- United States

- /

- Chemicals

- /

- NYSE:FMC

Will Analyst Revisions and Insider Selling Reveal Deeper Shifts in FMC’s (FMC) Competitive Position?

Reviewed by Sasha Jovanovic

- In recent days, major financial institutions including Morgan Stanley, Goldman Sachs, Wells Fargo, and RBC Capital have maintained either Hold or Buy ratings on FMC while lowering their price targets, reflecting a more cautious outlook on the company amid increased insider selling.

- Meanwhile, analyst sentiment appears increasingly influenced by industry trends and company-specific factors such as FMC's emphasis on developing new crop protection products and its ongoing cost restructuring efforts.

- Next, we'll look at how this wave of analyst reassessments and cautious sentiment may reshape FMC's overall investment narrative and outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FMC Investment Narrative Recap

To be a shareholder in FMC today, you need conviction in the company’s long-term innovation and demand for crop protection products while accepting that near-term challenges, such as insider selling and cautious analyst sentiment, could cloud momentum. The latest wave of price target reductions from major banks highlights ongoing uncertainty, but has no material effect on the most critical short-term catalyst: successful new product launches; nor does it reduce the biggest risk, which remains margin pressure from weak pricing and ongoing regulatory threats.

Of the recent company updates, the registration of Fundatis® herbicide in Great Britain stands out given its reliance on new Isoflex® active, a bright spot supporting innovation as a counterweight to negative sentiment and execution concerns. Innovations like Fundatis® are critical to driving volume growth, but only if market acceptance is strong and pricing holds up amidst intense competition and regulatory headwinds.

By contrast, investors should also be aware that persistent margin pressures, especially from contract price reductions and rising rebates, continue to threaten...

Read the full narrative on FMC (it's free!)

FMC's narrative projects $4.8 billion in revenue and $542.8 million in earnings by 2028. This requires 5.5% yearly revenue growth and a $413.1 million increase in earnings from the current $129.7 million.

Uncover how FMC's forecasts yield a $45.56 fair value, a 54% upside to its current price.

Exploring Other Perspectives

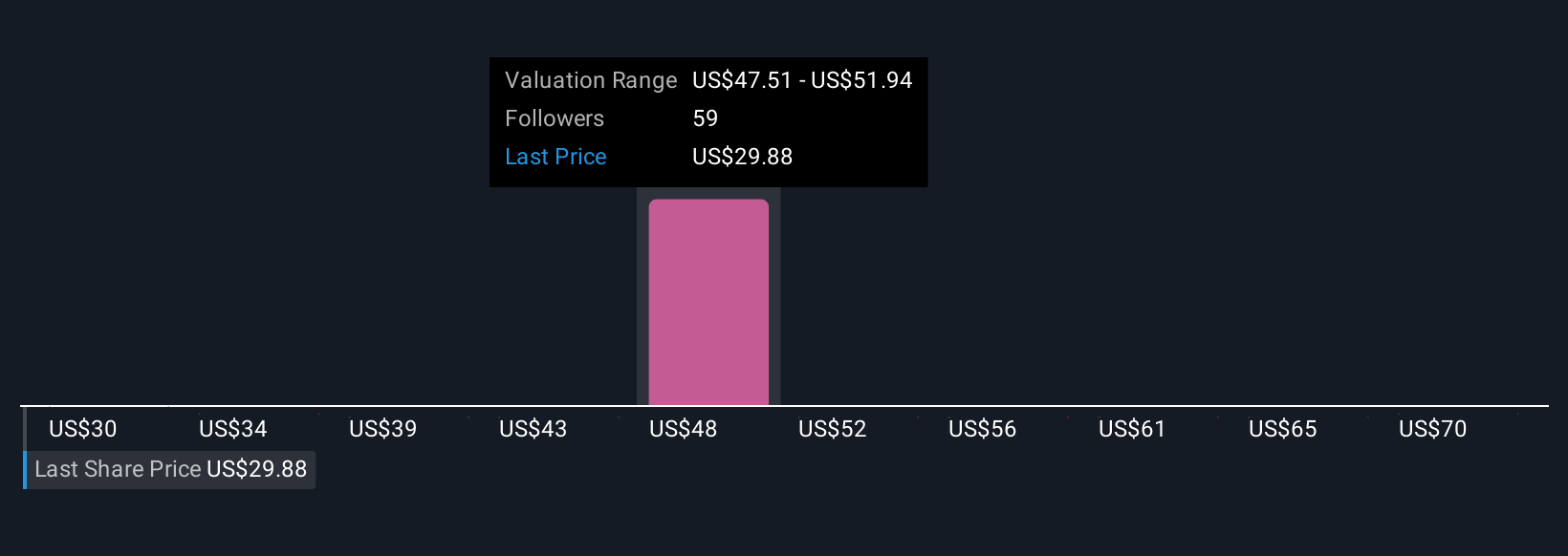

Seven members of the Simply Wall St Community estimate FMC’s fair value between US$29.78 and US$74.11, showing wide disagreement on the company’s prospects. This diversity of opinion reflects how risks like ongoing margin compression can influence the outlook and reinforces the importance of seeking multiple viewpoints.

Explore 7 other fair value estimates on FMC - why the stock might be worth over 2x more than the current price!

Build Your Own FMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FMC research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FMC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives