- United States

- /

- Chemicals

- /

- NYSE:ECL

Is Ecolab (ECL) Fairly Priced? A Fresh Look at Valuation After a Strong Year-to-Date Gain

Reviewed by Simply Wall St

Ecolab (ECL) shares have been quietly recalibrating after a choppy few weeks, and that drift gives us a cleaner look at what you are really paying for in this steady compounder.

See our latest analysis for Ecolab.

At around $264 per share, Ecolab has given investors a solid year to date with a mid teens share price return, while the more modest 1 year total shareholder return hints that momentum has cooled a little after a strong multi year run.

If Ecolab’s steady compounding appeals to you, it might be worth exploring other healthcare stocks that balance resilience with long term structural demand.

With earnings still climbing double digits and the share price hovering below analyst targets but above some intrinsic estimates, the question now is simple: Is Ecolab a buying opportunity, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 9.4% Undervalued

With Ecolab last closing at $264.42 against a narrative fair value of $291.75, the spread points to modest upside built on steady execution.

Investments in digital technologies have led to improved productivity, resulting in a 190 basis point increase in operating income margin. Continued investment in these technologies is anticipated to enhance earnings and operating margins further.

Want to see the playbook behind that margin story? It leans on disciplined revenue growth, fatter profit margins, and a premium earnings multiple that rivals sector leaders. Curious which precise assumptions make that valuation work?

Result: Fair Value of $291.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer industrial demand and tougher trade conditions could compress margins and derail the thesis if pricing power or cost efficiencies slip.

Find out about the key risks to this Ecolab narrative.

Another View: Multiples Point to a Richer Price

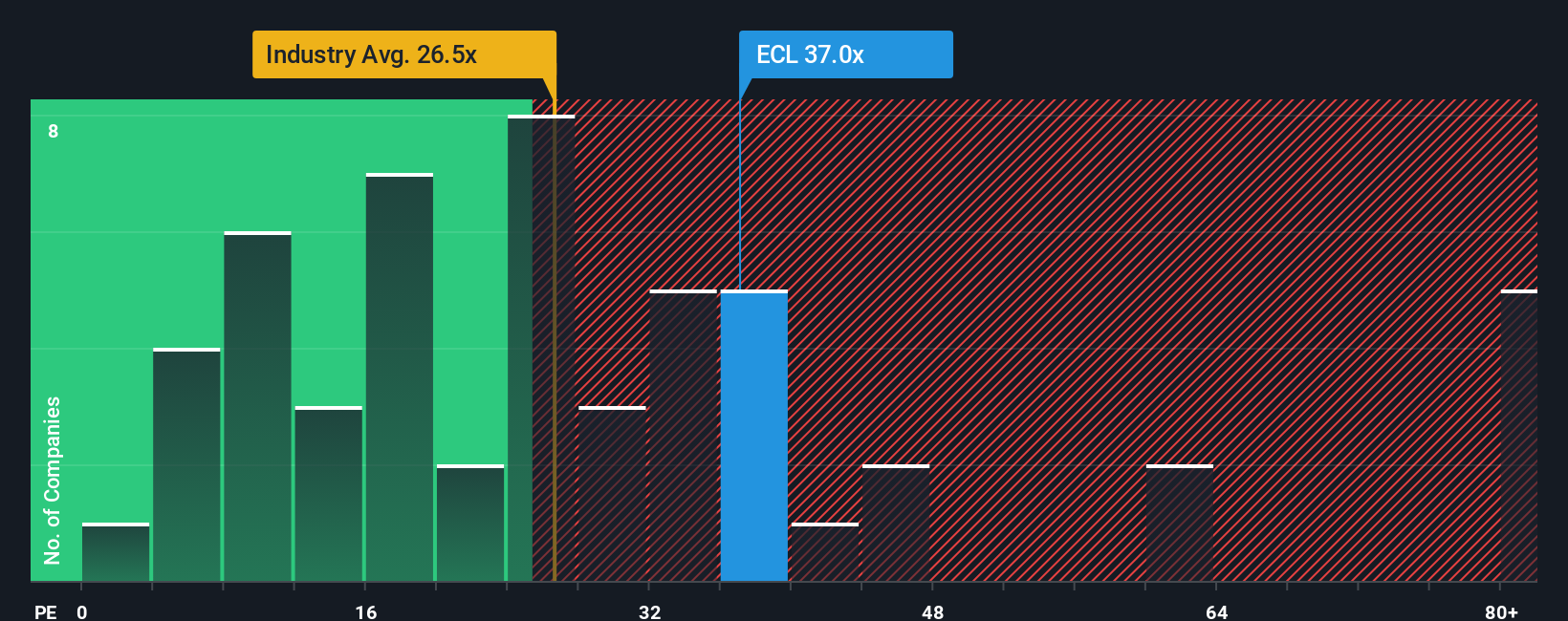

That narrative fair value hints at upside, but the earnings multiple tells a different story. Ecolab trades at 37.7 times earnings versus 23 times for the US chemicals sector, and a fair ratio of 25.3 times, suggesting valuation risk if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

If this perspective does not fully align with your own, you can dig into the numbers yourself and craft a custom narrative in minutes, Do it your way.

A great starting point for your Ecolab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more smart investment ideas?

Use the Simply Wall Street Screener now to uncover fresh opportunities before everyone else spots them, and keep your portfolio working harder across themes and sectors.

- Capture potential value by targeting bargain priced companies using these 908 undervalued stocks based on cash flows that align strong cash flows with attractive entry points.

- Ride structural growth trends by focusing on innovation leaders through these 26 AI penny stocks at the forefront of intelligent automation and data driven technologies.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that can support reliable payouts while still leaving room for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026