- United States

- /

- Chemicals

- /

- NYSE:FTK

Flotek Industries' (NYSE:FTK) earnings growth rate lags the 221% return delivered to shareholders

The Flotek Industries, Inc. (NYSE:FTK) share price has had a bad week, falling 12%. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 221% in that time. So it may be that the share price is simply cooling off after a strong rise. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

While the stock has fallen 12% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

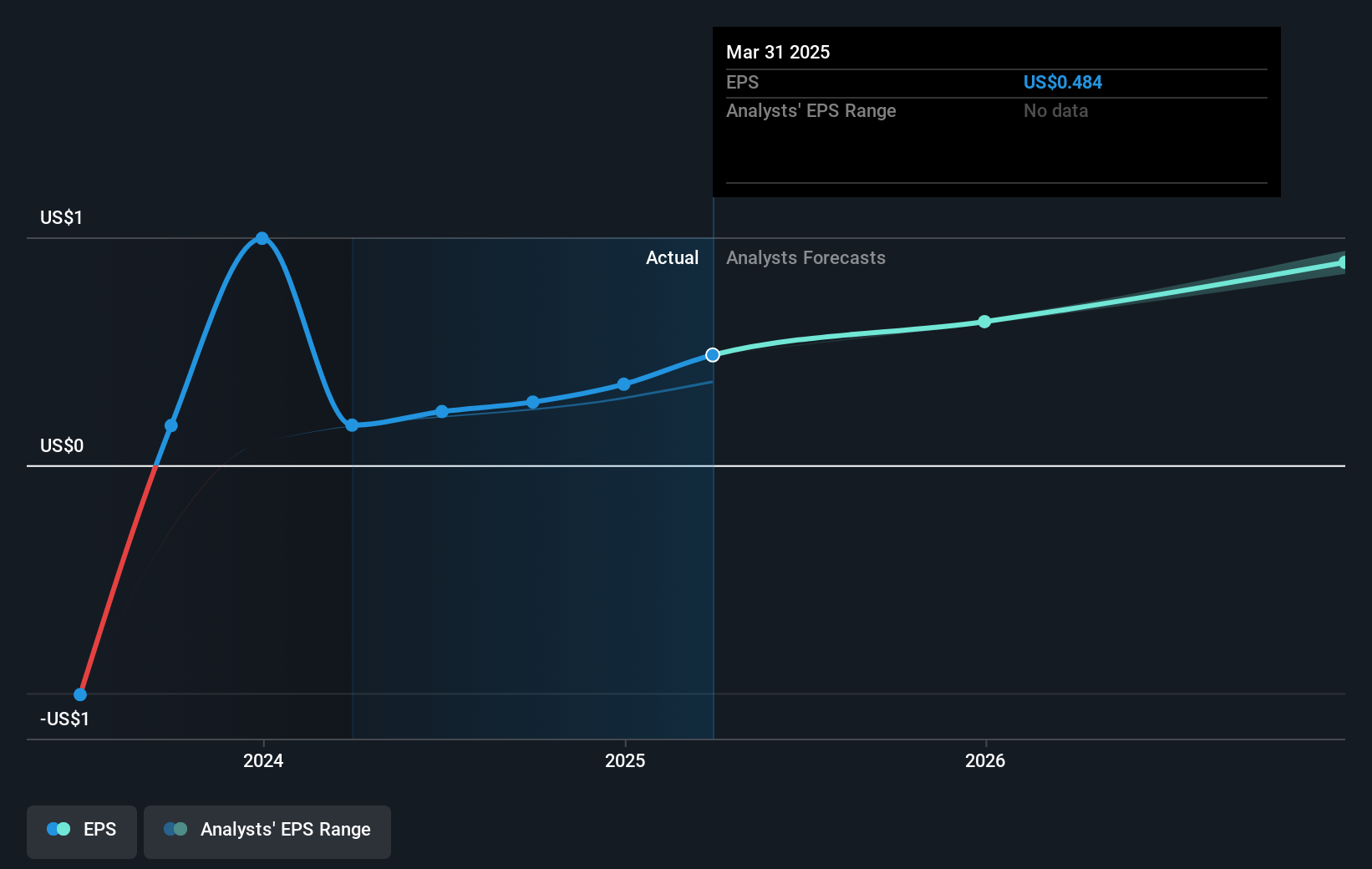

During the last year Flotek Industries grew its earnings per share (EPS) by 175%. The share price gain of 221% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Flotek Industries' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Flotek Industries shareholders have received a total shareholder return of 221% over the last year. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Flotek Industries better, we need to consider many other factors. Take risks, for example - Flotek Industries has 1 warning sign we think you should be aware of.

Flotek Industries is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FTK

Flotek Industries

Operates as a technology-driven green chemistry and data company that serves customers across industrial and commercial markets in the United States, the United Arab Emirates, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives