- United States

- /

- Chemicals

- /

- NYSE:ECL

Assessing Ecolab (ECL) Valuation Following Analyst Upgrades and Margin Expansion Signals

Reviewed by Kshitija Bhandaru

Recent analyst reports have put Ecolab (ECL) in focus this week, as several investment firms point to its expanding operating margins and improving financial health. Positive ratings suggest investors are taking note of these trends.

See our latest analysis for Ecolab.

Momentum continues to build for Ecolab, with the stock’s share price climbing nearly 20% year-to-date and recent gains pushing it to $276.75 at last close. The company’s three-year total shareholder return stands out at 96%, which suggests consistent long-term value creation as fundamentals improve.

If you’re interested in what else the market has to offer right now, consider broadening your search and discover fast growing stocks with high insider ownership.

With shares hovering just below analyst targets after a strong rally, the key question for investors is whether Ecolab still offers upside, or if the market has already factored in the company’s growth trajectory.

Most Popular Narrative: 3.3% Undervalued

Ecolab’s latest closing price of $276.75 sits just beneath the narrative’s fair value estimate of $286.10. This close proximity highlights how closely analyst expectations and share price have aligned after recent gains, suggesting a subtle optimism for continued momentum.

Investments in digital technologies have led to improved productivity, resulting in a 190-basis-point increase in operating income margin. Continued investment in these technologies is anticipated to enhance earnings and operating margins further.

Want to know what’s powering this ambitious valuation? Analysts are relying on a combination of tech-driven efficiency gains, strong profit growth, and bold margin forecasts. The real surprises are in the numbers behind these confident projections—see what could truly set Ecolab apart.

Result: Fair Value of $286.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer industrial demand or rising costs from new tariffs could still challenge Ecolab’s ambitious growth and margin expansion outlook in the near term.

Find out about the key risks to this Ecolab narrative.

Another View: High Valuation Signals a Cautious Note

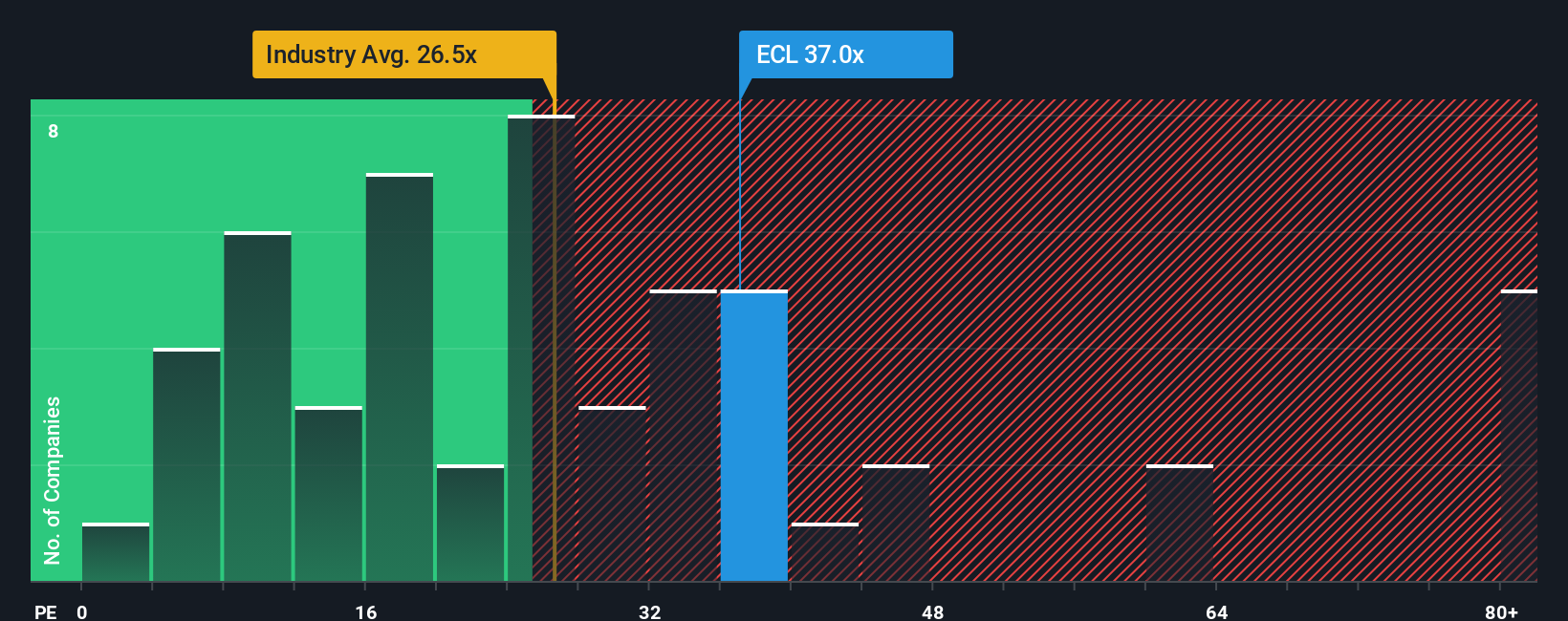

Looking at the market pricing, Ecolab trades at a price-to-earnings ratio of 36.7x, which is noticeably higher than both the US Chemicals industry average of 25.9x and its peer group’s average of 21.6x. The fair ratio, based on broader trends, comes in much lower at 23.2x. This gap means investors are paying a significant premium for future growth, which could raise risks if momentum cools or results disappoint. Can Ecolab keep outperforming, or has optimism run ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

Feel free to dig into the numbers and draw your own conclusions. Crafting a personalized view takes less than three minutes, and you can Do it your way.

A great starting point for your Ecolab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always searching for the next winning opportunity. Don’t let your money sit idle when there’s so much more potential in the market.

- Tap into future-defining breakthroughs by reviewing these 24 AI penny stocks, which are transforming industries through artificial intelligence and automation.

- Boost your income strategy and find consistent payouts by checking out these 18 dividend stocks with yields > 3%, offering yields above 3% to strengthen your portfolio.

- Embrace tomorrow’s technology shifts and leap ahead with these 26 quantum computing stocks, which is shaping advances in computing, security, and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives