- United States

- /

- Packaging

- /

- NYSE:GPK

Will Graphic Packaging’s CFO Transition Shape Its Management Credibility Story Going Forward? GPK

Reviewed by Sasha Jovanovic

- Graphic Packaging Holding Company announced that Stephen R. Scherger has resigned as Chief Financial Officer and Executive Vice President, effective November 7, 2025, after closing out third quarter reporting and helping ensure a smooth transition.

- Charles D. Lischer, previously Senior Vice President and Chief Accounting Officer, will assume the roles of Interim CFO and Senior Vice President, bringing significant financial leadership from prior roles at Teradata Corporation and The Coca-Cola Company.

- We’ll explore how this change in financial leadership may influence the company’s outlook and investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Graphic Packaging Holding Investment Narrative Recap

To be a shareholder in Graphic Packaging Holding, you have to believe in the company’s ability to generate margin expansion via recycled packaging investments and benefit from secular shifts to sustainable packaging, despite recent demand uncertainty and margin pressure. The announced CFO transition to Charles D. Lischer appears unlikely to materially change the short-term catalyst tied to the Waco recycled paperboard project, nor does it resolve the biggest near-term risk: ongoing volume weakness across core markets and pricing pressure in the oversupplied SBS segment.

Among recent developments, the Q2 2025 earnings report stands out, with sales and net income both down year over year, highlighting the persistent soft demand and input cost pressures. In this context, the successful execution and efficiency gains from the Waco project remain a critical catalyst, as these operational improvements are intended to improve margins and cash flow amid a challenging market.

But investors should also keep a close eye on how margin pressure from the oversupplied paperboard market could impact returns if cost control efforts lose steam and...

Read the full narrative on Graphic Packaging Holding (it's free!)

Graphic Packaging Holding's outlook forecasts $9.1 billion in revenue and $693.7 million in earnings by 2028. This implies a 1.7% annual revenue growth rate and a $159.7 million increase in earnings from the current level of $534.0 million.

Uncover how Graphic Packaging Holding's forecasts yield a $23.15 fair value, a 30% upside to its current price.

Exploring Other Perspectives

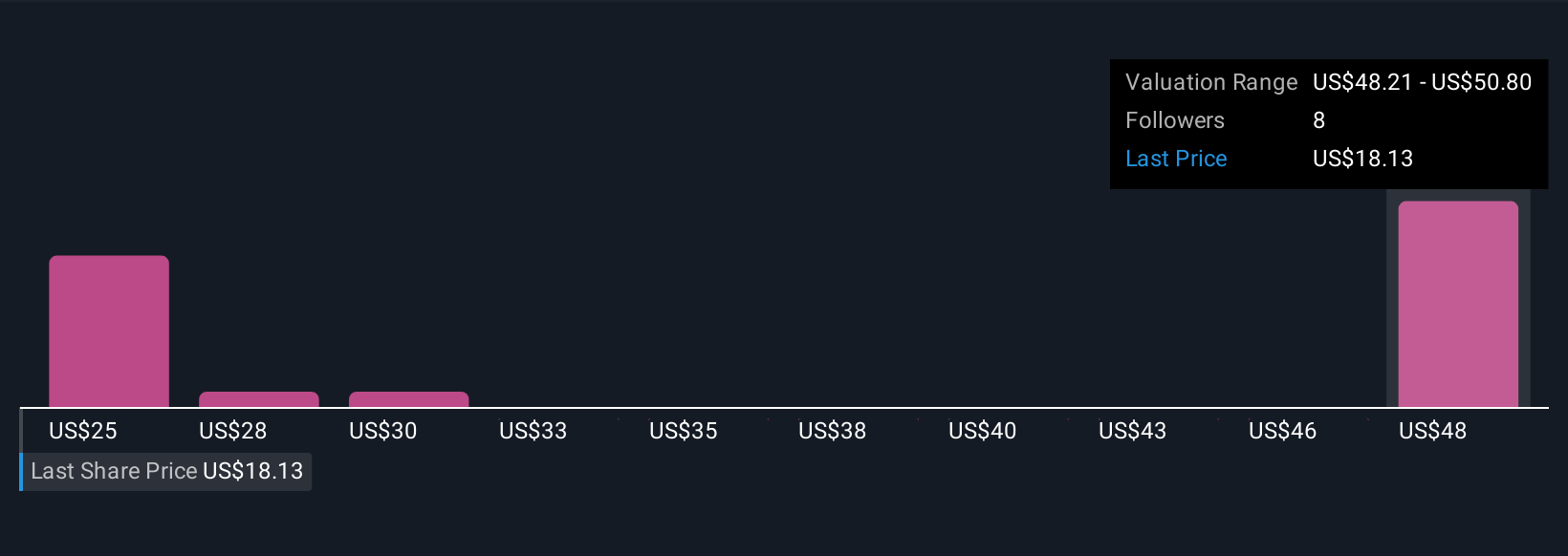

Three Simply Wall St Community members estimate Graphic Packaging's fair value from US$23.15 up to US$46.38 per share. While bulls focus on cost leadership in recycled packaging, others point out ongoing margin risks that could affect future profit resilience, reminding you to review a mix of outlooks.

Explore 3 other fair value estimates on Graphic Packaging Holding - why the stock might be worth just $23.15!

Build Your Own Graphic Packaging Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graphic Packaging Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Graphic Packaging Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graphic Packaging Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPK

Graphic Packaging Holding

Designs, produces, and sells consumer packaging products to brands in food, beverage, foodservice, household, and other consumer products in the Americas, Europe, and the Asia Pacific.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives