- United States

- /

- Metals and Mining

- /

- NYSE:CSTM

Will Constellium’s (CSTM) Leadership Shift Reinforce Its Long-Term Competitive Position?

Reviewed by Sasha Jovanovic

- Constellium SE recently announced that Ingrid Joerg will succeed Jean-Marc Germain as Chief Executive Officer and director effective January 1, 2026, following his retirement at the end of 2025.

- The decision ensures continuity, as Ms. Joerg has been deeply involved in overseeing all operating business units since 2023 and brings extensive prior leadership experience from both within Constellium and across the broader metals industry.

- We'll consider how this planned leadership transition, highlighted by Ms. Joerg's operational experience, could influence Constellium's investment narrative and future direction.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Constellium Investment Narrative Recap

To own shares in Constellium right now, you have to believe in the structural growth of aluminum across packaging, automotive, and aerospace, and the company’s ability to manage shifting demand. The CEO transition to Ingrid Joerg, while ensuring stable leadership and operational continuity, does not change the current near-term catalyst, which is a potential rebound in demand from premium auto and aerospace customers, nor does it materially affect the risk of prolonged shipment declines in these core segments.

The most relevant recent announcement is the extension of Constellium's partnership with Embraer to supply advanced aluminum solutions for aviation. This ties directly to upcoming catalysts tied to aerospace recovery, as sustained partnerships and robust contract pipelines could enhance margin recovery and support shipment growth if industry conditions improve.

In contrast, while management continuity offers reassurance, investors should be aware of the ongoing risk from sustained demand weakness in critical end markets like automotive and aerospace, especially if...

Read the full narrative on Constellium (it's free!)

Constellium's narrative projects $9.9 billion revenue and $448.3 million earnings by 2028. This requires 9.3% yearly revenue growth and a $416.3 million earnings increase from $32.0 million today.

Uncover how Constellium's forecasts yield a $18.31 fair value, a 8% upside to its current price.

Exploring Other Perspectives

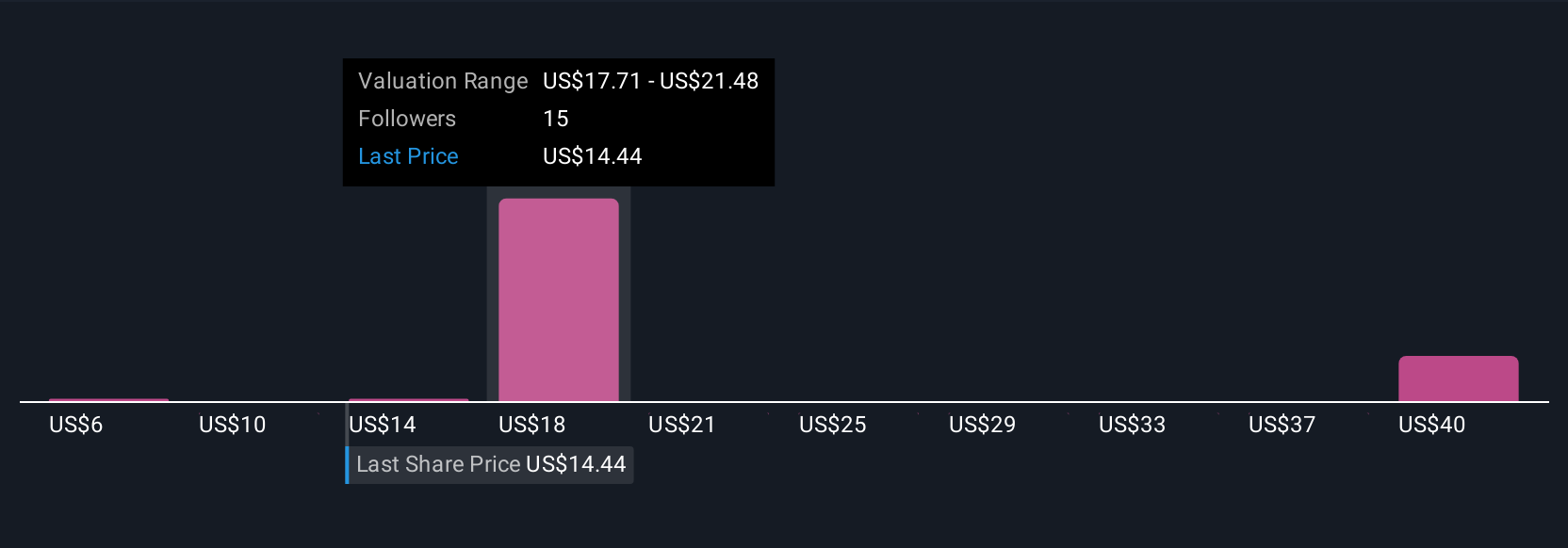

Four Simply Wall St Community fair value estimates for Constellium range widely from US$6.40 to US$32.18, highlighting both ends of the valuation spectrum. While some expect operational improvement and aerospace partnerships to drive growth, be aware that prolonged end-market weakness could weigh on performance, explore the community’s views for even more perspectives.

Explore 4 other fair value estimates on Constellium - why the stock might be worth as much as 90% more than the current price!

Build Your Own Constellium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellium research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellium's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSTM

Constellium

Engages in the design, manufacture, and sale of rolled and extruded aluminum products for the aerospace, packaging, automotive, commercial transportation, general industrial, and defense end-markets.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives