- United States

- /

- Chemicals

- /

- NYSE:CTVA

Corteva (CTVA): Valuation Insights Following Strategic Investment in Ascribe Bio's Sustainable Crop Solutions

Reviewed by Kshitija Bhandaru

Corteva (CTVA) is making headlines after co-leading a $12 million Series A funding round for Ascribe Bio. This move underscores its push into sustainable agricultural solutions and could open doors to new market opportunities.

See our latest analysis for Corteva.

Corteva’s strategic push into biological crop solutions has caught renewed attention, but recent share price momentum has faded a bit. The stock is off 12.7% over the past month and down 16.5% over the last 90 days. Still, with a positive year-to-date share price return of 8.3% and a solid 4.6% total shareholder return over one year, the company’s longer-term performance continues to reflect underlying demand for sustainable innovations in agriculture.

If Corteva’s bold moves make you curious about what else is possible in the sector, now is the perfect time to explore fast growing stocks with high insider ownership.

But with shares trading about 30% below analyst price targets and recent revenue and net income growth outpacing the broader sector, investors may wonder if this is an overlooked opportunity or if future gains are already factored in.

Most Popular Narrative: 23.6% Undervalued

Corteva’s last close at $61 sits well below the considered fair value of $79.81 in the most widely followed narrative. This gap reflects confidence in the company’s future prospects and sets the stage for some bold financial predictions.

Advancements in Corteva's innovation pipeline, including premium trait launches (Vorceed, PowerCore), expansion of biological products, and gene editing, enable premium pricing, secure market share, and improve product mix, translating into higher gross margins and earnings growth.

Want to understand what’s fueling this bullish outlook? The narrative leans heavily on aggressive margin expansion and a jump in bottom-line performance. There is a crucial financial lever hiding in plain sight. Find out what it is by reading the full story.

Result: Fair Value of $79.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition in crop protection and exposure to currency volatility could hinder Corteva’s margin growth if these headwinds persist longer than anticipated.

Find out about the key risks to this Corteva narrative.

Another View: Market Multiples Raise Red Flags

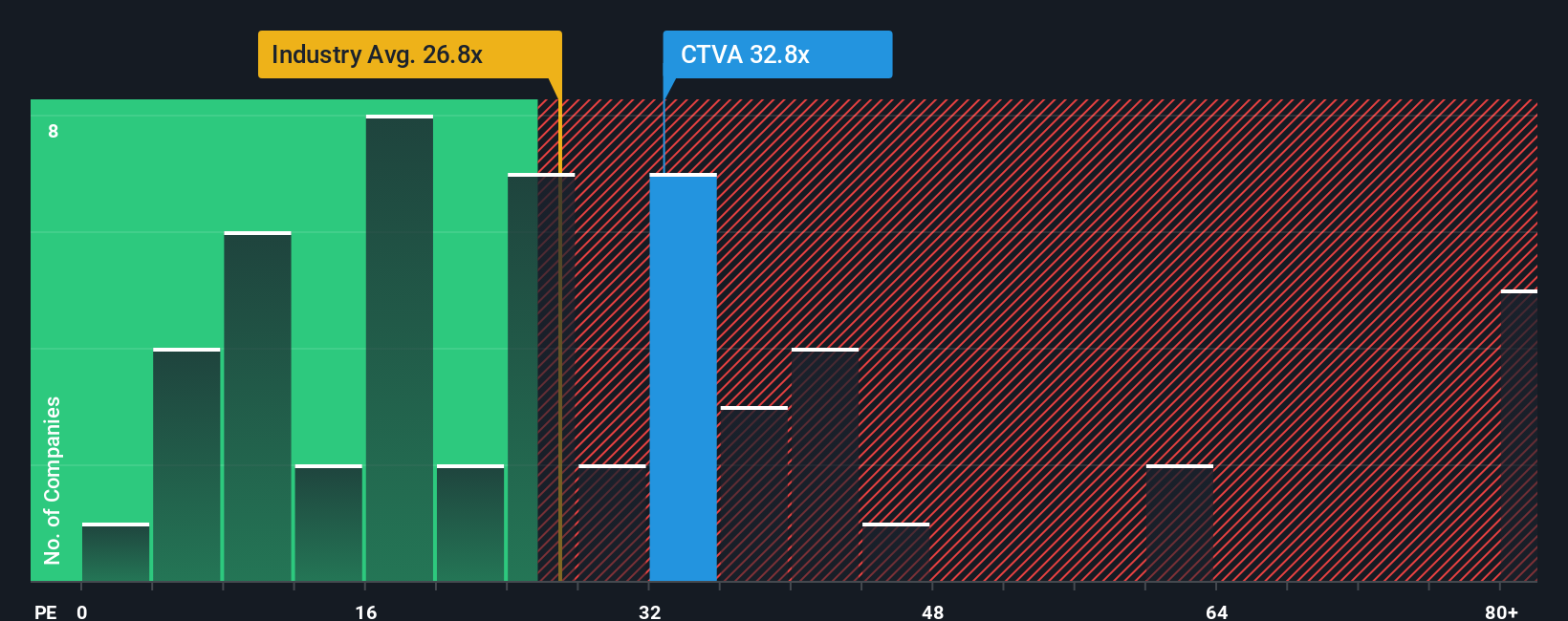

While the fair value estimate points to Corteva being undervalued, its current price-to-earnings ratio of 28.2x is notably higher than both the US Chemicals industry average of 26.6x and its peer average of 25.2x. The fair ratio for the company stands at 25x, suggesting Corteva carries a valuation premium that could limit upside if market sentiment turns. Is this heightened multiple a sign of untapped potential, or does it set a high bar for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If these perspectives do not match your own, or you would rather dive into the numbers yourself, you can craft a Corteva story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Corteva.

Looking for more investment ideas?

Smart investors know that the next big opportunity rarely waits. Make your next move count by not letting these high-potential stocks slip by you.

- Capitalize on dynamic AI advancements by checking out these 24 AI penny stocks and spot companies pushing the limits of innovation.

- Pursue reliable returns by browsing these 20 dividend stocks with yields > 3% to find steady yield stocks that can strengthen your portfolio against market swings.

- Seize value others overlook with these 868 undervalued stocks based on cash flows, showing you equities trading below their real potential today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives