- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (NYSE:ECL) Q1 Earnings Show Slight Decline In Revenue And Net Income

Reviewed by Simply Wall St

Ecolab (NYSE:ECL) recently announced its Q1 2025 earnings, reporting a slight decline in both revenue and net income compared to the previous year. Despite this, the company’s stock moved up 3.25% over the past week. This stock movement aligns with the broader market trend, as the Dow Jones and S&P 500 extended their winning streaks with rising investor sentiment amidst ongoing earnings reports and potential tariff developments. While Ecolab's financial results illustrate minor declines, they add weight to the overall positive momentum seen in market indices, reflecting investor optimism prevailing in the current market climate.

Be aware that Ecolab is showing 2 warning signs in our investment analysis.

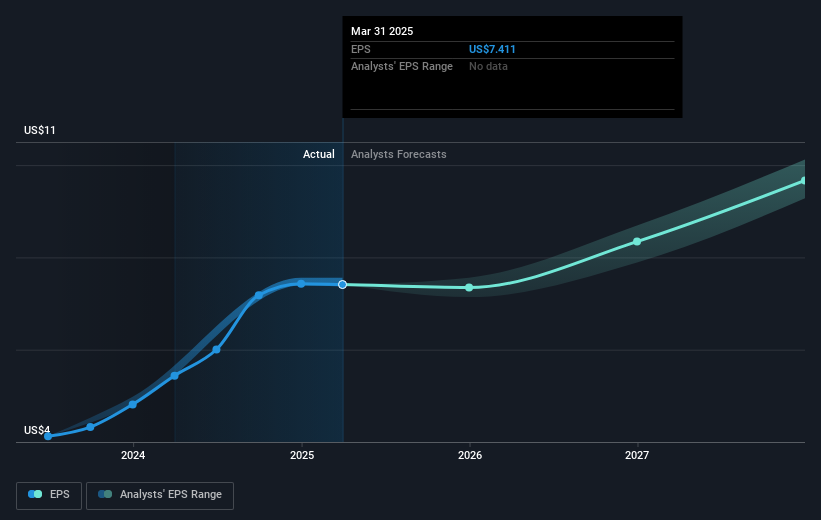

Ecolab's recent earnings announcement, showing declines in revenue and net income, doesn't appear to have dampened investor enthusiasm in the short term, as evidenced by the stock's upward movement. However, these financial results warrant a closer look at the longer-term potential impacts on its revenue and earnings forecasts. The company's strategic push into digital capabilities and high-growth sectors could mitigate short-term losses if these initiatives drive future sales growth and margin improvements. Yet, risks such as currency fluctuations, tariff changes, and execution challenges remain significant.

Over the past three years, Ecolab's total shareholder return has been 49.46%, indicating strong long-term performance. For additional context, the company's performance outpaced the US Chemicals industry, which saw a 3.7% decline over the previous year. It also matched the broader US market, which returned 7.5% in the same one-year period. The upward momentum seen over the past week reflects broader market sentiment, but the stock is currently trading at a discount compared to the consensus analyst price target of $274.91.

Shareholders might be cautiously optimistic as the stock is priced about 13.9% below this target, suggesting potential upside if Ecolab can align its future growth with these expectations. However, achieving this target requires significant growth in revenues and margins. The anticipated enhancement in digital sales and the expansion into profitable sectors like life sciences and data centers will be crucial in meeting these projections. Investors will need to weigh these growth opportunities against the inherent risks to determine if the company is positioned well for the future.

Click here to discover the nuances of Ecolab with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ecolab, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives