- United States

- /

- Chemicals

- /

- NYSE:FMC

FMC (NYSE:FMC) Reports Sales Decline In Challenging First Quarter

Reviewed by Simply Wall St

FMC (NYSE:FMC) recently reported a challenging first quarter with a sales decline and a net loss, alongside the affirmation of a regular quarterly dividend. The election of Steven Merkt to the Board and the appointment of Sara Velazquez Ponessa were key organizational changes. The regulatory approval for the Keenali herbicide in Peru highlights product innovation efforts. Despite these developments, FMC’s 1.33% price move aligns broadly with market trends, experiencing a similar movement amidst market fluctuations driven by tariff talks and a decline in key indices like the S&P 500 and Dow Jones. These factors collectively present a stable outlook.

FMC has 4 warning signs (and 1 which is potentially serious) we think you should know about.

In light of recent developments at FMC, the organizational changes, including the board election and regulatory approvals, may bolster investor confidence but have yet to significantly impact revenue or earnings forecasts. Despite these strategic shifts, FMC's total shareholder return over the past year stands at 38.41%, underscoring the volatility faced by the company amidst a complex operating environment.

In contrast to the broader market and the US Chemicals industry, which saw returns of 8.2% and a decline of 8.9% respectively over the same one-year period, FMC's challenges in managing inventory and currency risks have contributed to this decline. Analysts continue to hold a consensus price target of US$47.56, which is 12.24% above the current share price of US$41.74, suggesting potential upside if the company can align its cost optimization and market expansion efforts with analysts' expectations.

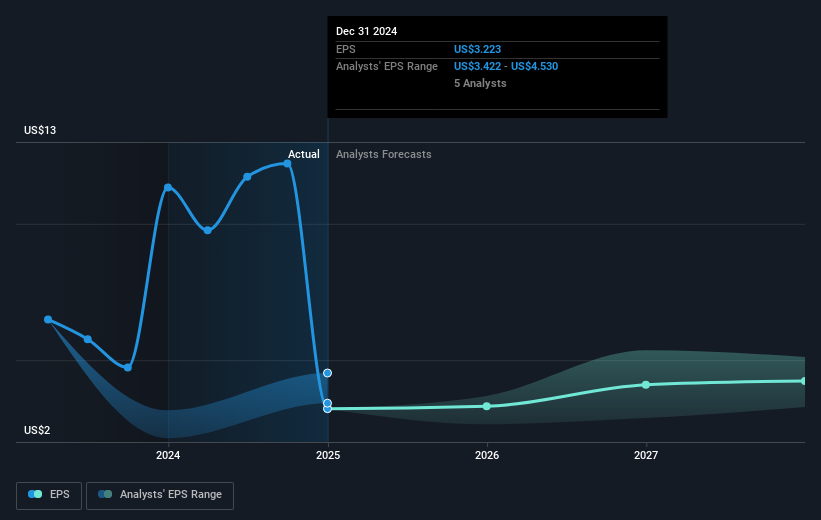

While the company's ongoing initiatives aim to capitalize on new market opportunities, any delays in these implementations could affect projected revenue growth of 5% per year. Similarly, profit margins, expected to rise from 9.5% to 11.2% in three years, remain contingent upon effective cost management and competitive positioning. The near-term share price performance, coupled with the discrepancy between current valuation and analyst price targets, accentuates the importance of FMC's ability to execute its strategy amidst current challenges.

Our valuation report here indicates FMC may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives