- United States

- /

- Metals and Mining

- /

- NYSE:FCX

What Freeport-McMoRan (FCX)'s Leadership Shift in Americas Operations Means for Shareholders

Reviewed by Sasha Jovanovic

- Freeport-McMoRan recently announced that A. Cory Stevens has been appointed President and Chief Operating Officer of Freeport Americas, effective December 1, 2025, expanding his oversight over the company's North and South American operations following his leadership of the Indonesian smelter project and technical organization.

- This leadership transition comes as the company focuses on ramping up innovative growth projects and operational initiatives, including the large-scale smelter in Indonesia and advanced leach technologies.

- We'll examine how the appointment of A. Cory Stevens to oversee Americas operations could reshape Freeport-McMoRan's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Freeport-McMoRan Investment Narrative Recap

To be a Freeport-McMoRan shareholder, belief in the company's ability to scale innovative growth projects, optimize its Americas operations, and manage complex global mining risks is essential. The appointment of A. Cory Stevens as President and Chief Operating Officer of Freeport Americas strengthens operational oversight but does not materially impact the most important short-term catalyst, the full ramp-up of the Indonesian smelter. The biggest ongoing risk remains government and operational uncertainty related to the Grasberg mine in Indonesia.

Among recent announcements, updated 2025 sales guidance stands out. Freeport projects consolidated sales of about 3.5 billion pounds of copper and 1.05 million ounces of gold for the year, reflecting the volume targets tied closely to its ramp-up efforts in Indonesia, which remains central to revenue and margin drivers. The ongoing transition in operational leadership in the Americas is likely to have a more gradual effect on near-term catalysts.

However, investors should also be aware that, even as growth initiatives progress, new leadership may have to address...

Read the full narrative on Freeport-McMoRan (it's free!)

Freeport-McMoRan's outlook anticipates $31.1 billion in revenue and $3.3 billion in earnings by 2028. This implies a 6.4% annual revenue growth rate and a $1.4 billion earnings increase from the current $1.9 billion.

Uncover how Freeport-McMoRan's forecasts yield a $46.76 fair value, a 16% upside to its current price.

Exploring Other Perspectives

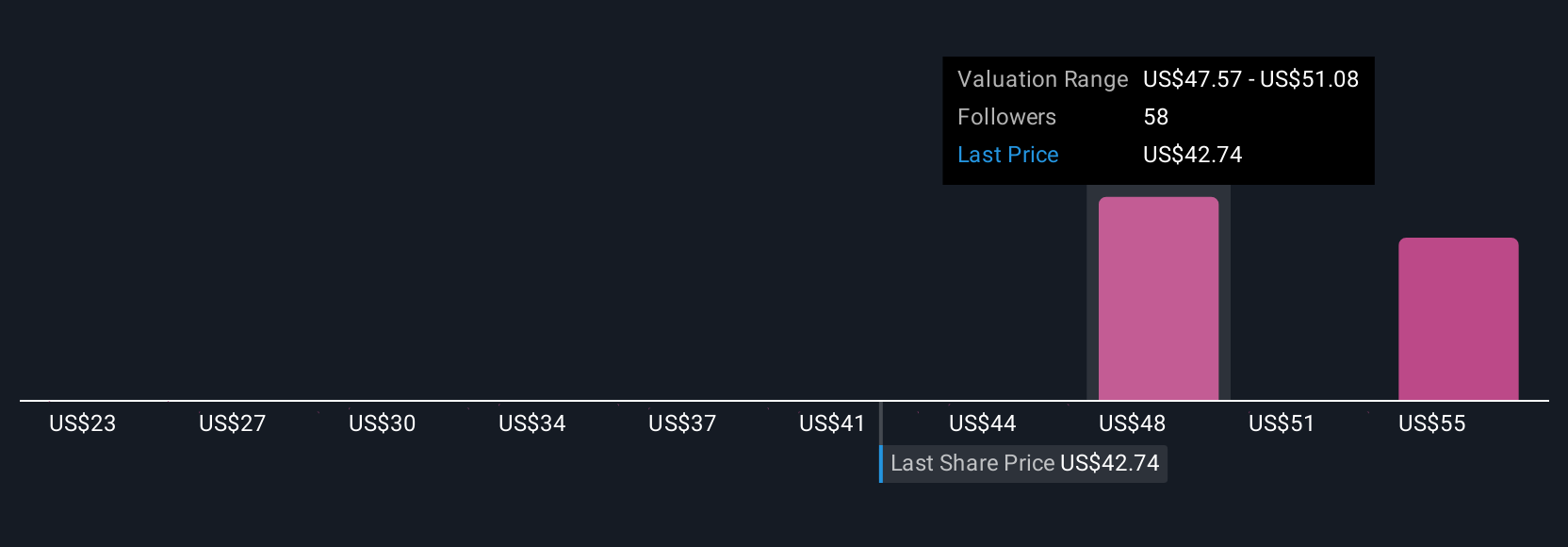

Simply Wall St Community members have published 11 fair value estimates for Freeport-McMoRan, ranging from US$25.20 to US$69.99. Amid these diverse views, remember the full Indonesian smelter ramp-up is seen as the key near-term catalyst influencing future prospects across these opinions.

Explore 11 other fair value estimates on Freeport-McMoRan - why the stock might be worth 37% less than the current price!

Build Your Own Freeport-McMoRan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freeport-McMoRan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freeport-McMoRan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freeport-McMoRan's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives