- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Freeport-McMoRan (FCX) Valuation After Grasberg Safety Tragedy, Production Halt and Rising Investor Lawsuits

Reviewed by Simply Wall St

Freeport McMoRan (FCX) is back in the spotlight after a tragic safety incident at its Grasberg Block Cave mine led to fatalities, a sharp share price drop, and a wave of investor lawsuits.

See our latest analysis for Freeport-McMoRan.

Even with the selloff around the Grasberg tragedy and a flurry of class action filings, Freeport McMoRan’s share price has still delivered a strong year to date return of 26.5 percent. Its 5 year total shareholder return above 100 percent shows the longer term uptrend is intact, suggesting momentum has cooled but not broken.

If this kind of event driven risk has you thinking about diversification, it could be worth scanning other materials heavy names and adjacent plays via fast growing stocks with high insider ownership for fresh ideas.

With FCX still up solidly over one and five years, trading just below a fresh analyst target yet at a hefty discount to some intrinsic value estimates, is the recent pullback a buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 1.2% Undervalued

Compared with the last close at $47.92, the most followed narrative points to a fair value of about $48.52, implying only a slight upside.

The analysts have a consensus price target of $50.479 for Freeport-McMoRan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $57.0, and the most bearish reporting a price target of just $27.0.

Want to understand what really underpins that near flat fair value call, despite rich multiples and modest revenue growth expectations? The narrative leans on a powerful combination of accelerating earnings, expanding margins, and a future profit multiple that assumes Freeport-McMoRan keeps its copper edge in a tighter market. Curious which specific growth and profitability milestones must fall into place to justify that trajectory?

Result: Fair Value of $48.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational risks at Grasberg and potential policy shifts in Indonesia could quickly undermine these optimistic growth and valuation assumptions.

Find out about the key risks to this Freeport-McMoRan narrative.

Another Lens on Valuation

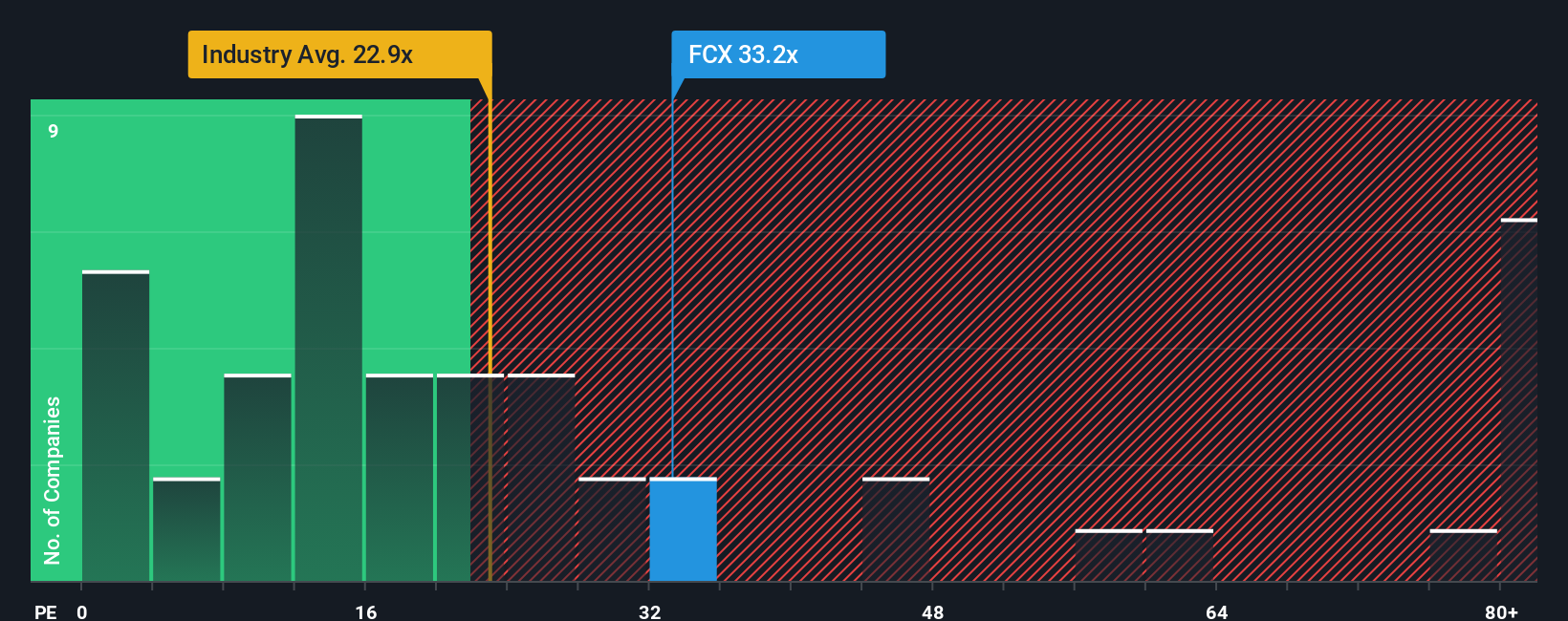

On earnings, the picture looks very different. FCX trades on a price to earnings ratio of about 33.3 times, far richer than both the US Metals and Mining industry at 24.5 times and peers at 22.3 times, and even above a 28 times fair ratio that the market could drift back toward. This raises the risk of a de rating if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freeport-McMoRan Narrative

If you disagree with this view, or would rather dig into the numbers yourself, you can build a full narrative in just minutes: Do it your way.

A great starting point for your Freeport-McMoRan research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential winners with targeted stock ideas from the Simply Wall St Screener, tuned to very different strategies.

- Capture hidden value opportunities by using these 918 undervalued stocks based on cash flows that highlight companies trading below what their cash flows may truly justify.

- Tap into cutting edge innovation with these 25 AI penny stocks focused on businesses building real products and revenue around artificial intelligence.

- Strengthen your income stream through these 13 dividend stocks with yields > 3% that spotlight companies offering attractive yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion