- United States

- /

- Metals and Mining

- /

- NYSE:CSTM

Constellium SE's (NYSE:CSTM) Shares Not Telling The Full Story

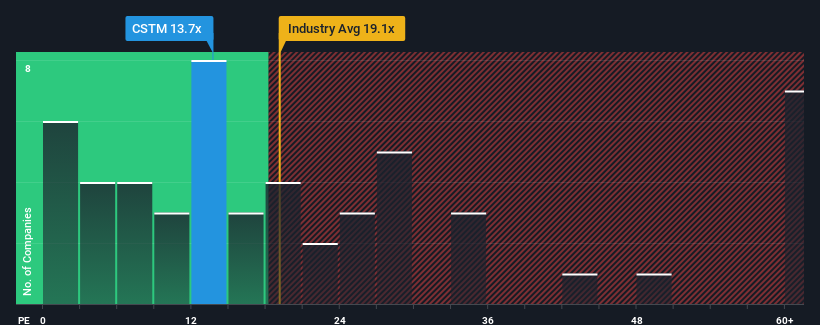

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Constellium SE (NYSE:CSTM) as an attractive investment with its 13.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Constellium's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Constellium

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Constellium would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 65% over the next year. Meanwhile, the rest of the market is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's peculiar that Constellium's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Constellium's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Constellium's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Constellium has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If these risks are making you reconsider your opinion on Constellium, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CSTM

Constellium

Engages in the design, manufacture, and sale of rolled and extruded aluminum products for the aerospace, packaging, automotive, commercial transportation, general industrial, and defense end-markets.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026