- United States

- /

- Chemicals

- /

- NYSE:FMC

S&P Downgrades FMC (FMC) After Patent Expiration: What Does It Mean for Earnings Stability?

Reviewed by Sasha Jovanovic

- In late November 2025, S&P Global Ratings downgraded FMC Corp.’s credit rating to junk status (BB+) from investment grade, citing weak credit metrics and persistent uncertainty about future performance.

- The key driver was the expiration of FMC’s Rynaxypyr patent, which exposes a significant portion of its revenues to generic competition in major growth regions.

- We’ll examine how S&P’s downgrade and patent expiration may shift FMC’s investment narrative and outlook for earnings stability.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FMC Investment Narrative Recap

To own FMC stock right now, an investor needs confidence that new products and cost-saving efforts can offset near-term revenue declines and generic competition following the Rynaxypyr patent expiration. S&P’s downgrade sharply raises the profile of credit metrics and earnings reliability, making profitability and debt reduction the most important immediate catalysts, while exposing the business to higher financial risk, the material threat for shareholders at this point.

Among recent company updates, FMC’s October 2025 dividend reduction stands out, directly linked to the need for preserving cash as the company adapts to rising debt levels and revenue headwinds. Lower dividends free up capital, which aligns with efforts to stabilize earnings amid intense generic competition and helps support future reinvestment, both central to the evolving FMC story.

Yet, in contrast to cost action, investors should be aware that sustained generic competition in Asia and Latin America could intensify if...

Read the full narrative on FMC (it's free!)

FMC's narrative projects $4.8 billion revenue and $542.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $413.1 million earnings increase from $129.7 million today.

Uncover how FMC's forecasts yield a $25.50 fair value, a 83% upside to its current price.

Exploring Other Perspectives

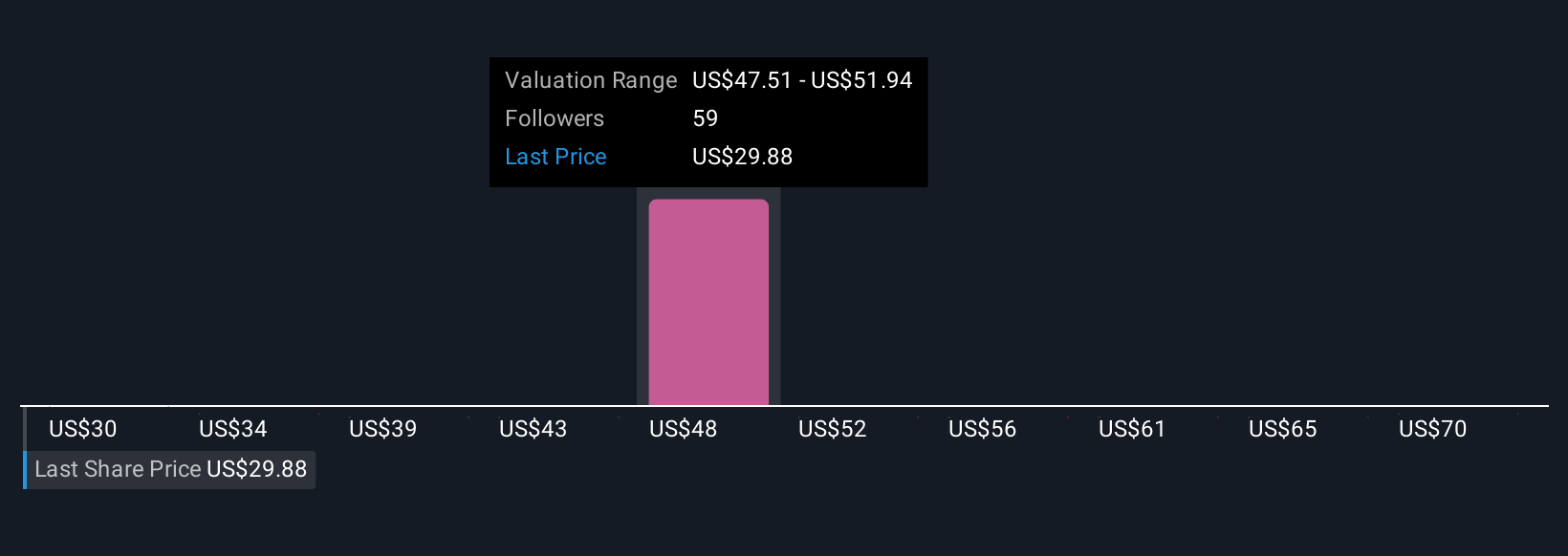

Simply Wall St Community members shared seven fair value estimates for FMC, ranging from US$24.97 to US$74.11 per share. While opinions differ, the recurring risk from patent expirations and margin pressure is top of mind for many market participants, explore these diverse perspectives to consider wider implications for FMC’s recovery.

Explore 7 other fair value estimates on FMC - why the stock might be worth just $24.97!

Build Your Own FMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FMC research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FMC's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.