FutureFuel Corp.'s (NYSE:FF) investors are due to receive a payment of $0.06 per share on 15th of December. The dividend yield will be 3.5% based on this payment which is still above the industry average.

Check out our latest analysis for FutureFuel

FutureFuel's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. However, prior to this announcement, FutureFuel was quite comfortably covering its dividend with earnings and it was paying more than 75% of its free cash flow to shareholders. However, with more than 75% of free cash flow being paid out to shareholders, future growth could potentially be constrained.

EPS is set to fall by 7.3% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 25%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

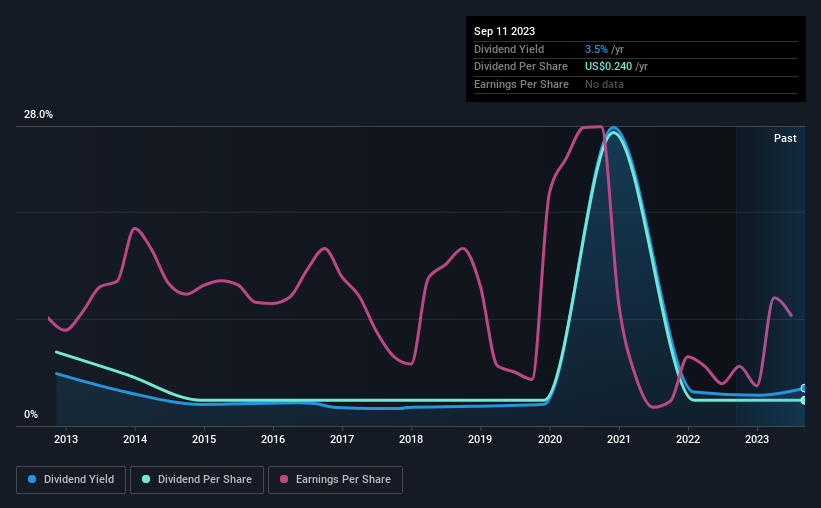

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was $0.69 in 2013, and the most recent fiscal year payment was $0.24. Dividend payments have fallen sharply, down 65% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Come By

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. FutureFuel has seen earnings per share falling at 7.3% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

Our Thoughts On FutureFuel's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for FutureFuel (of which 2 are potentially serious!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FF

FutureFuel

Manufactures and sells diversified chemical, bio-based fuel, and bio-based specialty chemical products in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026