- United States

- /

- Metals and Mining

- /

- NYSE:B

Persistent Inflation and Market Woes Could Put Barrick Gold on Buffett's Radar Again

Summary:

- Barrick Gold remains on track to deliver the guided results for 2022

- The company keeps up healthy margins despite expanding the operations

- Given the positive copper outlook, its latest expansion in Pakistan might strike gold

A little over two years ago, while the world was grappling with the COVID-19 Pandemic, Warren Buffett disclosed a US$565 million investment in Barrick Gold Corporation (NYSE: GOLD). Yet, by the end of the same year, he was out of it altogether.

For Mr.Buffet, that was barely 0.28% of his portfolio, likely representing a hedge against the high uncertainty at the time. Once he identified that the risk had passed, he sold the position. However, his pick is interesting as it points out that the company might be one of the best in its sector – prompting us to look into the current state of affairs before the next potential commodity super cycle.

See our latest analysis of Barrick Gold

Barrick Gold Company Profile

Founded in 1983 with headquarters in Toronto, Canada – Barrick Gold Corporation operates in the mining industry, engaging in exploration, mine development, and production and sale of gold and copper.

The company operates 16 sites in 13 countries with over 21,000 employees and is regarded as the second-largest gold mining company in the world. It boasts a particularly good position in Nevada, US, with majority ownership of 3 tier one gold mines that classify as stated life in excess of 10 years, annual production of at least 500,000 ounces, and total cash costs per ounce are below the industry average.

In the latest annual report, Barrick declared proven and probable gold reserves at 69 million ounces at an average grade of 1.71g /t. Meanwhile, copper proven and probable mineral reserves were 12 billion pounds at an average grade of 0.38%.

Barrick Gold's Latest Developments

The Q2 earnings report saw a nearly 19% rise in Q2 profit due to growing copper output. Yet, the cost of production is up as well, as all-in-sustaining costs per ounce of gold increased 13% in the first half of the year (15% for copper).

According to the Q3 preliminary results, the company produced 0.99 million ounces of gold and 123 million pounds of copper. The 2022 guidance production remains on track even with the access to high-grade ore at Nevada Gold Mines postponed for Q4. The company will report full earnings before the market opens on November 3, 2022.

Despite being one of the largest gold producers, the company is engaged in connected diversification, investing US$7b in a Reko Diq project in Pakistan. The project should create 4,000 jobs and provide Barrick with 50% ownership in one of the world's largest undeveloped copper-gold deposits. The other 50% will be split between the Balochistan Provincial Government and Pakistani state-owned enterprises.

Barrick Gold's Fundamental Look

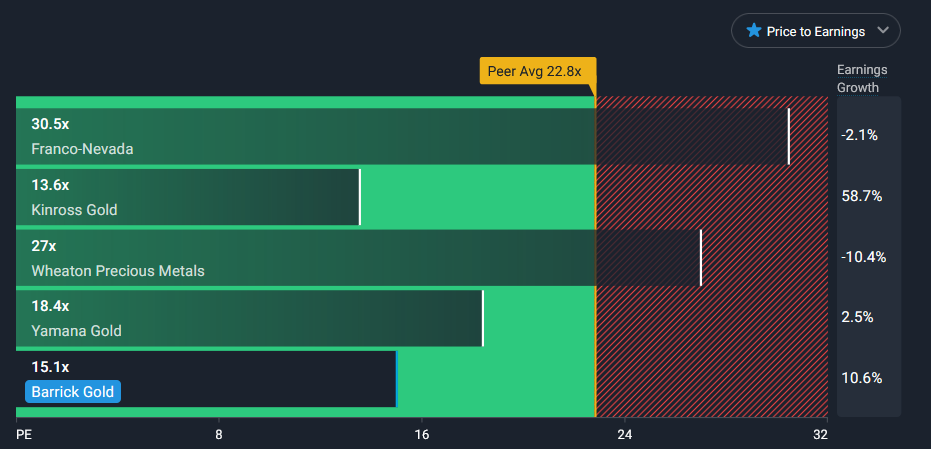

Barrick Gold is currently trading at a reasonable valuation of 12.9x P/E, which seems good value compared to the peer average.

Even the forward-looking P/E still classifies it among the lower end of the sector.

According to the data, the average net profit margin in the sector for 2022 is 15%. Meanwhile, Barrick has a margin of 16.87% despite its size – showing that the company manages its growth well without diminishing the returns.

However, the management's most notable accomplishment is the balance sheet. Over the last 6 years, they reduced the amount of debt from US$9b to US$5b. That brought the company to a position where it has more cash & short-term investments than debt. Yet, every company can contain risks outside of the balance sheet. For instance, we've identified 1 warning sign for Barrick Gold that you should be aware of.

Barrick pays a 3.1% dividend which is above the industry average of 2.7%. Although over the last 10 years, it has been unstable, and payments have not grown at an impressive pace. In its defense, the payout ratio is reasonably low at 35%, and the dividend is well covered by the cash flow.

Barrick's External Outlook

Gold had a turbulent year so far, with geopolitics and central banks having been sources of great volatility. However, even tho it is down 9% year-to-date, it is worth noting that its decline significantly lagged behind the meteoric rise of the US dollar, which rose by almost 18%.

For 2023, institutional analysts are issuing a broad range of gold price forecasts:

- Fitch – US$1,600

- ANZ – US$1,650

- Reuters – US$1,750

- ABN Amro – US$1,900

At the moment, Barrick is mining gold at an all-in-sustaining cost of US$ 1,212 per ounce and copper at US$2.87 per pound.

The strength of the US dollar is attributed to the aggressive policy of the US Federal Reserve, which wasn't met with the same response from other central banks around the world like the ECB and Bank of Japan. While it is hard to speculate on central bank actions, this strong divergence in rates could close at some point in the near future, causing the US dollar to revert to its historic mean price and, in turn, push gold to higher levels.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:B

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026