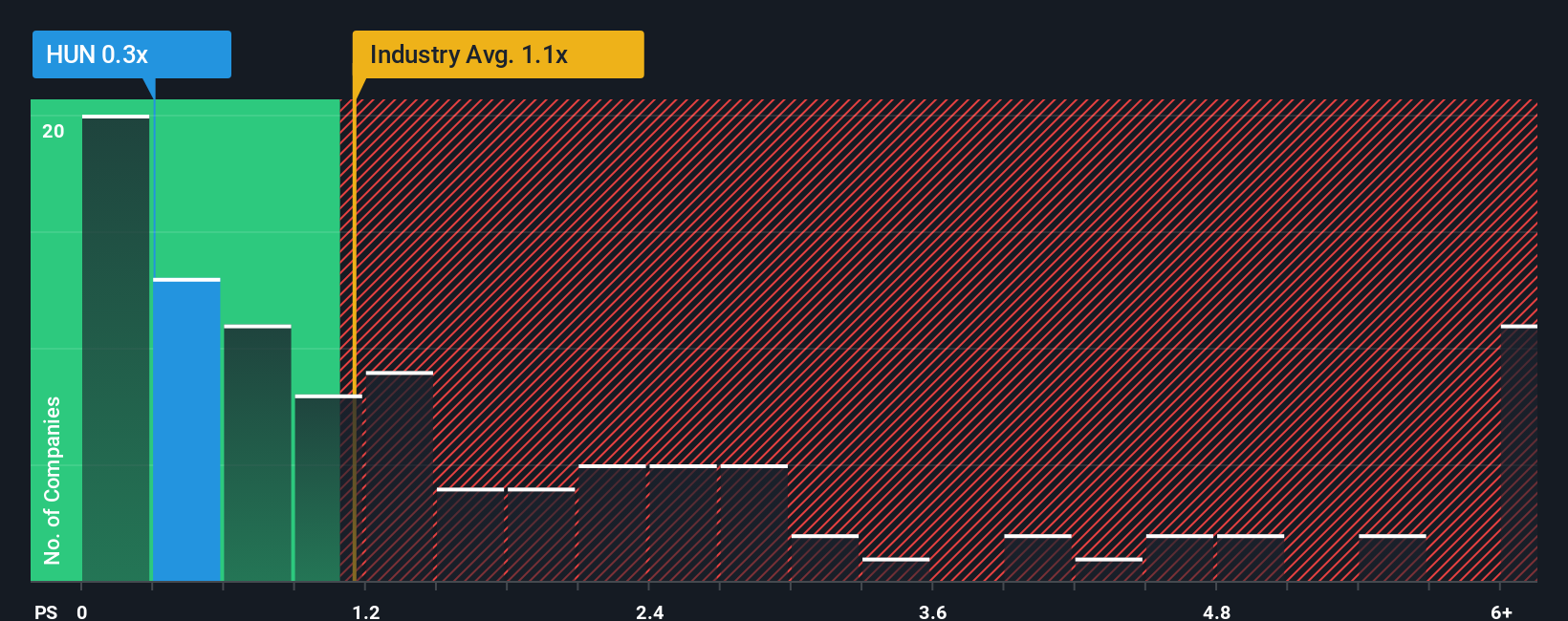

Our valuation work also looks at Huntsman through its price to sales ratio of 0.3 times, which is far below both peers at 0.8 times and the wider US Chemicals industry at 1.2 times, and even under a fair ratio of 0.7 times. Is the market overreacting to near term pain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Huntsman Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized Huntsman view in minutes by using Do it your way.

A great starting point for your Huntsman research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, tap into fresh opportunities using the Simply Wall Street Screener, so you are not leaving potential long term winners on the table.

- Consider overlooked growth stories with these 920 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Explore the next wave of innovation by targeting these 25 AI penny stocks positioned at the heart of accelerating AI adoption.

- Strengthen your income stream by scanning these 14 dividend stocks with yields > 3% that may help support more reliable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntsman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUN

Huntsman

Manufactures and sells diversified organic chemical products worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026