- United States

- /

- Metals and Mining

- /

- NYSE:CRS

Carpenter Technology Corporation's (NYSE:CRS) Shares Climb 32% But Its Business Is Yet to Catch Up

Despite an already strong run, Carpenter Technology Corporation (NYSE:CRS) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 129% following the latest surge, making investors sit up and take notice.

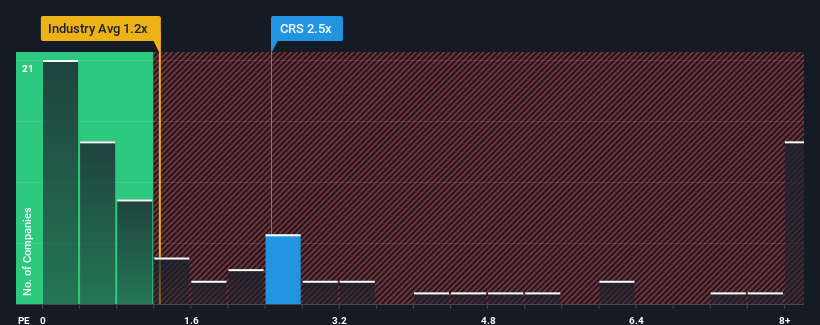

After such a large jump in price, when almost half of the companies in the United States' Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Carpenter Technology as a stock probably not worth researching with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Carpenter Technology

What Does Carpenter Technology's P/S Mean For Shareholders?

Carpenter Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Carpenter Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Carpenter Technology's Revenue Growth Trending?

Carpenter Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 82% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 8.7% per year over the next three years. That's shaping up to be materially lower than the 36% each year growth forecast for the broader industry.

In light of this, it's alarming that Carpenter Technology's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Carpenter Technology's P/S Mean For Investors?

Carpenter Technology's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Carpenter Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 4 warning signs for Carpenter Technology that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives