- United States

- /

- Chemicals

- /

- NYSE:DD

DuPont (DD) Valuation: Is There Hidden Value After Recent Profit Growth and Long-Term Gains?

Reviewed by Kshitija Bhandaru

See our latest analysis for DuPont de Nemours.

The share price has climbed 4.6% year-to-date, but a 1-year total shareholder return of -4.7% shows that recent gains have only partially reversed last year’s declines. Meanwhile, DuPont’s strong three-year total return of 61.7% suggests that long-term momentum still matters more than any single headline.

If recent moves in industrials have sparked your curiosity, it could be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading about 18% below analyst price targets and DuPont posting impressive profit growth, investors may wonder whether there is real value left on the table or if the market is fairly reflecting future potential.

Most Popular Narrative: 14.9% Undervalued

With the latest close at $78.88 and the most widely followed narrative calculating fair value at $92.67, there is a notable gap in perceived worth. This difference comes down to aggressive forecasts for certain divisions and how analysts expect DuPont’s evolving business mix to boost future earnings.

"DuPont's accelerated growth in Electronics, particularly from AI-driven applications, advanced packaging, and high-performance computing, positions the company to capture outsized revenue expansion as node migrations and broader electronics market recovery unfold through 2025 and beyond."

Want to know the growth blueprint behind this high valuation? Hint: there is an earnings leap projected, powered by shifting business priorities and bold profit assumptions. Want to see the metrics that underpin these expectations? Dive into the full narrative to uncover what is driving the calculation.

Result: Fair Value of $92.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legal liabilities and heavy exposure to geopolitical tensions, especially in China, still threaten to derail DuPont’s ambitious growth story.

Find out about the key risks to this DuPont de Nemours narrative.

Another View: Market Multiples Tell a Different Story

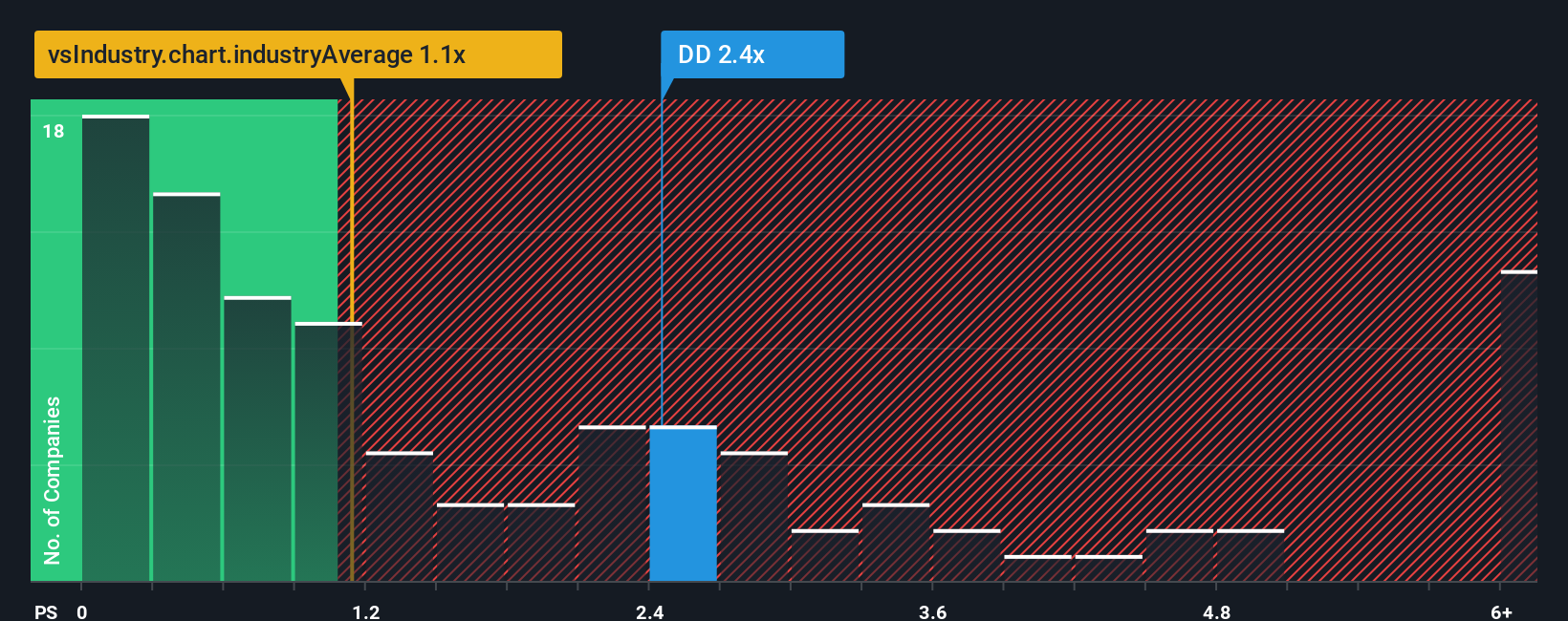

Looking at DuPont through a price-to-sales lens, the market sees it as more expensive than both its industry (2.6x versus 1.2x for US Chemicals) and its peers (2.6x versus 2.5x). This is also above its fair ratio of 2.3x, highlighting possible overvaluation risk. Could this premium be justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DuPont de Nemours Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view of DuPont’s story in just minutes by using Do it your way.

A great starting point for your DuPont de Nemours research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Tapping into the right opportunities now means you could be ahead of the crowd when the next wave hits. Don’t let these powerful trends pass you by.

- Capture potential market swings by targeting these 895 undervalued stocks based on cash flows to spot stocks priced below their true worth before the rest of the market catches on.

- Secure steady income streams, even in turbulent times, with these 19 dividend stocks with yields > 3% which offers yields above 3% for those hungry for returns.

- Step boldly into tomorrow’s breakthroughs as you scan these 26 quantum computing stocks for companies at the forefront of quantum computing innovation and game-changing discoveries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives