- United States

- /

- Metals and Mining

- /

- NYSE:HL

Hecla Mining (HL): Evaluating Valuation Following Roth MKM Downgrade and Recent Insider Selling

Reviewed by Kshitija Bhandaru

Hecla Mining (HL) was just downgraded to a Sell rating by Roth MKM, with the move coming as a result of a wave of insider selling activity over the past quarter. Recently, the company’s Principal Accounting Officer sold a batch of shares, a development that has caught investors’ attention.

See our latest analysis for Hecla Mining.

Looking at the bigger picture, Hecla Mining’s share price has edged higher over the past year, though momentum appears muted even as management turnover and insider sales dominate headlines. The latest 1-year total shareholder return is just under 1%, suggesting lukewarm sentiment despite a recent uptick in news around leadership activity.

If you’re curious about where momentum and ownership trends might be shaping tomorrow’s leaders, now is a great time to discover fast growing stocks with high insider ownership

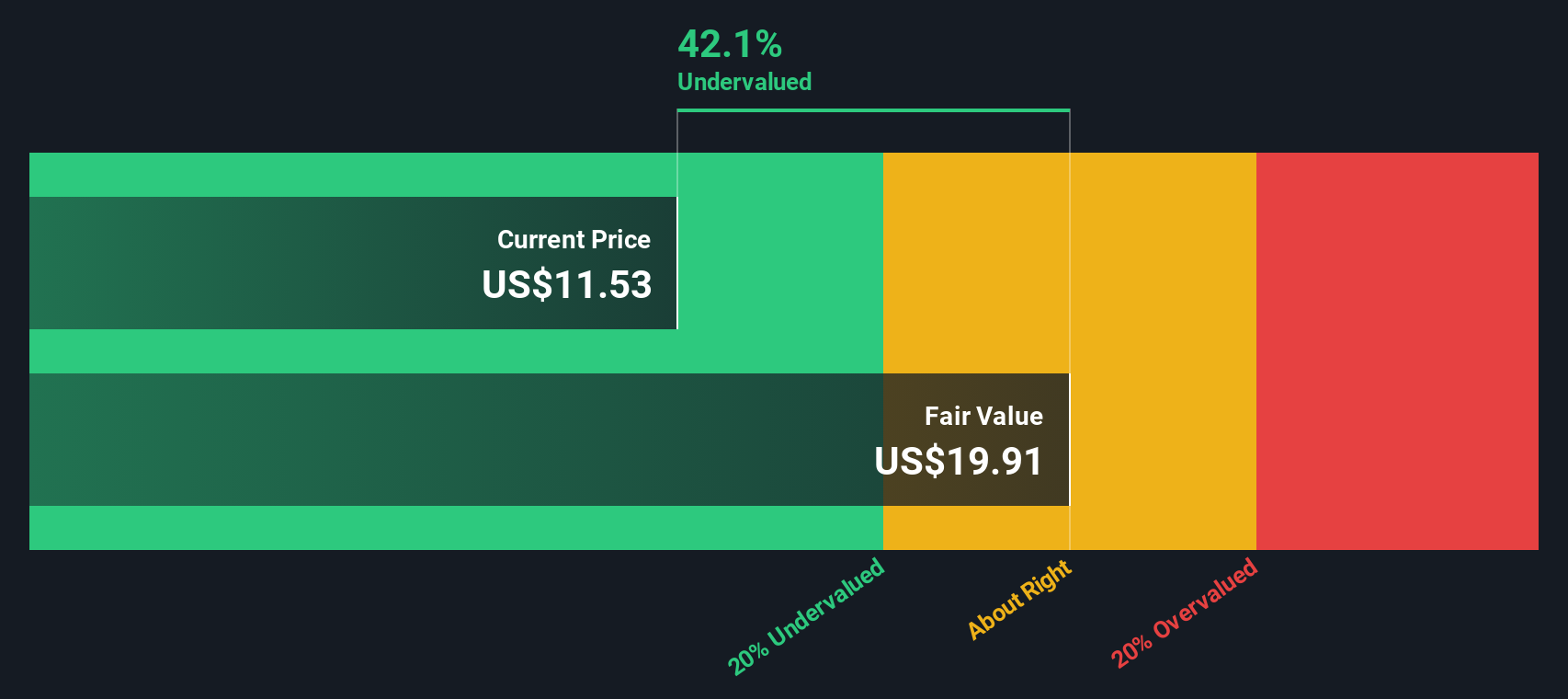

With insider selling on the rise and valuations appearing less compelling at current levels, the key question is whether Hecla Mining is undervalued today or if the market has already factored in all of its future growth potential.

Most Popular Narrative: 23.6% Overvalued

Hecla Mining's latest fair value estimate lands at $9.62, which sits well below its last close price of $11.90. The narrative underpinning this figure highlights specific drivers fueling analyst sentiment and sets up a critical discussion about growth versus valuation expectations.

The company's disciplined production ramp-up at Keno Hill, targeting a sustainable throughput of 440 tonnes per day by 2028, along with proven high-return economics even at conservative silver price levels, sets the stage for steady long-term free cash flow and earnings growth as the mine achieves scale.

Wondering why the narrative’s math points to a premium price? The underlying story revolves around bullish operational assumptions, ambitious margin improvements, and an aggressive profit growth runway. Get the full details behind these bold forecasts. The numbers might surprise you.

Result: Fair Value of $9.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steadily increasing capital requirements or unexpected regulatory delays could quickly disrupt earnings growth and undermine the optimistic outlook on Hecla Mining.

Find out about the key risks to this Hecla Mining narrative.

Another View: Discounted Cash Flow Shows Upside

While most analysts see Hecla Mining as overvalued at current prices using a fair value estimate, our SWS DCF model paints a different picture. This method suggests the stock is trading almost 39% below its estimated fair value of $19.51, which points to potential upside if optimistic cash flow projections are realized. However, the question remains whether future results will match these expectations or if the risks are already reflected in the price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hecla Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hecla Mining Narrative

If you see things differently or want a deeper dive into the data, you can easily craft your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hecla Mining.

Looking for More Investment Ideas?

Expand your investment horizons and capture opportunities others might miss by leveraging the best tools Simply Wall St has to offer. Find compelling stocks beyond the headlines and get ahead of emerging market trends today.

- Power up your portfolio by seizing these 896 undervalued stocks based on cash flows that are trading below their true worth and could deliver long-term growth as the market catches up.

- Boost your passive income potential by selecting these 19 dividend stocks with yields > 3% with proven records of high, reliable yields above 3%.

- Ride the wave of digital finance growth when you uncover these 78 cryptocurrency and blockchain stocks that are revolutionizing how the world transacts and invests.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HL

Hecla Mining

Provides precious and base metal properties in the United States, Canada, Japan, Korea, and China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives