- United States

- /

- Chemicals

- /

- NYSE:FMC

FMC (NYSE:FMC) Shares Rise 10% Over Last Week Amid Sofero Pheromone Registration In Brazil

Reviewed by Simply Wall St

FMC (NYSE:FMC) recently registered the Sofero Fall pheromone in Brazil, aiming to combat the fall armyworm, and entered a partnership with Bayer to commercialize Isoflex™ active in Europe. Simultaneously, market volatility due to U.S. restrictions on chip exports to China affected the broader market indices, which saw a decline. Despite the downward pressure from these broader market conditions, FMC shares moved up 10.09% over the last week. This positive shift suggests that FMC's product and partnership announcements may have bolstered investor confidence, adding weight to its stock performance during a mixed week for global markets.

You should learn about the 4 risks we've spotted with FMC (including 1 which is concerning).

The recent registration of the Sofero Fall pheromone in Brazil and FMC's partnership with Bayer are significant developments. These moves could strengthen FMC's market position and potentially support revenue growth, particularly in European and Latin American regions. Such initiatives align with FMC's narrative of expanding market reach and enhancing product offerings. Despite these positive developments, over the past year, the company's total return, including dividends, was 29.41%, underperforming both the broader market and the US Chemicals industry, which saw a 5.9% increase and a 10.4% decline, respectively. This long-term performance context provides a more tempered view against the recent weekly uptick.

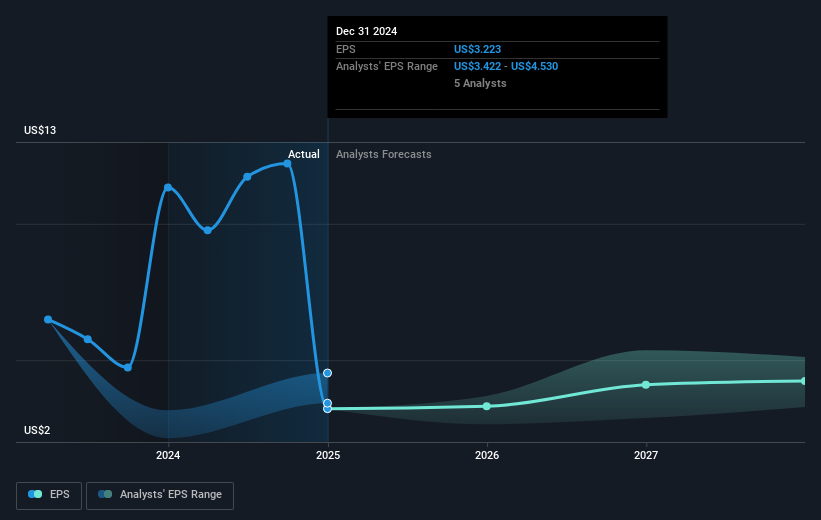

The potential revenue from products like Isoflex and the fluindapyr-driven expansion can influence analysts' earnings and revenue forecasts for FMC. With the consensus price target set at US$49.58, compared to the current share price of US$33.98, the price movement reflects a 31.5% potential increase assuming the company achieves projected earnings growth. However, analysts remain divided, reflecting uncertainties in inventory management and competitive pressures. The company's earnings are expected to grow by about 11% annually, which is slower than the market's anticipated pace but supported by strategic cost reduction efforts and new market entries.

Review our historical performance report to gain insights into FMC's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives