- United States

- /

- Metals and Mining

- /

- NYSE:DRD

Is There Still Opportunity in DRDGOLD After 217% Year to Date Rally?

Reviewed by Bailey Pemberton

If you have been keeping an eye on DRDGOLD recently and wondering whether to buy, hold, or cash in, you are not alone. The story here is more than just impressive price charts, and there are plenty of factors investors are weighing right now. Over the past year, DRDGOLD has surprised even seasoned analysts, boasting a staggering 217.4% return year to date and climbing an incredible 488.1% over the last three years. Even in the last month, the stock rose 36.9% and added another 0.8% in just the past week. Big numbers like these often make headlines, but it is the drivers behind these rallies and corrections that matter most.

Much of this growth can be linked to the macro narrative around gold prices and broader shifts in commodities markets. Investors are clearly seeing DRDGOLD as more than just a play on the metal itself, perhaps recognizing efficiencies or a value opportunity that the broader market has missed. Before getting swept up in the excitement, it is wise to examine the numbers that matter, specifically whether the stock is still undervalued or if the golden window has been missed.

For DRDGOLD, a structured valuation check shows the company is undervalued in 4 out of 6 standard criteria, giving it a value score of 4. While this is a promising sign, not every metric indicates a strong positive, and understanding what works (and what might not) for this stock is crucial before making any decisions. Next, let us explore each of these valuation approaches in detail. Later in the article, I will share an even clearer way to separate profit potential from pure hype.

Approach 1: DRDGOLD Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation tool that estimates a company's intrinsic worth by projecting its future cash flows and discounting them back to today’s value. For DRDGOLD, the latest twelve months' Free Cash Flow (FCF) stands at approximately ZAR 946 million, reflecting the company’s ability to generate liquidity from its operations.

Analyst projections show the company’s FCF transitioning from a slight negative in 2026 to a significant growth trajectory, reaching as high as ZAR 12.43 billion by 2035. While direct analyst estimates cover only the next several years, the extended 10-year forecasts, extrapolated by Simply Wall St, highlight expectations for rising free cash flow throughout the next decade.

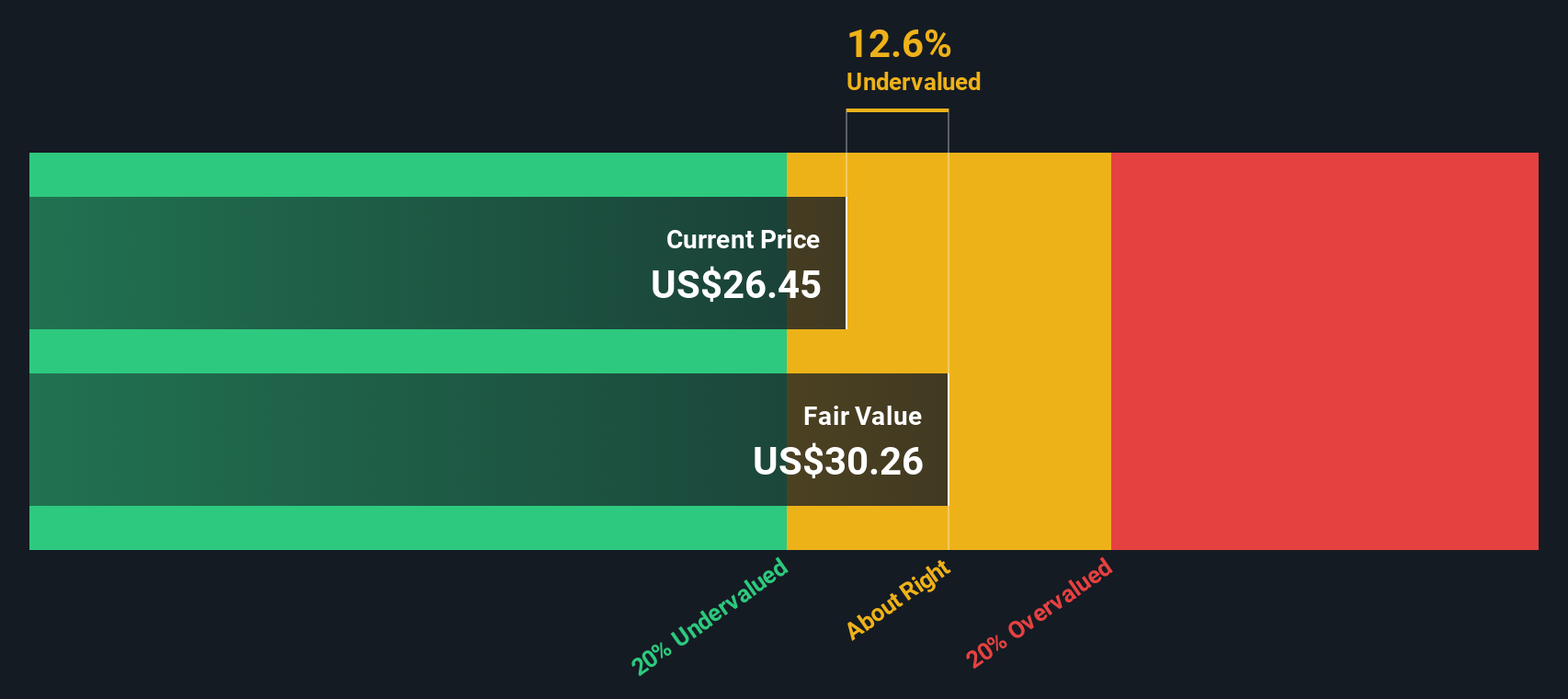

Based on this cash flow outlook and using the 2 Stage Free Cash Flow to Equity method, the model estimates DRDGOLD’s intrinsic value at ZAR 63.52 per share. This represents a 54.9% discount relative to the current share price, indicating the stock is substantially undervalued according to the DCF approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DRDGOLD is undervalued by 54.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DRDGOLD Price vs Earnings

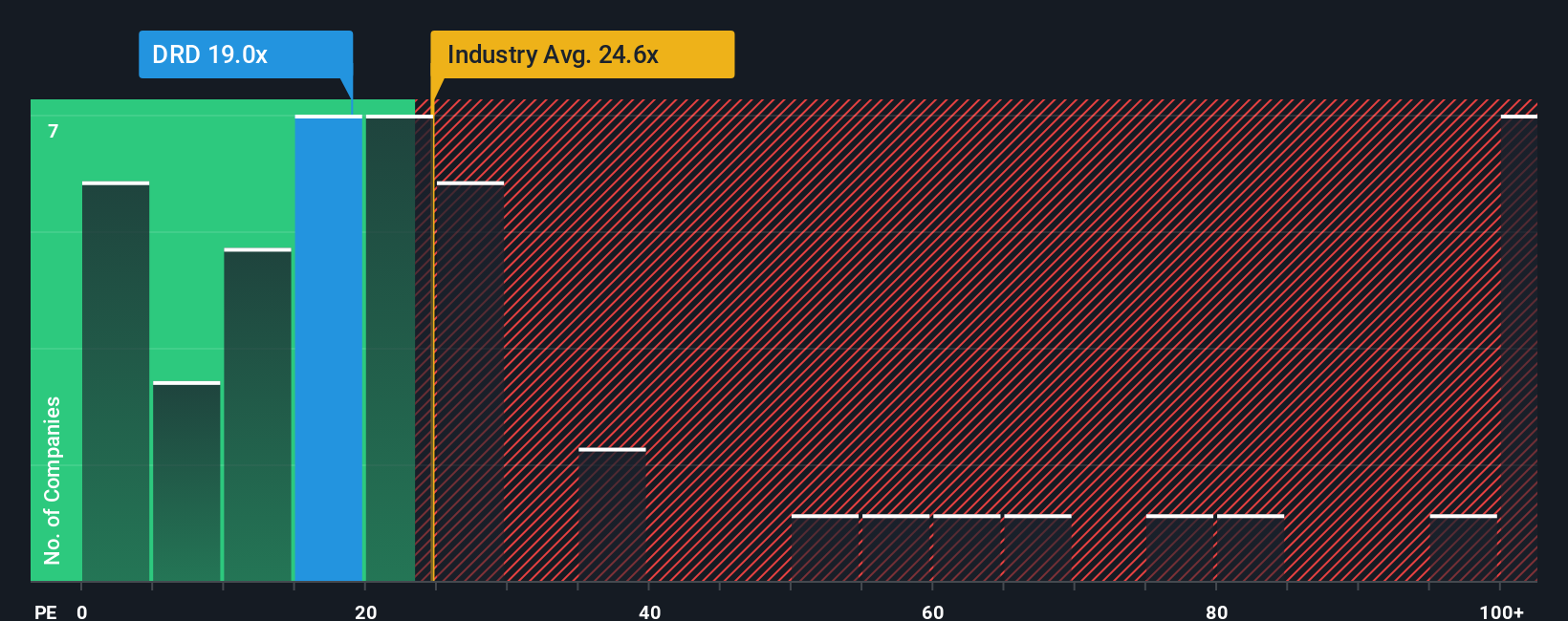

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it directly connects a stock's price to the actual earnings generated by the business. This makes it especially helpful for companies like DRDGOLD, which have a consistent record of generating profits. In general, what counts as a “fair” PE ratio depends on the company’s expected growth and perceived risk. Higher growth companies or those with less risk tend to command higher PE ratios, while riskier or slower-growing businesses typically trade at lower multiples.

Currently, DRDGOLD trades at a PE ratio of 19x, which sits below both the Metals and Mining industry average of 24.6x and the peer group average of 31x. By these measures alone, DRDGOLD appears relatively undervalued compared to its sector and similar companies.

However, Simply Wall St uses a proprietary “Fair Ratio” to give a more nuanced view. Unlike simple peer or sector comparisons, the Fair Ratio blends together factors such as the company’s expected earnings growth, its profit margins, risk profile, industry dynamics, and market capitalization. This makes it a more precise benchmark for what DRDGOLD’s PE ratio should be, not just what its peers are doing.

When we compare DRDGOLD’s current PE to its Fair Ratio, we find that the stock is valued about right, reflecting the balance between its current earnings, future prospects, and risk factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DRDGOLD Narrative

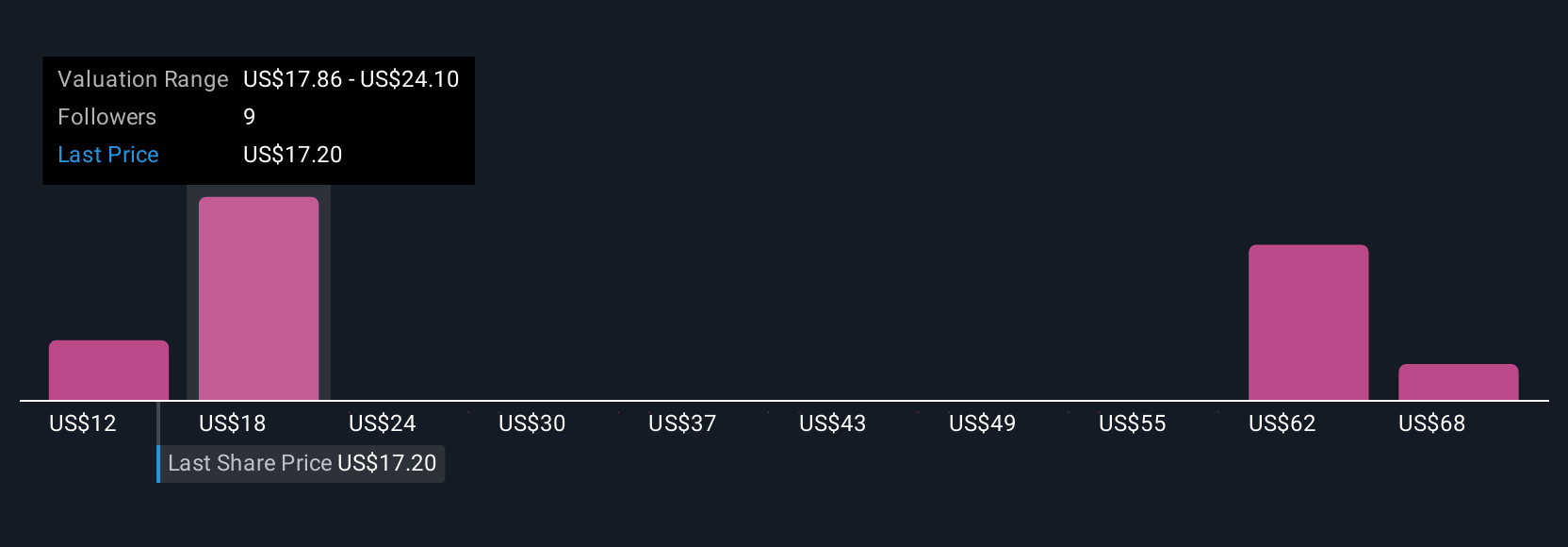

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your personal story or thesis about a company, linking the facts you see, such as revenue growth rates, future profits, or sector changes, to a realistic forecast and fair value you believe in.

This approach ties the company’s history and outlook directly to concrete numbers, empowering you to build a forecast that reflects your perspective, rather than passively accepting market assumptions. On Simply Wall St’s Community page, millions of investors use Narratives because they are accessible and easy to update when new information lands, whether that is a major news event or the latest earnings report.

Narratives make it clear whether you see DRDGOLD as a buy, hold, or sell by comparing your estimated Fair Value to today’s share price, giving you the confidence to act on your own informed view. For example, some investors’ Narratives see DRDGOLD’s fair value as much higher than the current price, while others, using different assumptions, project a much lower value. This demonstrates how dynamic and personalized this tool can be.

Do you think there's more to the story for DRDGOLD? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives