- United States

- /

- Chemicals

- /

- NYSE:CTVA

Will Splitting Seed and Crop Protection Units Change Corteva's (CTVA) Growth Story?

Reviewed by Sasha Jovanovic

- Corteva, Inc. recently announced it will separate its seed and crop protection businesses, aiming to sharpen its operational focus and future direction.

- This move comes as Corteva's Enlist E3 platform has achieved over 60% penetration of U.S. soybean acres in less than two years, highlighting rapid innovation adoption within the company.

- We'll explore how the planned business split may affect Corteva's long-term growth prospects and market positioning.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Corteva Investment Narrative Recap

To own Corteva stock, investors need to believe in the company's ability to drive growth through innovation in seeds and crop protection, while managing competitive, regulatory, and commodity price pressures. The announced separation of the seed and crop protection businesses is designed to enhance operational focus, but it is not expected to materially disrupt the rapid adoption of Corteva's Enlist E3 platform, which remains the company's primary short-term growth catalyst. However, this shift refocuses attention on ongoing pricing and margin risks in crop protection, especially in competitive emerging markets.

Among Corteva's recent announcements, the reaffirmation and subsequent raising of its 2025 full-year earnings guidance in early October stands out. This guidance increase, shortly before the separation news, signals management's confidence in underlying business momentum, even as structural business changes introduce new strategic variables for investors tracking near-term performance.

Yet in contrast to the company's sustained innovation and growth plans, investors should not overlook the ongoing risk of margin pressure if crop protection prices remain under pressure in key markets like Brazil and...

Read the full narrative on Corteva (it's free!)

Corteva's outlook anticipates $18.8 billion in revenue and $2.3 billion in earnings by 2028. This scenario assumes annual revenue growth of 3.1% and a $0.8 billion increase in earnings from the current $1.5 billion level.

Uncover how Corteva's forecasts yield a $79.81 fair value, a 30% upside to its current price.

Exploring Other Perspectives

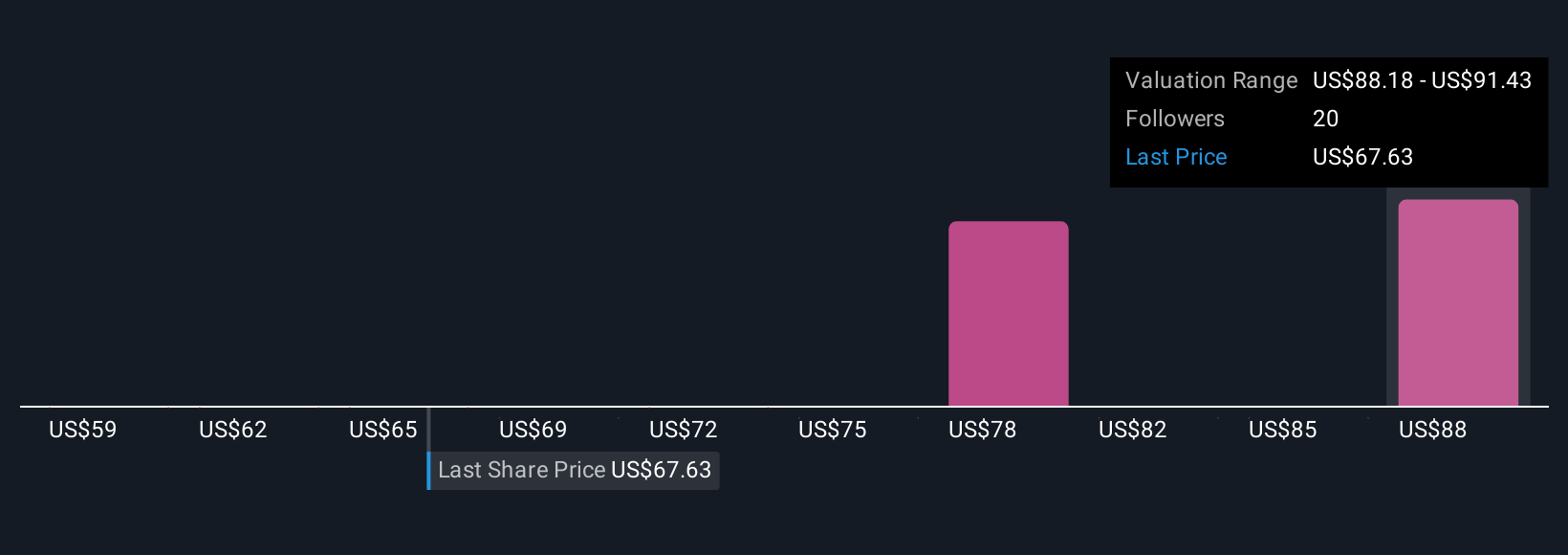

Eight individual fair value opinions from the Simply Wall St Community place Corteva’s worth between US$53.09 and US$91.12 per share. This breadth of estimates reminds you that persistent pricing and competition risks in crop protection can have outsized impact on company outlooks, so it pays to weigh several viewpoints.

Explore 8 other fair value estimates on Corteva - why the stock might be worth 14% less than the current price!

Build Your Own Corteva Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corteva research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Corteva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corteva's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives