- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (NYSE:ECL): Evaluating Valuation as New AI-Driven CIP IQ Solution Advances Sustainability Strategy

Reviewed by Kshitija Bhandaru

Ecolab (NYSE:ECL) has introduced CIP IQ, an AI-powered clean-in-place solution. This marks a key step in its digital innovation push. Developed with 4T2 Sensors, CIP IQ aims to improve efficiency and sustainability for food and beverage manufacturers.

See our latest analysis for Ecolab.

Ecolab’s partnership with 4T2 Sensors and the launch of CIP IQ come on the heels of robust company moves, including strong earnings and a $500 million notes issuance earlier this year. While its latest innovation highlights Ecolab’s commitment to digital transformation and sustainability, momentum in the market has been steady, reflected by a one-year total shareholder return just above 10%. Long-term holders have enjoyed solid multi-year gains, showing that disciplined performance and ongoing digital strategy continue to underpin Ecolab’s appeal.

If sustainability and efficiency gains have you interested, now is a great time to explore other companies with fast growth trajectories and strong insider commitment. Discover fast growing stocks with high insider ownership

With Ecolab’s digital strength boosting long-term returns and analysts projecting ongoing growth, investors now face a familiar question: is there real upside left in the stock, or is future success already reflected in today’s price?

Most Popular Narrative: 4.2% Undervalued

Ecolab's last close of $274 is just below the narrative fair value estimate of $286.10. This points to a small valuation gap that has caught investors’ attention. This difference sets the scene for a deeper dive into the strategic drivers behind the company’s future prospects.

Strategic pricing adjustments, digital technology investments, and Life Sciences growth position Ecolab for improved operating income margins and long-term earnings potential. Softer demand, international tariffs, and local supplier costs may compress margins, despite strategic investments that could offer long-term growth.

Curious which smart strategic bets and margin expansion targets underpin this valuation? Discover the combination of innovation, pricing power, and bold assumptions analysts are hinging their fair value on. What might analysts know that the market is missing? Uncover the financial leap behind Ecolab’s price today.

Result: Fair Value of $286.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued softness in key industrial markets or heightened global tariffs could pressure Ecolab’s margins, which would challenge the optimistic outlook behind these forecasts.

Find out about the key risks to this Ecolab narrative.

Another View: Market Ratios Suggest a High Price Tag

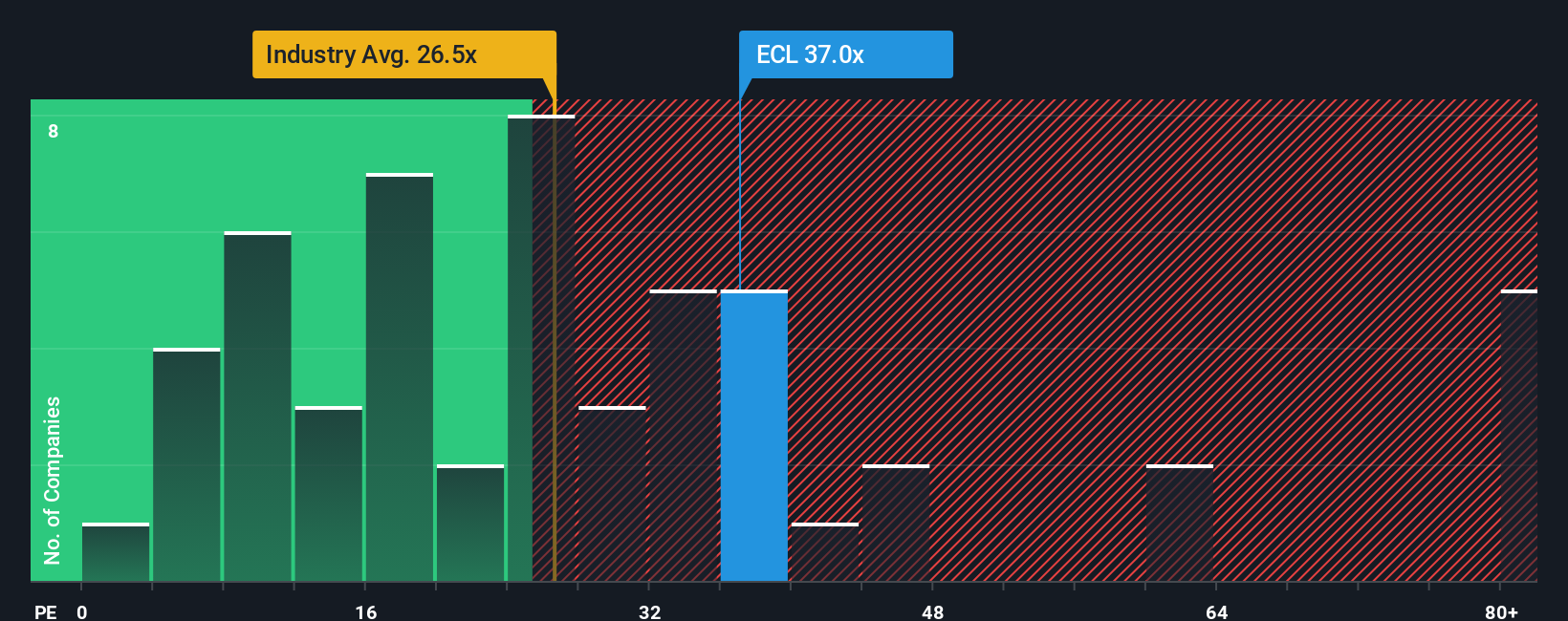

While the analyst consensus points to Ecolab having a fair or slightly undervalued share price, our market ratio lens tells a different story. Ecolab’s price-to-earnings ratio of 36.4x is much higher than both the US Chemicals industry average of 25.9x and the average peer value of 22.6x. In comparison to the fair ratio estimate of 23.1x, the gap signals investors are paying a premium. This could point to greater valuation risk if future growth does not accelerate as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

If you see the numbers differently or want to base your view on your own research, building a personal narrative is quick and insightful. Do it your way.

A great starting point for your Ecolab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for ordinary returns? Countless stocks are making waves right now, and you owe it to yourself to see which ones fit your strategy best.

- Tap into potential market disruptors by checking out these 3568 penny stocks with strong financials poised for surprising growth and resilience in uncertain conditions.

- Unlock high-yield opportunities by exploring these 19 dividend stocks with yields > 3% that can boost your income above the mainstream options.

- Strengthen your portfolio with breakthrough innovation through these 31 healthcare AI stocks, focusing on companies transforming healthcare with advanced technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives