- United States

- /

- Metals and Mining

- /

- NYSE:HCC

A Fresh Look at Warrior Met Coal's Valuation After Strong Q3 Results and Raised 2025 Outlook

Reviewed by Simply Wall St

Warrior Met Coal (HCC) topped earnings expectations in the third quarter and boosted its outlook for 2025 after starting longwall mining early at Blue Creek, achieving record steelmaking coal production and lower costs.

See our latest analysis for Warrior Met Coal.

Shares of Warrior Met Coal have steadily built momentum in recent months, helped by early production wins at Blue Creek and solid quarterly results. The company’s 21% year-to-date share price return stands out, even as the one-year total shareholder return remains slightly negative. This highlights some market volatility but also the long-term potential reflected in a 95% gain over the past three years.

If the recent uptick has you curious about what other opportunities could be waiting, now’s the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trending higher and operational momentum building, the key question is whether Warrior Met Coal still trades at a discount or if the latest growth surge is already reflected in the share price. Is there further upside ahead, or are investors now paying up for future gains?

Most Popular Narrative: 10.7% Undervalued

With the narrative fair value of $74 per share above Warrior Met Coal’s last close of $66.06, the market sees room for further upside if projections hold. The stage is set for a pivotal shift in future earnings and efficiency based on the company's operational execution and strategic positioning.

“The ahead-of-schedule and on-budget launch of the Blue Creek longwall in early Q1 2026 accelerates Warrior Met Coal's transition from capital investment to higher-volume revenue generation. This unlocks increased production capacity and lower-cost, higher-quality tons, positioning the company to grow both revenues and net margins as volumes ramp and cost efficiencies are realized.”

What’s driving the narrative’s confidence in Warrior’s future price? One central assumption is a leap in profitability and operational scale few would expect for a coal miner. Ready to see which forecasting levers could put this stock in the spotlight? Dive into the details and discover the bold growth expectations that underpin this compelling value story.

Result: Fair Value of $74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in global steel demand or rising competitive pressures could quickly undermine Warrior Met Coal’s optimistic outlook and future earnings potential.

Find out about the key risks to this Warrior Met Coal narrative.

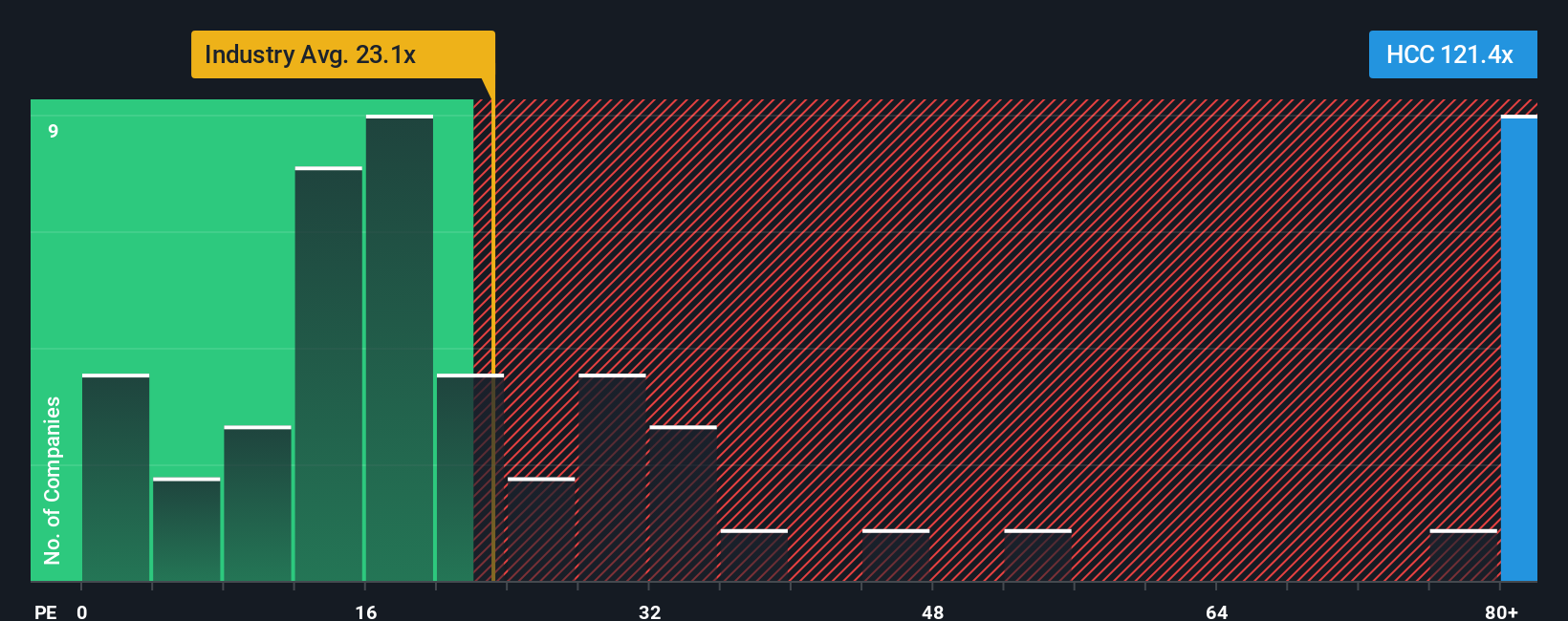

Another View: Multiples Raise Valuation Questions

Taking a closer look at traditional valuation ratios, Warrior Met Coal trades at a price-to-earnings ratio of 86.1x. That is much higher than the US Metals and Mining industry’s 21.7x average and its peer group’s 32.9x. Even compared to its fair ratio of 71.9x, Warrior appears lofty by this measure. This gap suggests investors are paying a premium for expected growth rather than current profits. Are they right to?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warrior Met Coal Narrative

If you see things differently or want to dig deeper on your own terms, crafting your personalized narrative takes just a few minutes. Do it your way

A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by when the next breakout play could be one click away. Use these smart tools to tap into exciting trends and unlock fresh possibilities for your portfolio:

- Boost your income by targeting these 20 dividend stocks with yields > 3% offering strong yields and a track record of reliable payouts.

- Tap into breakthroughs in medical technology by checking out these 33 healthcare AI stocks, which is driving innovation in the fast-evolving healthcare sector.

- Ride the wave of digital transformation with these 81 cryptocurrency and blockchain stocks as it pushes boundaries in blockchain and cryptocurrency industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives