- United States

- /

- Chemicals

- /

- NYSE:ECL

The Bull Case for Ecolab (ECL) Could Change Following Launch of AI Clean-in-Place Platform

Reviewed by Sasha Jovanovic

- On September 26, 2025, Ecolab announced the launch of Ecolab CIP IQ, an AI-powered clean-in-place solution in partnership with 4T2 Sensors, giving Ecolab exclusive access to advanced fluid sensing technology for the food and beverage industry.

- This innovative product aims to transform food and beverage manufacturing by promising improved operational efficiency, reduced water usage, and enhanced production capacity through real-time actionable insights.

- We'll now explore how Ecolab’s exclusive access to digital fluid sensing technology could influence its investment narrative and long-term growth prospects.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ecolab Investment Narrative Recap

To be a shareholder in Ecolab, you would need to believe in its ability to drive growth through digital innovation, margin expansion, and sustainability, despite modest broader market growth. The launch of Ecolab CIP IQ, through exclusive access to advanced AI-driven fluid sensing, underscores the company’s focus on enhancing operational efficiency, a key short-term catalyst. While this product strengthens Ecolab’s value proposition, it does not materially ease risks from rising raw material costs and tariff impacts that continue to pressure margins.

Among recent company announcements, the expansion of Ecolab’s digital solutions through the launch of RushReady within KitchenIQ further highlights ongoing investments in AI-powered productivity tools. These efforts are relevant in the context of Ecolab’s margin protection and value pricing strategies, especially as the company adapts to persistent cost pressures affecting the industry. The combined momentum from digital initiatives supports Ecolab’s growth narrative, but investors should also consider…

Read the full narrative on Ecolab (it's free!)

Ecolab's narrative projects $18.4 billion revenue and $2.8 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $0.7 billion earnings increase from $2.1 billion.

Uncover how Ecolab's forecasts yield a $286.10 fair value, a 3% upside to its current price.

Exploring Other Perspectives

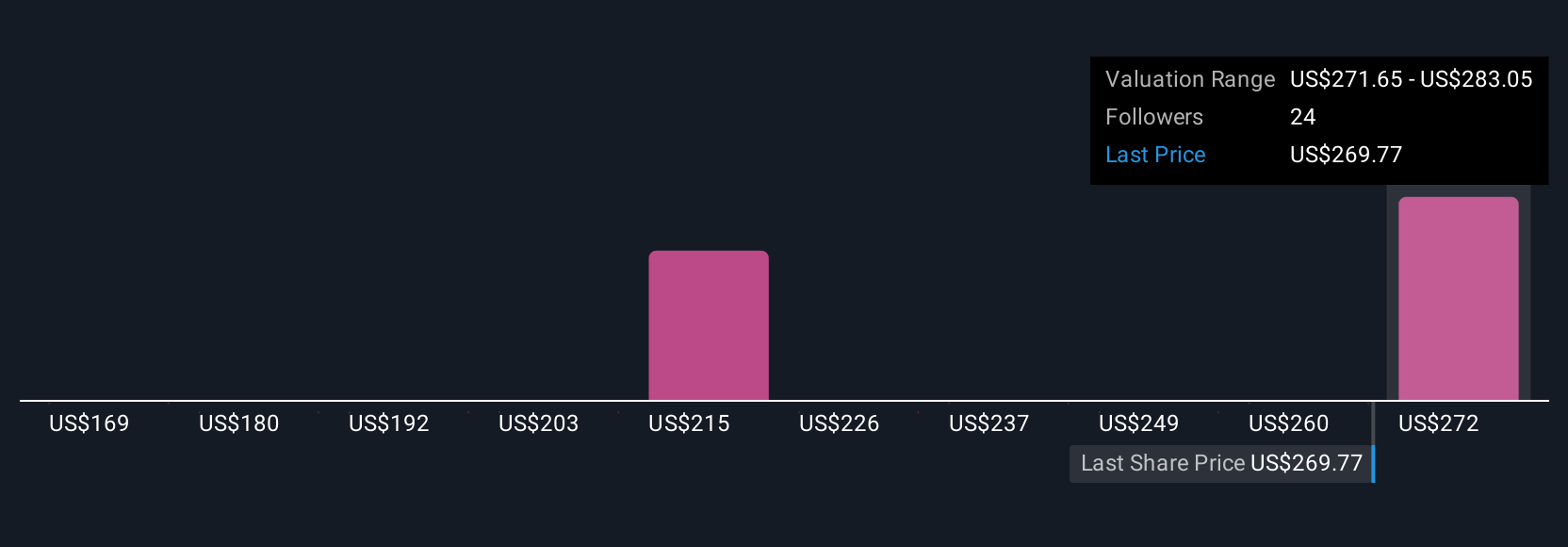

Fair value estimates from six members of the Simply Wall St Community range from US$169.01 to US$286.10 per share. While these views vary widely, many focus on how rising supplier and tariff costs could shape Ecolab’s long-term margins, inviting you to explore several contrasting opinions on future performance.

Explore 6 other fair value estimates on Ecolab - why the stock might be worth 39% less than the current price!

Build Your Own Ecolab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ecolab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ecolab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ecolab's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives